Value Investor: CCL's short-term pain is for long-term gain

In the words of Coca-Cola Amatil's management, fiscal 2014 will not be an easy year. This follows a disappointing fiscal 2013, punctuated by an earnings downgrade in April. Coca-Cola shareholders have suffered, with the share price falling approximately 25 per cent in the last year, to 2009 levels.

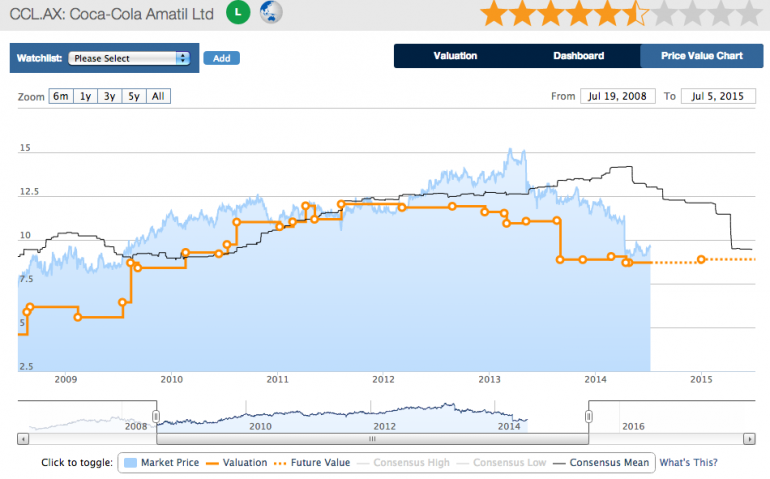

Figure 1: CCL Price to Value Chart

Source: www.stocksinvalue.com.au

In April, new chief executive Alison Watkins advised the market that first half fiscal 2014 earnings before interest and tax would be about 15 per cent lower than the previous corresponding period and difficult trading conditions would continue.

At the board’s request, Watkins is reviewing group strategy including brands, distribution, pricing, costs and capability. Coca-Cola's review is responding to increasing competition, loss of pricing power, cost problems and a lack of product innovation.

The group's grocery channel continues to be challenging with aggressive pricing activity limiting its ability to recover cost increases. Coca-Cola is experiencing operating deleverage. In the context of increasingly frugal consumers and competitive pressures there is little scope for it to increase prices to offset cost inflation in the near term.

Competition in the grocery channel is not only due to an aggressive competitor in PepsiCo but private label carbonated soft drink brands, which are gaining market share. There is a clear trend in consumers seeking value. The major supermarkets, Coles and Woolworths, recognise if they don’t meet that demand, consumers will seek it elsewhere.

While Coca-Cola enjoys strong brands, the dominance of Coles and Woolworths is limiting margins as they continue to seek supplier discounts and closely watch inventory levels.

On a per capita basis, consumption of sugary CSDs has declined in Australia since 2009. Health trends have driven a rotation from sugary to low or no-sugar beverages, with the latter’s volumes growing at swifter rates.

The offsetting factor for Coca-Cola is this trend has been a positive for beverages such as Coke Zero, Diet Coke, bottled water (Mount Franklin and Pump), low calorie offerings and its portion control packs.

Bottled water is a growth market but brand differentiation and charging a price premium are more difficult. New product innovation in low calorie offerings should help stem the trend towards bottled water.

Coca-Cola has failed to innovate and keep on top of consumer preferences. Instead, it has depended on price growth in core categories for earnings growth. With margins constrained, it requires a strategic shift towards brand revitalisation and leveraging that brand loyalty across other categories, in particular low calorie offerings.

The Coca-Cola brand is one of the group's core competitive advantages and it is the brand equity that allows it to command a price premium and generate healthy margins. Coca-Cola must revitalise brand interest and reinforce loyalty to protect against market share losses to private label categories.

The group is also facing challenges offshore. The Indonesia business has been severely impacted by cost inflation resulting from the 20 per cent depreciation of the rupiah in 2013, as well as legislated material increases in wages and fuel costs. The intensifying competitive landscape, with two new entrants (Aje Beverage and Asahi/Indofood), is making it more difficult to offset these costs through pricing.

We have incorporated the April downgrade and expectations of restructuring charges in our fiscal 2014 forecasts. We expect a lower dividend. The group's issues will not be rectified immediately however we maintain a long-term positive view on the company. Coca-Cola has an enduring business model, which is underpinned by its powerful distribution network and strong brand equity across a broad product portfolio.

We adopt a forecast sustainable return on equity of 36 per cent and a low required return of 12 per cent to derive a fiscal 2014 (31 December 2014) valuation of $8.89.

By Amelia Bott of StocksInValue, with insights from Stephen Wood and George Whitehouse of Clime Asset Management. StocksInValue provides valuations and quality ratings of 400 ASX-listed companies and equities research, insights and macro strategy. For a no obligation FREE trial, please visit StocksInValue.com.au or call 1300 136 225.