Top fund managers: K2 Select International Fund

Summary: The K2 Select International Fund looks for companies that are likely to grow regardless of the business cycle. The fund is particularly interested in technology and healthcare stocks, but recently felt it was a good time to lock in some gains. The fund also looks for companies trading at the right price. |

Key take out: The fund takes the view that US tech firms are essentially moving to control the world – a handful of players will dominate. |

Key beneficiaries: General investors. Category: Shares. |

International investors looking for growth are likely to find interesting companies in the US tech space. As the head of K2's Select International Fund, Nick Griffin, explains, the tech companies that achieve scale will win – and they're playing a game of winner takes all.

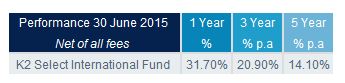

Griffin's team have returned 14.1 per cent annualised over 5 years, with a three-year performance of 20.9 per cent and a one-year return of 31.7 per cent. This compares to a target of 15 per cent. The team looks at any company that is benefitting from the ways the world is changing – such as semiconductor companies that allow every device in the world to connect – that will succeed regardless of economic activity.

K2 Select International Fund performance. Source: K2

The fund is also interested in healthcare stocks and European retailers, as it looks for companies that will do well despite the strength or weakness of the broader economy.

The trick? Finding companies that investors value incorrectly – things that look cyclical but become structural.

Head of K2 Select International Fund, Nick Griffin. Source: Supplied

DD: The K2 Select International Fund looks at secular growth and structural change in the world. What does that actually mean and what do the investments look like?

NG: When we talk about secular growth we are trying to focus on companies we think are going to succeed regardless of the business cycle. So we're looking at how the world's changing and evolving and we try to find the companies that are most likely to benefit from this.

In that way we feel like we can reduce the risk of the economic cycle. Obviously you never eradicate the risk, but we think that the share prices of companies that make more money every year generally go up. So if we're investing in the winners of this changing world, then, through the cycle, we're more likely to generate absolute returns. For instance, we're not trying pick a turning point in European retail growth, we're trying to pick disrupted retailers in Europe.

We look for strong, structural or secular earnings growth, and that generally means revenue growth, so double GDP and earnings growth of around double digits. And then from that point of view, the hard bit is obviously trying to find when something is at the right price.

Are there any countries or sectors that show more or less of these types of companies over the 10 years that you've run this fund?

It's not bound by sectors or regions, but in practice, most of the big changes occurring in the world and the big disrupters are related to the technology area. The US stands out as somewhere we generally find ourselves honing back to with investments in things like Apple and Google over the years and more recently investments in semiconductor companies and even investments in bigger tech players. The other area is healthcare where there's been a lot of change occurring over the last 10 years which has essentially been ground breaking and that's areas such as biotechnology companies like Celgene and Gilead Sciences (to read more on Gilead Sciences, see Clay Carter's story: Gauging Gilead's superior growth, October 27, 2014).

You've got nearly 30 per cent cash at the moment. How long has it been like that for?

Over the journey the funds have roughly been 65 per cent to 70 per cent net invested because we want to participate in the upside and protect against the downside. So if you look at our returns, we think risk adjusted they're very good returns because we're not running 100 per cent long the whole time.

We're not gearing the funds in any way, we're just quite simply taking the pragmatic view of when a good time and bad time is to be taking risk. Four weeks ago we decided we'd had a very good run and felt it was prudent to try and lock in some of our gains and come back later in the year once essentially the Fed had hiked rates, the Greece issue had passed and people had taken profits. That cash will come in handy if markets do correct because then we have the ability to buy stocks on their bad days.

You haven't quite reached your aim of returning 15 per cent, does that bother you? Can it be attributed to anything?

We've more than doubled the index over the 10 years that the fund's been running, so it is a good result, but you're right, it's short of what we target. The goal was set in a completely different interest rate environment, so since then as interest rates have fallen, the ability to generate those returns is definitely harder and obviously that includes the financial crisis.

So, there are hurdles that we have to achieve to reach 15 per cent, but it's still something we are trying to do – and our internal remuneration is still based off that number after all fees.

What are some of the companies that that you find exciting and the spaces that they're in?

It's undeniable that US tech firms are essentially moving to control the world and in an internet world, everything gets connected, creates network effects and essentially revolves around a handful of good platforms.

A lot of the stocks are pretty fully valued at the moment but we do still like Apple and we like Facebook a lot – though we just can't seem to get our head around the valuation. What we've done is basically move down the chain and invest in the manufacturers of this change – essentially the semiconductor companies that are enabling every device in the world to connect.

On the platform side of things we are getting more comfortable with companies like Amazon. For instance, they recognise that this is a game of scale and it will be just a handful of players that dominate. If you don't have scale, then you become the Yahoo, the eBay, the Myspace of the world and you're worth nothing. It's the winner takes all at the moment unfortunately. In Australia, there's a Seek, a realestate.com [majority owned by News Corp, publisher of Eureka Report], a carsales.com. You are number one or you're nobody.

How long do you hold your companies for?

Ultimately a structural or a secular trend can last the decade, but in a valuation sense it could last less than a year, up to three. From our point of view, we have no shortage of ideas; the hard bit is finding them at the right price. And we have to balance this with the point in the future when they become fully valued – when the structural trend we're thinking of becomes fully appreciated and we have to sell them and move on. The real trick is to find something that people are valuing as cyclical which actually becomes structural.

The best example I could probably give you there would be Disney which we've owned for three years now. At the time, we bought the company in a market multiple at 15 times earnings and people thought that Disney was very much a cyclical TV network, a theme park and a movie business. But in reality what's happened – and people appreciate it now – is they've invested in Marvel and Lucas Films and they've essentially built these wonderful franchises that allow them to release movie after movie after movie (see also: Disney hits light speed, June 29).

Do you invest in the fund yourself?

As a rule everyone at K2 has essentially all of their personal wealth in the funds, well at least I don't invest in anything else. You could give the money to other fund managers if you wanted to, but I have to admit I do this for a living and I don't have time to invest my own money, so it's just easier. I struggle to understand how others have time to invest their own money.

Daniella D'Ambrosio is a writer at brightday. The K2 Select International Fund is available on the brightday platform, which allows a minimum investment of $1,000 in managed funds.