Uncovering LIC manager fees

Summary: How much you pay in management fees on a LIC will depend on whether it is internally managed by an in house team, or externally managed – and contracted out to a fund manager who charges a management fee. For this exercise I have calculated management expense ratios by including management fees, accounting fees, share registry, custody, legal and other fees. |

Key take-out: At the end of the day, it comes down to overall returns – but know what goes into calculating an MER and if performance doesn't match up with fees, it might be time to look elsewhere. |

Key beneficiaries: General investors. Category: Listed Investment Companies. |

The F word is undoubtedly the dirtiest in financial language… Fees.

Investors want to pay as little as possible and managers are constantly battling to justify them. It's a delicate subject.

Managers should get paid for managing a portfolio. Not everyone can do it, hence why the funds management industry exists. Yet investors are sceptical of the industry and constantly ask if they are getting value and heaven forbid if a manager under performs over one year or so…that leads to: “I'm not paying for underperformance!”

You are paying for a professional service. Some are going to be better than others just like in any profession, but you are paying for a team of analysts who live and breathe the stock market. That costs something and it should emerge as a charge to the customer.

Just like in any industry, some are more expensive than others and some are better value than others.

Today I examine the 20 largest Australian focussed LICs listed on the ASX.

Internally managed vs. externally managed

In the Listed Investment Company (LIC) space there is a clear divide between internally managed LICs and externally managed LICs. Externally managed LICs have management contracts with a fund manager. They charge a management fee (typically around the same rate that manager charges for its other products) and the portfolio then covers the additional costs associated with the day to day running of the portfolio. The management contracts will be up for renewal every five or so years. They vary from LIC to LIC.

On top of the management fee there will typically be a performance fee as well. This too will vary from depending on the LIC.

Internally managed LICs employ their own investment team and operating staff. This is run on a fixed cost basis. Therefore as the size of the fund grows, the costs as a proportion of the portfolio reduce. These costs are known as a management expense ratio (MER). This is why Australian Foundation Investment Company will always have a lower management expense ratio than, say, a Wilson Asset Management LIC.

You will find in the tables presented below that internally managed LICs are cheaper in terms of management expenses compared to externally managed funds: That's because keeping it in house they avoid external management fees.

This is not saying an internally managed LIC is better than an externally managed one. It is just that investors need to be aware of the difference and expect more from those who charge more.

Expenses

Another difference between internally managed LICs and externally managed is the reporting of expenses. Typically an external LIC will separate expenses from management fees. Internally managed LICs will, generally speaking, lump brokerage and any other expenses to do with the day to day running of the portfolio into the same category and include them when calculating the management expense ratio.

Depending on the nature of the particular investment approach, some LICs will incur more costs than others. LICs that trade regularly are going to have higher brokerage costs. Those that employ a long short strategy are going to have stock loan fees and short dividend expenses. This specific cost comes out of the portfolio but it is not a management expense, rather shorting-related charges are treated by the manager as a cost of doing business.

If certain costs were included such as brokerage and shorting-related expenses the difference would be dramatic and in some cases it would change the management expense ratio from one per cent to as much as five per cent.

Calculating the MER

Typically in unlisted managed funds investors have become accustomed to seeing the MER reported clearly by the fund manager.

However, in the LIC sector there is no such requirement and the provision of MERs is at the manager's discretion. In fact the shareholder has invariably to go through the annual report and attempt the calculation themselves.

Here I have done the calculation for you: To calculate the management expense ratio I include the management fees, performance fees, accounting fees, share registry fees, custody fees, legal fees, directors' fees, ASX listing fees and the bucket at the bottom labelled “other”.

To calculate the MER add the above expenses together and divide by the total assets.

For the record, the MER reported by LICs that choose to advertise it is calculated on a monthly basis and the final figure is an average of the 12 months.

For those who want a simpler way that will get you a rough idea of the MER, you can just grab the total assets and expenses from the annual report. It won't give you exact figures as it is looking at the value of the portfolio at that particular point in time and as we all know the value of a portfolio will vary day to day.

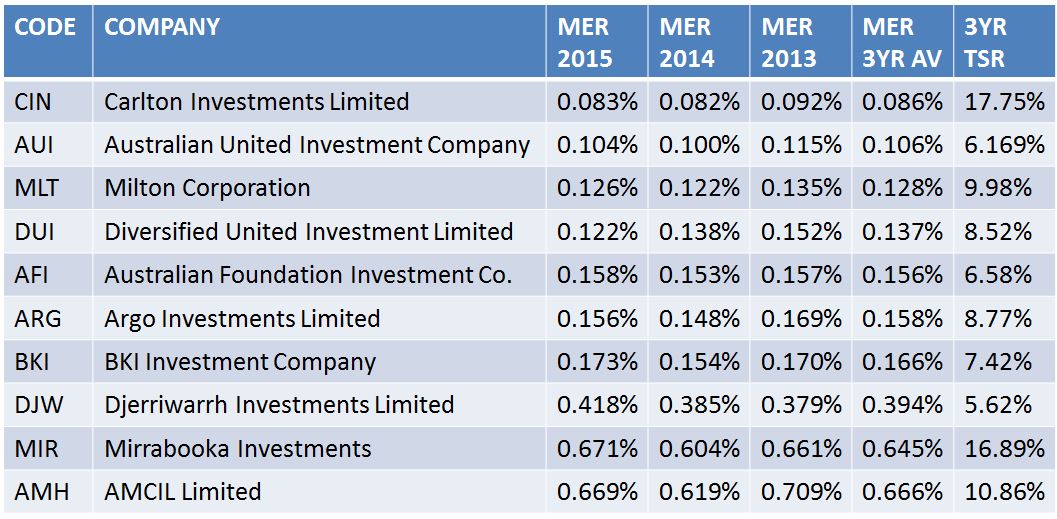

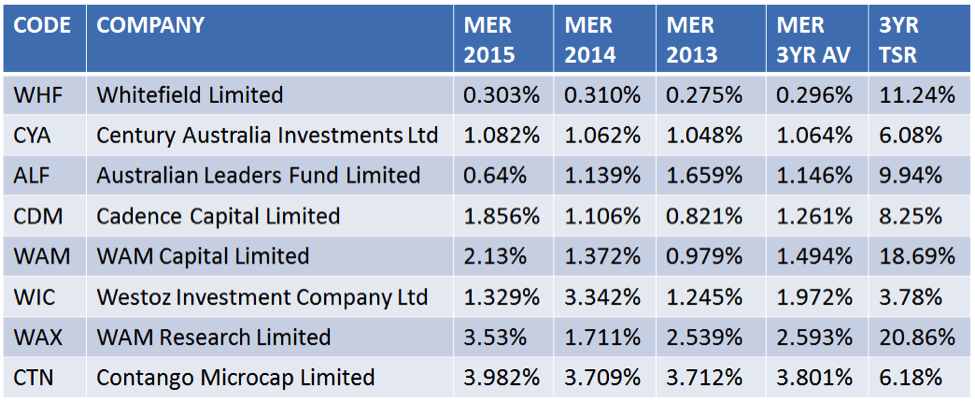

With internally managed LICs you will note they do not split out brokerage costs when displaying expenses in the annual report. Occasionally you will see employee costs separated from operating but that is as far as internally managed LICs tend to go. Therefore it is difficult to compare apples with apples as some choose to show a breakdown of everything whereas others choose not to. For the purpose of the table below I have split out internally and externally managed LICs.

Needless to say, some LIC managers will take issue with our selection of data in the tables below but to attempt a standardised MER for the sector which anyone do at home we had to impose the same rules on every manager.

Externally managed

TSR source: Bloomberg as of 27/05/2016

Internally managed:

TSR source: Bloomberg as of 27/05/2016

Note the calculations are approximate calculated off the closing value of the portfolio on June 30 – therefore the actual MER may vary.

As previously mentioned there is nothing wrong with a manager charging higher fees if they can deliver a greater return. On top of that those with a higher cost should demand a greater discount to NTA.

Management expense ratios are a messy subject. Depending on who you ask you will get different answers as to what should and should not be included. Ask an internally managed manager and they will tell you all expenses, ask an external manager and they will take out the expenses. Be aware of all the costs because these will eat into your returns.

Certainly, LIC investors could be better served when it comes to expense reporting and the sooner a standardised MER is established for the sector the better.

In the meantime it comes down to the overall returns. If the manager is performing well then it is worth the cost. But if not, look elsewhere.