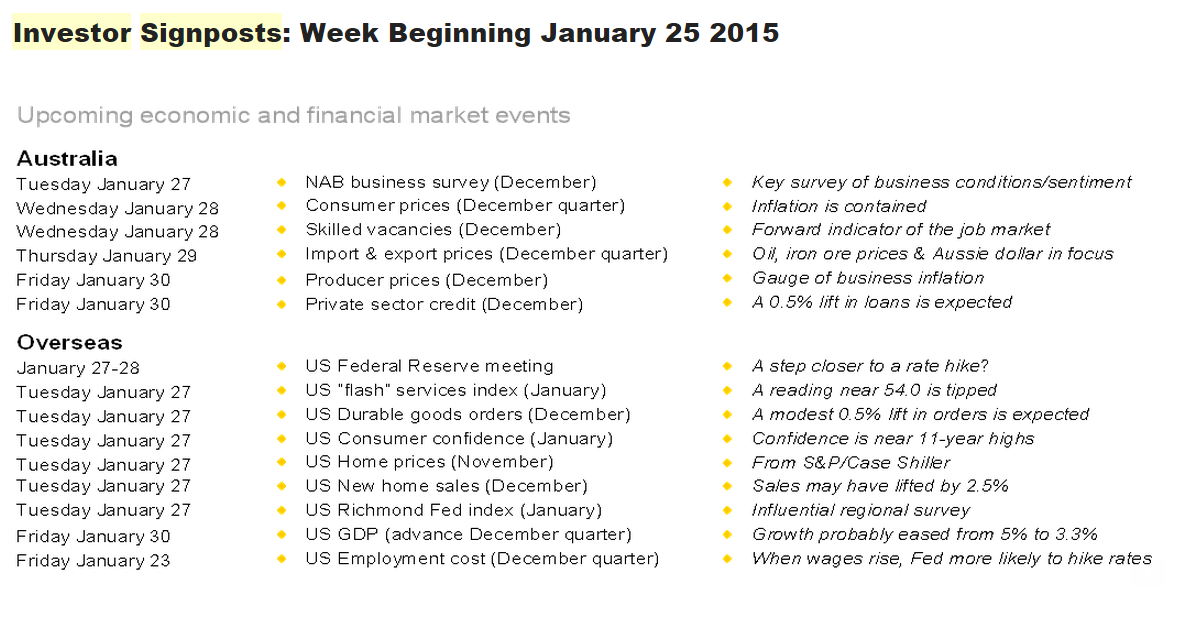

The Week Ahead

Official inflation data only comes around once a quarter in Australia. There is private sector monthly survey on inflation from TD Securities and Melbourne Institute, but the Bureau of Statistics only publishes its inflation measures once a quarter.

The consumer price index for the December quarter is released on Monday. The authors of the monthly inflation gauge are tipping that prices rose 0.3 per cent in the quarter and 1.8 per cent for the year. The CBA Group is tipping a similar result ( 0.2 per cent/1.8 per cent).

Over the quarter, the price of petrol plunged by 6.3 per cent and that alone will cut around 0.2 percentage points off the quarterly CPI change.

More importantly, investors will need to focus on the ‘underlying' measures that exclude petrol as well as the non-tradable price measures that focus on domestic price pressures.

We expect that underlying inflation grew 0.4-0.5 per cent in the December quarter and around 2.1-2.2 per cent over the year. Only if inflation threatened to undershoot the 2-3 per cent target band would the Reserve Bank elect to deliver more stimulus.

The other readings on inflation are trade prices (export and import prices) released on Thursday, and producer prices, released on Friday. Both these measures are heavily influenced by changes in iron ore, oil and coal prices and the Aussie dollar.

The other indicator to watch in the coming week is private sector credit (or loans outstanding) to be released on Friday. We expect that credit grew by 0.5 per cent in December, keeping the annual rate at 5.9 per cent. This should be close to the peak for annual loan growth with Aussies still reluctant to take on new debt.

The US Federal Reserve hogs the limelight

The flow of Chinese economic data has dried up, so the US takes centre stage. And not only is there a hefty schedule of data releases; the Federal Reserve meets to decide interest rate settings.

The week begins on Monday when the Dallas Federal Reserve releases a survey on manufacturing.

On Tuesday, more than half a dozen readings will be released in the US: ‘Super Tuesday'. Among the data are durable goods orders, a ‘flash' (current) reading on the services sector, home prices, consumer confidence, new home sales, weekly chain store sales and an influential survey from the Richmond Federal Reserve.

Consumer confidence should be strong while home prices have lifted by 4.5 per cent over the year and durable goods orders are tipped to have lifted by 0.5 per cent.

Over Tuesday and Wednesday the US Federal Reserve meets and the decision is announced at 6am Sydney time on Thursday morning. Financial markets expect the Federal Reserve to lift rates around mid-year. And each meeting over the next six months we will gather clues on when that rate hike will occur.

On Wednesday, housing starts data is due in the US with annualised starts tipped to lift from 1.028 million to 1.04 million in December. New building permits are also expected to have edged higher in the month. The usual weekly data on mortgage finance is also released.

On Thursday in the US, data on pending home sales is released with the usual weekly data on claims for unemployment insurance.

And on Friday, the final January estimate for consumer sentiment is issued (currently at an 11-year high) together with data on employment costs, the Chicago purchasing managers index and the advance reading of economic growth for the December quarter. The current 5 per cent annualised economic growth was never sustainable and the likely 3.3 per cent annualised growth rate in the December quarter will be closer to the mark.

Sharemarket, interest rates, currencies & commodities

Across the Tasman, many were preparing ‘parity parties' -- parties to celebrate the Aussie dollar going one-for-one with the NZ dollar. Well after reaching the strongest levels of $ NZ1.035 per Australian dollar, the Kiwi has softened to levels above $NZ1.07. A low inflation result has reduced the imperative for Reserve Bank New Zealand to lift rates.

The US earnings season (release of quarterly earnings) continues in the coming week. Among companies reporting on Monday is tech giant Microsoft. On Tuesday earnings are tipped from Apple, Caterpillar, Yahoo, AT&T, 3M, Pfizer, Proctor & Gamble and DuPont.

On Wednesday earnings are expected from Boeing, Facebook and Qualcomm.

On Thursday, profit results are slated from Amazon, Ford Motor, Google, Time Warner, Viacom, Dow Chemical, and ConocoPhillips.

And on Friday, Chevron and Altria are amongst those expected to report earnings data.