Value investing has got tougher

| Summary: Stockmarket volatility is very low, and now nearly back at the levels experienced just before the global financial crisis. Is an impending financial disaster around the corner? The short answer is no, with global growth accelerating and the risks to growth very low. |

| Key take-out: For investors, low volatility is extremely good. But it means that stock bargains will be hard to find. Playing the value game by sitting on the sidelines until a stock falls into its intrinsic value range is risky. For some stocks, you could be waiting a long time. |

| Key beneficiaries: General investors. Category: Investment strategy. |

There’s been a lot of discussion lately about what the sharp drop in market volatility might mean for investors.

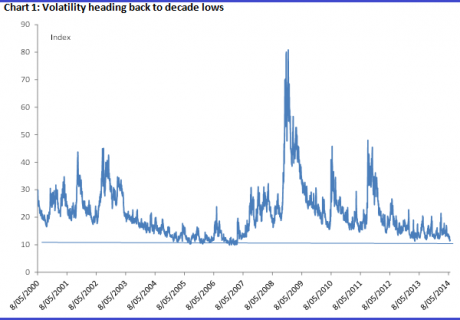

Take a look at the chart below of the VIX index, which is a measure of implied volatility of S&P500 index options. Also called the “fear index”, the higher the index the higher the market’s fear factor. While it’s an index for the US stockmarket, it’s useful for domestic investors as well given the high correlation, over time, between the All Ordinaries and US indices. I’ve referred to it on a few occasions before, as it’s a good indicator to keep an eye on. The important thing to note now is that not only is volatility very low, it’s nearly back at the lows we saw in 2006-07 (i.e. around 14-year lows).

As a consequence of this low volatility, many policymakers and investors have expressed concern that equity markets are being far too complacent – that they’re not really pricing in or aware of the severe downside risks facing the globe. According to that view, this means a negative market event is imminent. There is no shortage of people who make that point. In doing so, nearly all point to the slump in bond yields as a sign of impending turmoil, as bond yields usually only decline when market participants are expecting economic weakness, or when some crisis has flared.

One problem with this view is that we’re not seeing safe haven flows elsewhere. In fact, the bond rally and the general view of market complacency is inconsistent with recent gold price moves. While the 10-year US bond yield is down some 30 basis points over the last couple of months, the gold price is off about $US20. If that fall in bond yields really did point to some concern in the broader market, then gold prices would be rising, not falling. You’d also see it in other price action somewhere, and the fact is we’re not.

Now bad things happen, and I’m not suggesting they won’t happen again. Yet, if there is one thing investors should not be nervous of, it is this low market volatility - it is not a sign of impending disaster. It’s low for a reason, and it’s a little disingenuous to suggest equity markets are being complacent. Markets can only price in available information and a reasonable expectation of what might be.

Is it unreasonable for the stockmarket to price in such a benign environment? I don’t think it is, and I noted at the start of the year that 2014 was shaping up to be the most benign year for at least seven years. So far, that is proving to be correct and for good reason. The ‘crisis’ - pick one - is over: Europe is getting its act together, China didn’t implode, and the US economy is accelerating (the global economy is accelerating). The global backdrop is very positive, and this is manifesting in variety of ways: the absence of the so called “sell in May and go away” effect is one.

Nearly five months on, my view is tracking very well. Not only is global growth accelerating but the risks to that growth have declined substantially. Meanwhile, global central banks are still loath to “normalise” monetary policy.

So what does it all mean?

First up, investors need to prepare for a prolonged period of subdued volatility. It doesn’t mean that some adverse event will follow, with the complacency advocates pointing to the low period of volatility in 2007 that was followed by the GFC. In 2007, there were quite visible signs of imbalances developing - and rates were being tightened by overzealous central banks. Now the pendulum has swung the other way – there is no catalyst.

Low volatility is certainly bad for brokers and investment banks - that’s why we’re hearing so much about it. Yet, for retail investors and other real money investors, low volatility is great. Think about it. Low volatility gives real money investors the confidence to invest. And, if history is any guide, that is exactly what they will do - for the simple reason that they can be more confident in the market.

Thought of another way, investors are less concerned about a sudden and dramatic capital loss. Through the years 2004-2007 which was also a period of very low volatility, this confidence manifested in a 40% increase in the S&P500, while the All Ords was up nearly 100%. Now have a think about how people felt from 2010 through to 2012 - through all the euro trash talk. Volatility was high and for many people it was just too risky an environment to invest.

Now, we find ourselves in the opposite scenario. But if you’re looking for value, you could be waiting a long time. Very low volatility makes following a value investing strategy difficult. That’s not to say that value opportunities won’t arise, but don’t expect them. Don’t wait for them either, because by sitting on the sidelines you could miss out altogether.