US dollar: Bucking the trend

Summary: In a gloomy year for the global bond, commodity and share markets, only the currency market has been able to provide some colour for investment, and in particular the stand-out performance of the US dollar. |

Key take-out: There are more factors than just US rate expectations supporting the ascension of the greenback. |

Key beneficiaries: General Investors. Category: Investment Strategy. |

Despite yielding little more than nothing, cash is on track to beat the return on both global stocks and bonds this year. With the decline in bond prices, breakdown in stocks and bear markets in most commodities, the argument for a stuffed mattress is intriguing. And even in a currency versus currency battle, the greenback is coming out on top.

The chart of the US dollar index is flat for the year, but charts of other major currencies are weak. And that suggests the dollar is still in a bull market.

Let's start with the dollar index, which tracks the performance of the dollar versus a trade-weighted basket of other currencies. The euro makes up about half the index's weight.

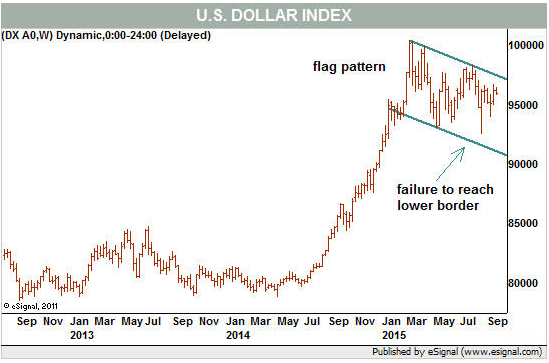

The long-term chart below shows a major breakout and rally in 2014 and corrective action in 2015. Since peaking in March, the index settled back into a flag pattern, so named for its appearance of a flag flying on a flagpole. It serves to correct the long advance that preceded it and usually resolves to the upside.

Chart One: US Dollar Index

Usually, of course, is not the same as always. In this instance, however, we have an extra clue that suggests higher levels ahead. During the August decline, the index failed to trade down to the bottom of the pattern. The bulls did not wait to buy, which implies strong underlying demand even as prices sagged.

To be sure, the true breakout does not occur until the upper border is pierced. That is roughly 1.3 per cent above current trading, which would constitute a big move for currency markets.

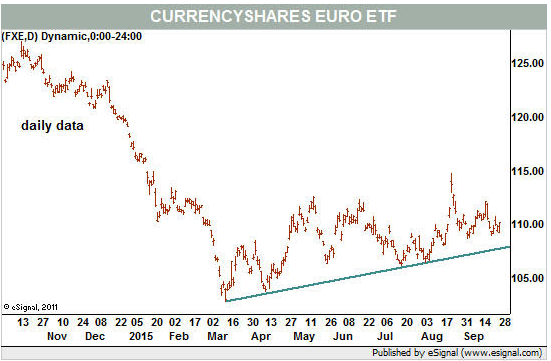

Since the euro comprises half the index, let's look at the CurrencyShares Euro Trust exchange-trade fund (US:FXE). Predictably, it also has a flag pattern since March, albeit inverted from the dollar index's pattern (see Chart Two).

Chart Two: CurrencyShares Euro Trust ETF

Because it is inverted, it has a bearish connotation, which is commensurate with a bullish dollar. If the ETF trades below the $US108.25-$US108.50 zone it will complete the pattern and be on track to revisit its March lows near $US103.00 (the ETF traded at $US110.16 Monday afternoon).

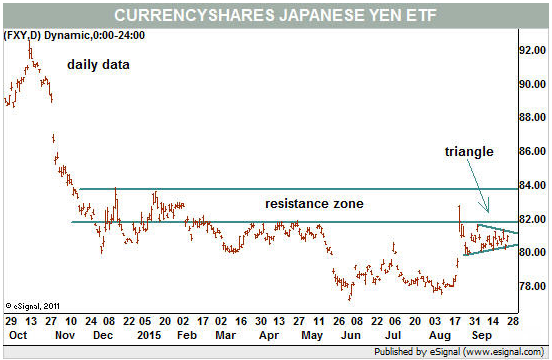

The Japanese yen is the next most heavily weighted currency in the dollar basket, at roughly 14 per cent. And the trend in the CurrencyShares Japanese Yen ETF (FXY) has been down since 2011 without any clear major pattern in force this year (see Chart 3 below),

Chart 3 CurrencyShares Japanese Yen ETF

In August, the ETF jumped higher and settled into a small triangle pattern. Given its position after a long trendless and pattern-less period, it actually leans bullish.

But in context of the bear market that preceded it, the pattern is too small to effectively launch a sustainable rally. Plus, there is ample overhead resistance from several price peaks from December through May.

In other words, there is plenty of work for bulls to do here, and that work cannot even begin until the small triangle breaks to the upside. There is no promise it will.

The next largest currency in the basket is the British pound. Its ETF (US:FXB) had a similar flag pattern to the euro's. In August, however, that pattern broke to the downside, giving the pound a clear shot at its March-April lows.

The Canadian dollar ETF (US:FXC) and Australian dollar ETF (US:FXA) are both already in declining trends and both have hit multi-year lows. Both of the economies represented are heavily dependent on commodities, adding a fundamental bearishness to the already gloomy technical conditions.

Trends in other currencies, from the Indian rupee to the Brazilian real to the Chinese Yuan are also bearish. This suggests the dollar strength will continue and suggests the euro will finally break down to complete the greenback's domination of the world's major currencies.

Note how none of the above arguments included the effects of the Federal Reserve and the potential for rising interest rates in the US Theoretically, as interest rates move up, demand for securities that offer that interest – mainly US Treasury bonds and markets such as corporate bonds that are priced relative to them – rises.

Foreign investors need dollars to buy these securities and that further increases demand for dollars.

So as stocks, bonds and commodities fall, the only game in town is the currency market. And in the currency market, the US dollar is still king.

Michael Kahn, a longtime columnist for Barrons.com, comments on technical analysis at www.twitter.com/mnkahn. A former Chief Technical Analyst for BridgeNews and former director for the Market Technicians Association, Kahn has written three books about technical analysis.

This piece has been reproduced with permission from Barron's.