Value Investor: CSL's red-hot opportunity

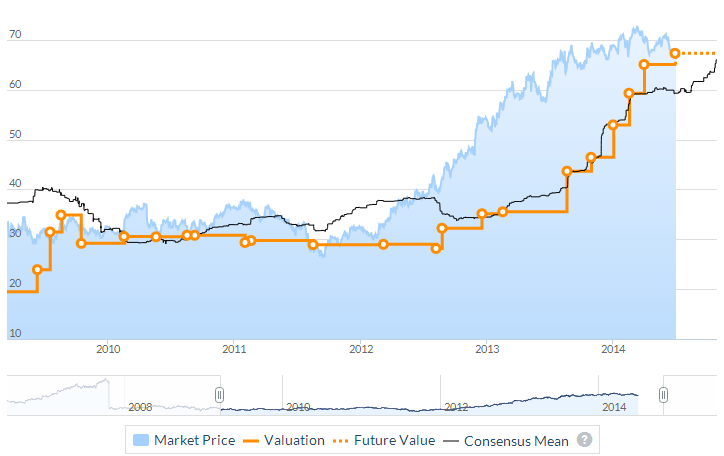

CSL has been a rewarding and attractive investment for investors due to its solid track record of delivering earnings and dividend growth. Until now, there have been few opportunities for value investors to consider investing in CSL shares, with the stock trading primarily above value (orange) in recent years.

Figure: CSL Price to Value

Source: www.stocksinvalue.com.au

CSL specialises in biologically-based health care products and the supply of plasma products and vaccines. It is a high-quality defensive business with a reputation for innovation and cost competitiveness.

CSL has a positive outlook underpinned by an ageing population, increasing health care expenditure in emerging markets and greater recognition of the benefits of its therapies.

Global demand for its core products, immunoglobulin and albumin remain robust and CSL’s historical investment in capacity makes it well-positioned to benefit from growing demand.

Through acquisitions and organic growth, CSL has become a major player in the global blood plasma-derived biotherapies space. Through its significant acquisitions, including Aventis Behring, CSL has achieved economies of scale and operating leverage.

CSL’s cost competitiveness is also driven by its ability to make a variety of different products from a single unit of blood. Through patents, CSL has further enhanced its return and competitive position in the industry.

The major risk to CSL’s outlook is a material change in output from its competitors that would affect the current supply/demand equilibrium of blood plasma derived products. CSL, Baxter and Grifols dominate this market, accounting for around 85 per cent supply. As such, rational supply decisions to ensure industry profitability are more likely to be made.

As sales and profit growth matures in the core business, investment in the research and development pipeline has grown. The successful licensing of innovative products should provide a competitive advantage and diversify its earnings streams.

CSL’s R&D investment is expected to grow 13 per cent in fiscal 2014. The key drivers of the lift in spend are the later stage trials of recombinant coagulant products, which will capitalise on the US$7 billion haemophilia market if they reach commercialisation. Commercialisation is expected from late calendar year 2015.

CSL's R&D program has historically been very successful, resulting in some 17 new product approvals or registrations over the past 10 years. The successful commercialisation of its research and development pipeline should provide upside to future earnings.

While CSL has a solid pipeline of R&D that supports our growth outlook, there is likely to be a gap in new products/innovations that CSL can bring to market. In our view, CSL is likely to grow more in line with industry trends, rather than above them.

CSL’s profitability, as measured by return on equity, has averaged 33 per cent over the last five years and has benefitted from CSL’s ongoing buybacks. Since 2005, around 22 per cent of the company’s shares have been bought back contributing to a boost in earnings per share of over 15 per cent.

We adopt a return on equity of 45 per cent and low required return of 11 per cent. Using our adopted metrics we derive a fiscal 2014 valuation of $67.30, rising to $78.25 in fiscal 2015. CSL has a forecast fiscal 2015 dividend yield of 1.9 per cent unfranked.

CSL’s reinvestment in the business at high rates of return contributes to CSL’s strong intrinsic value growth of 16.3 per cent in fiscal 2015. CSL is a high-quality defensive business and we would require a 10 per cent margin of safety to intrinsic value before investment.

By Amelia Bott of StocksInValue, with insights from Stephen Wood and George Whitehouse of Clime Asset Management. StocksInValue provides valuations and quality ratings of 400 ASX-listed companies and equities research, insights and macro strategy. For a no obligation FREE trial, please visit StocksInValue.com.au or call 1300 136 225.