The Week Ahead

The consumer price index

The main measure of inflation in Australia is the consumer price index. Despite the fact that the CPI is a key focus of Reserve Bank monetary policy deliberations, the data is only produced quarterly, not monthly, as it is more commonly issued in other parts of the globe.

Still, that also means that investors are spared from yet more volatility. Clearly the data would have potential to move around markedly on a monthly basis, causing some to fret about interest rate changes one month, only for those fears to be possibly allayed the next month.

The June quarter CPI figures will be released on Wednesday. And one benefit of the data being produced on a quarterly (rather than monthly) basis is that significant work can be put into getting the most accurate results. In fact the Bureau of Statistics obtains 100,000 price quotations each quarter across 87 expenditure classes (or groupings of ‘like’ items).

In the March quarter the CPI lifted by 0.6 per cent to stand 2.9 per cent higher over the year. Excluding volatile items, the key 'underlying' inflation measures rose by around 0.5-0.6 per cent in the quarter to stand 2.7 per cent higher over the year.

In other words, inflation remains within the Reserve Bank’s 2-3 per cent target band. And the more modest growth of prices in the quarter -- compared with the two previous quarters -- suggested that inflation wasn’t poised to significantly push through the upper bound of the target band. In fact the Reserve Bank continues to emphasise its view that inflation will stay between 2-3 per cent over the next few years.

In the June quarter we expect that the 'headline', or All Groups CPI measure, rose by 0.6 per cent in the June quarter with the annual rate of inflation edging up slightly from 2.9 per cent to 3.1 per cent. The carbon tax would be one factor contributing to a slightly higher annual inflation rate.

The various 'underlying' measures of inflation probably rose by around 0.7 per cent in the quarter and by 2.8 per cent over the year.

There was a seasonal increase in health fund costs in the June quarter, but this may be offset by a fall in the cost of domestic travel and accommodation after the peak summer season. Clothing prices may also have fallen in response to warm autumn weather. Car prices also remain the most affordable since the 1970s, courtesy of a firm dollar and competition.

Reserve Bank in focus

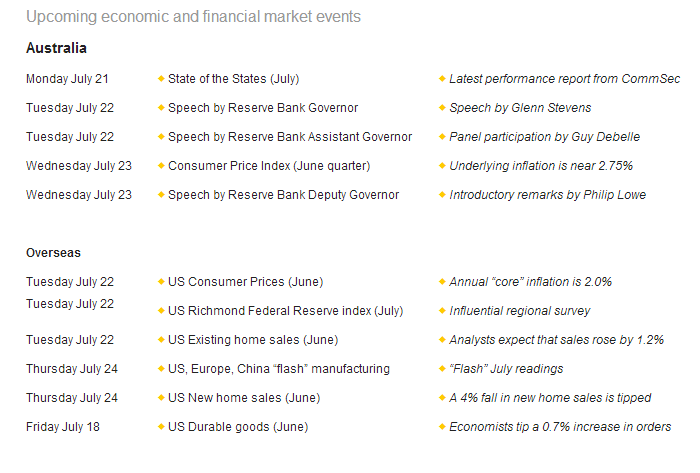

If it wasn’t for the Reserve Bank, there wouldn’t be much in the way of economic data or financial events to interest investors. But on Monday, CommSec will release the State of the States report.

On Tuesday, Reserve Bank Governor Glenn Stevens delivers the annual luncheon address to the Anika Foundation. Also on Tuesday, there is panel participation by Guy Debelle, Reserve Bank Assistant Governor (Financial Markets), at the 2nd Latin America Australia Investors Forum in Sydney.

And on Wednesday Reserve Bank Deputy Governor Philip Lowe, Deputy Governor, gives introductory remarks at the RMB Internationalisation Round Table in Sydney.

There are two key points being stressed by Reserve Bank officials at present. The first is that there is no need for interest rates to move in any direction. And the second point is that home prices don’t always have to go up. The senior Reserve Bank officials are likely to deliver similar messages in the coming week.

Focus on housing in the US

There is the usual bevy of economic indicators for release in the US with home sales and prices dominating the schedule. But the influential 'flash' manufacturing gauges are released in the US, Europe and China.

The week kicks off in the US with the National Activity index released on Monday.

On Tuesday, the consumer price index (CPI) for June is issued. At present “core” or underlying inflation is running at a 2 per cent annual pace. Economists expect that the core measure rose by 0.2 per cent in June, keeping inflation at a tame 2 per cent annual rate.

Also on Tuesday the US Federal Housing Finance Agency releases May home price data while data on existing home sales, the influential Richmond Federal Reserve index and weekly chain store sales figures are issued.

In the US on Wednesday, the usual weekly data on mortgage activity is released: new loans and refinancing.

On Thursday the 'flash' (or early) readings of manufacturing activity are issued in the US, Europe or China. These readings may mislead about the true state of activity, but investors still watch the measures closely. Also on Thursday in the US, data on new home sales is released together with the usual weekly figures on jobless claims (new claims for unemployment insurance).

And on Friday, a measure of business investment in the US (orders for 'durable goods') is expected. Orders are tipped to have lifted 0.7 per cent in June after falling 0.9 per cent in May.

US profit-reporting season

The US profit-reporting season moves into full swing in the coming week

Among companies reporting on Tuesday are Apple, Coca Cola, McDonalds, Microsoft and Verizon.

On Wednesday, 36 companies from the S&P 500 index report earnings including Boeing, E*Trade, Facebook, PepsiCo, and AT&T. Around 50 companies from the S&P 500 index report profit results on Thursday including Altera, Amazon, Caterpillar, Ford, General Motors, 3M and Visa. And on Friday, Moody’s and Xerox are among those expected to release earnings results.