Value Investor: Domino's takes a slice offshore

While this reporting season has shown modest overall earnings growth, conditions remain challenging for Australian based companies and opportunities to profitably reinvest earnings are limited. With a subdued domestic economy, we could see an increasing trend of companies expanding offshore for growth.

Although the recovery in the housing market has benefited companies like REA Group, Stockland and Boral, others face the challenges presented by the slowdown in the mining sector, subdued retail conditions and recovering business confidence. Concerns about job security linger, with unemployment on the rise.

The low growth environment has resulted in few reinvestment opportunities. While many companies are opting to return cash to shareholders (such as Telstra and Rio Tinto), this lack of reinvestment is constraining intrinsic value growth.

In this situation, companies will often consider overseas opportunities for earnings and profit growth.

SEEK Limited (ASX: SEK) is a good example of a company with a sound strategy and execution of its global expansion. It has just reported revenue growth of 40 per cent and a 65 per cent rise in net profit after tax. This strong result was driven by 200 per cent growth in earnings from Seek International, comprised of market leading employment websites in China, south-east Asia, Brazil and Mexico. With an exposure to emerging economies and rising internet penetration, the growth profile for SEK appears strong and sustainable.

Similarly, Breville Group (ASX: BRG) also reported a better than expected result, underpinned by 15 per cent growth in sales from North America and 70 per cent growth in sales from its Rest of World (Hong Kong and UK) division. This continued its strong performance from last year, with its share price rising over 50 per cent in the last 12 months, closing at an all-time high of $9.73 last Friday.

The recovery in the European and US economies also bodes well for growing overseas earnings. Meanwhile, the tapering of the quantitative easing program announced by the US Federal Reserve has pushed the Australian dollar down to three-year lows. The expected depreciation in the Australian dollar will assist the translation of foreign earnings for Australian companies.

Recent company announcements have shown management is attracted to the idea of expanding overseas. Westfield Group and Westfield Retail Trust are planning a restructure, dividing domestic and overseas operations to allow management to focus on growing its international operations. Interestingly, Myer CEO Bernie Brookes hinted at an overseas expansion, if a merger with David Jones is successful.

Unfortunately for value investors, companies delivering earnings growth from overseas operations, such as SEK, BRG and DMP, have been priced at a significant premium by the market.

Focusing on Domino’s Pizza (ASX: DMP), it benefited from expanded operations to Japan, contributing to an 89 per cent increase in revenue to $265.4 million and net profit after tax grew 40 per cent to $17.5 million.

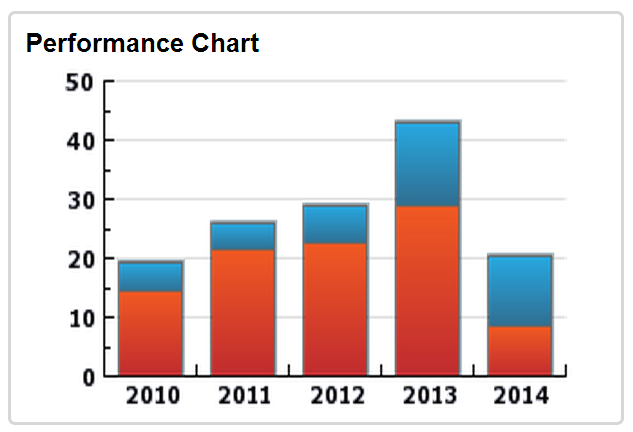

DMP exhibits strong profitability, evidenced by high normalised return on equity (NROE) figures.

Figure 1. DMP – Normalised Return of Equity, 2010-2014

Source: www.stocksinvalue.com.au

DMP has arguably maximised its growth prospects in Australia, with close to 500 stores nationwide. In addition, management have also capitalised on the online consumption trend, with early investments into the digital platform. DMP has benefited with a strong take up of the website and mobile app by customers, which offers streamlined ordering, payment and delivery options. It sales 60 per cent of its total sales are online, 50 per cent of which comes from mobile devices.

As a result, expansion into Japan by the acquisition of a 75% equity interest in Domino’s Pizza Japan, provides a platform to leverage its proven track record of successfully growing DMP in Australia. Domino’s Japan is currently the third largest pizza chain in the country.

However, unlike SEK and BRG, this expansion required a $156 million equity raising, increasing total equity to $256.1million. It is unlikely that this capital can be redeployed at its high historical rates of profitability, explaining the reduction in NROE for FY14 in Figure 1 (above).

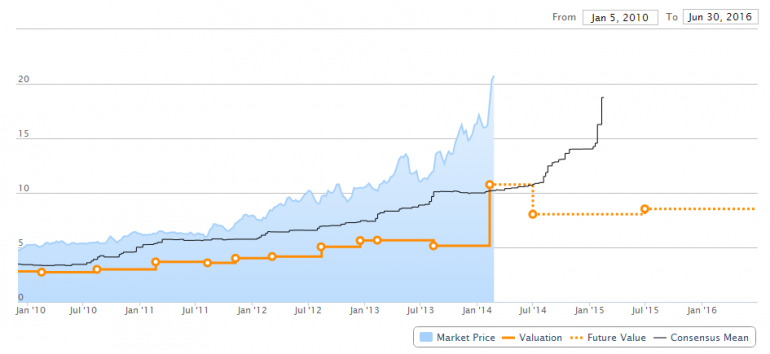

As a result, our forecast of NROE has dropped from 34 per cent to 27 per cent, with intrinsic value falling from $10.76 to $8.04. The chart below shows an interesting divergence between consensus forecasts and our own, with the mean consensus valuation chasing the market’s positive reaction to the expansion. In contrast, our valuation has fallen, due to a reduced return on equity.

Figure 2. DMP – Price Value Chart

Source: www.stocksinvalue.com.au

The sober note for value investors from these overseas forays is that the current appetite for companies that can achieve earnings growth often means these firms are priced at a premium, with no margin for error. As famed investor Kerr Neilson says: ‘Remember we advocate buying neglect and avoiding euphoria.’

Brian Soh, associate analyst at StocksInValue, with the assistance of Adrian Ezquerro of Clime Investment Management. StocksInValue is an a joint venture between Clime Investment Management, a value fund manager, and Eureka Report. StocksInValue provides valuations and quality ratings of 400 ASX-listed companies and equities research, insights and macro strategy. For an obligation free, FREE trial please visit www.stocksinvalue.com.au or call 1300 136 225.