Value Investor: Sizing up three market giants

Welcome to the second reporting season wrap. Today we examine supermarket giants Woolworths and Coles and analyse the problems plaguing Qantas.

Woolworths (ASX:WOW), Australia’s largest grocery retailer with 40 per cent market share, reported another strong result, with revenue up 3.9 per cent to $60.7 billion and after-tax profits increasing 6.1 per cent to $2.45bn.

Australian food and liquor earnings grew 9 per cent to $3.28bn, with same-store food and liquor sales rising 3.3 per cent in the last quarter. This division is the major valuation driver, as it contributes over 80 per cent of all earnings. Woolworths increased group margins to record highs; the after-tax profit margin expanded 17 bps to 4.03 per cent. Woolworths is able to share efficiency gains between consumers and shareholders.

Elsewhere, losses from the Masters home improvement chain widened to $176m. Masters has seen group working capital increase by over $1bn in recent years with stock turnover falling by a ratio of 2:1. This has delayed capital management.

Total fiscal 2014 dividends totalled $1.37 per share, up slightly from $1.33. Management expects after-tax profit growth of 4-7 per cent in fiscal 2015.

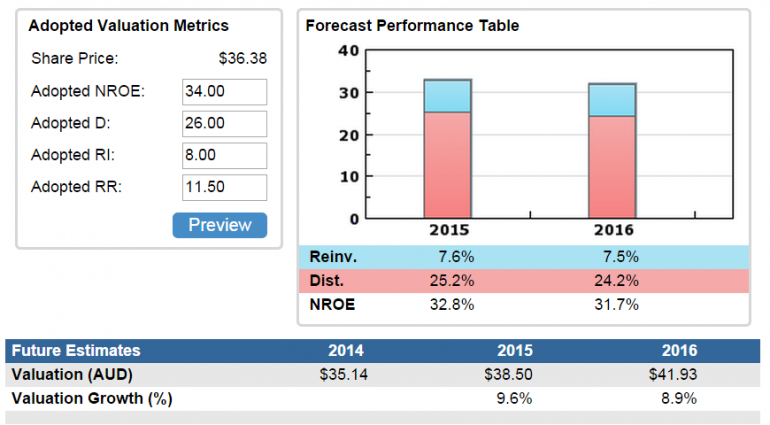

After the result, we trimmed our adopted return on equity slightly to 34 per cent, still above consensus. Required return remains very low at 11.5 per cent. Intrinsic value is projected to grow at around 9 per cent in the next two years.

Woolworths is currently trading slightly above value.

Figure 1: Woolworths' future valuation

Source: StocksInValue

Wesfarmers (ASX:WES) is more diversified than Woolworths, with other retailers such as Bunnings and Officeworks, as well as industrial and insurance operations.

Coles, like Woolworths, delivered earnings growth of 9 per cent to $1.67bn. Bunnings continues to show good momentum, with store-on-store sales growth of 8.4 per cent, while Officeworks also performed strongly with earnings increasing 11 per cent to $103m. Together, these divisions contributed 70 per cent of all earnings.

Target was very weak, with earnings falling 37 per cent to $86m. Return on capital was poor at 2.9 per cent and can be contrasted with Kmart’s strong 26.9 per cent. Target continues to struggle with price deflation in the product mix and competitive pressures. It remains in the midst of restructuring, with changes to sourcing strategies and operational improvements.

Wesfarmers declared a fully franked dividend of $1.05 per share and a special dividend of $0.10. It also announced a separate capital management distribution of $1.00 subject to an ATO ruling and shareholder approval at its annual general meeting

While other analysts have stated their concern over the non-retail divisions, we are less concerned. Chemicals, energy and fertilisers, resources and industrial and safety are cyclical divisions that are still delivering solid returns on their capital.

Our adopted ROE increased to 16 per cent (from 15 per cent), slightly above consensus. Along with a required return of 12 per cent, we derive a fiscal 2014 valuation of $31.61. Wesfarmers is currently trading above valuation.

Qantas (ASX: QAN) remains controversial after its $2.8bn statutory loss for fiscal 2014. This included a $2.56bn impairment of its international fleet. Excluding this, the underlying loss after tax was $656m.

Chief executive Alan Joyce said Qantas would return to profitability in the first half of 2015. While the market responded positively to the news, we see longer-term structural problems.

Firstly, competition in the airline industry remains intense. Domestically, the futile price war seems to have abated for the moment, but internationally, Qantas remains vulnerable to competitors’ capacity decisions.

Secondly, low consumer confidence is reducing domestic leisure travel. Data from the Bureau of Infrastructure, Transport and Regional Economics shows that the total passengers carried on domestic flights rose only 1 per cent since the last financial year.

Business confidence remains similarly patchy, due to concerns over unemployment, the budget deadlock, the slowdown in mining and global instability.

Thirdly, expenses are high, with high Australian wages and increasing fuel prices. A major contributor to the poor fiscal 2014 result was Australian dollar fuel costs, which rose to a record $4.5bn. Qantas will be lucky to avoid brand damage from its $2bn cost-cutting program.

As Qantas owns its own aircraft fleet, the cost of maintaining these assets is high, even before considering replacement or development of older aircraft. Clearly, Qantas is a capital-intensive business.

These factors have seen the share price and intrinsic value fall in the past five years.

Figure 2: Qantas Price-Value Chart

Source: StocksInValue

We adopt a low ROE of 7.5 per cent, reflecting our long-held view of the poor profitability outlook ahead for Qntas. In fact, our forecasted ROE has not changed since March 2012. On the risk side, the required return is high at 17 per cent. We derive a fiscal 2014 valuation of $0.25.

The current market price assumes a ROE of 18.5 per cent or a required return of 6.9 per cent. Neither can be justified in light of the competition pressures, economic uncertainty and rising fuel costs.

Overall, Qantas is a low-quality business trading significantly above valuation.

By Brian Soh, Associate Analyst, with insights from George Whitehouse of Clime Asset Management. StocksInValue provides valuations and quality ratings of 400 ASX-listed companies and equities research, insights and macro strategy. For a no obligation FREE trial, please visit StocksInValue.com.au or call 1300 136 225.