The Week Ahead

Home prices grow at slower rate

For those who have been fretting that the upward ascent of home prices had come to an end, there is good news. Over June, home prices advanced, but at a sustainable rate, highlighting the consolidation now underway across the housing sector.

On current data from RP Data, home prices across mainland states capital cities have lifted by 0.8 per cent so far in June after retreating 1.9 per cent in May. Over the past year, home prices have been rising by around 0.9 per cent a month, although average growth over the past four months has been far slower at 0.2 per cent per month.

Perth has led the gains in home prices in June, up 1.3 per cent, followed by Brisbane and Gold Coast, up 1.2 per cent, followed by Sydney (1.1 per cent) and Melbourne (up 0.4 per cent). Adelaide home prices have fallen by 0.5 per cent so far in June.

Sydney continues to lead the way in annual growth with home prices up 15.7 per cent over the year. Melbourne home prices are up 9.2 per cent on a year earlier, followed by Brisbane/Gold Coast, up 6.6 per cent, Perth, up 4.9 per cent and Adelaide, up 3.0 per cent. On average across the five capital cities, home prices are up 10.2 per cent.

Annual growth of home prices will continue to soften over 2014/15 as the construction of houses and apartment is completed, adding to the supply of available homes.

The full results for the RP Data-Rismark home value index for June will be published on Tuesday.

Aussie economic events

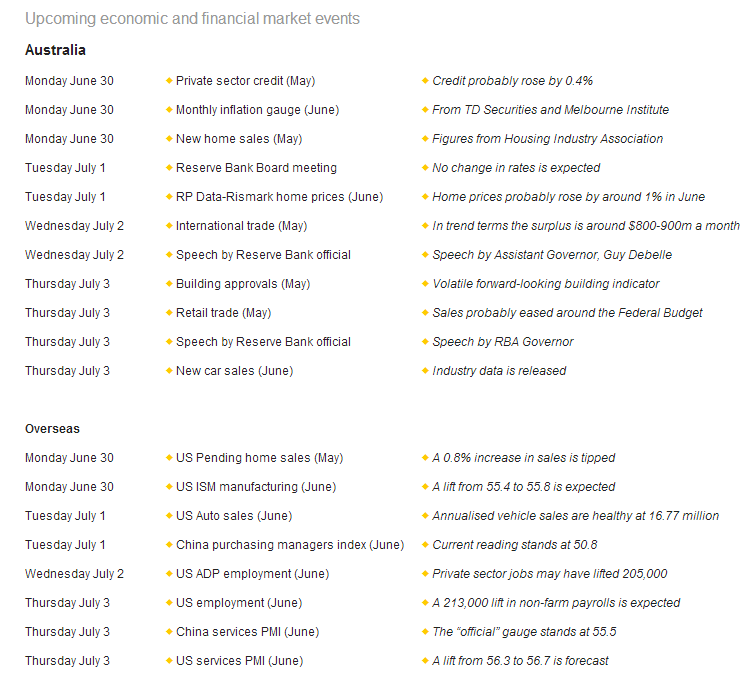

A spattering of ‘top shelf’ economic indicators will usher in the new financial year including a meeting of Reserve Bank board members.

But ahead of the start of the 2014/15 financial year on Tuesday, there are some important indicators to navigate on Monday. The Reserve Bank will release private sector credit or lending data while data on new home sales is also released together with the TD Securities/Melbourne Institute monthly inflation gauge.

On Tuesday the Reserve Bank Board meets but the main challenge for investors and analysts is to determine whether there has been any change to the wording of the accompanying statement compared with the June meeting. The Reserve Bank has made it clear that stability is a key goal at present.

On Wednesday the international trade (export & import) data for May is released while Reserve Bank Assistant Governor (Economic) Guy Debelle delivers a speech.

On Thursday, ‘top shelf’ economic data is issued in the guise of retail trade and building approvals, both indicators for the month of May. The industry body for the motor vehicle industry -- the Federal Chamber of Automotive Industries -- issues data on new car sales for June. And the Reserve Bank Governor delivers a speech to the Economic Society conference in Hobart.

US prepares to celebrate independence

There is a holiday-shortened week ahead in the US, meaning ‘top shelf’ economic data has to be squeezed into four days. The Independence Day holiday is celebrated on Friday.

The week kicks off on Monday with the ISM manufacturing gauge and data on pending home sales. The US manufacturing sector is good shape and the ISM may have risen from 55.4 to 55.8 in June, well above the 50 ‘advance/decline’ line.

On Tuesday the regular weekly chain store sales figures are issued in the US while the June data on auto sales is released. And on the same day in China, the “official” and HSBC variants of the purchasing managers index (manufacturing) are released.

On Wednesday in the US, weekly mortgage finance data is released together with the ADP National Employment index while the Federal Reserve chair delivers a speech. Analysts expect that private sector jobs rose by around 205,000 in June. The Challenger series of expected job layoffs is also released on Wednesday.

On Thursday in the US, the June employment figures (non-farm payrolls) are released. Economists are tipping a 213,000 lift in job numbers but no change in the 6.3 per cent unemployment rate. Also on Thursday the ISM services gauge is released where an increase from 56.3 to 56.7 is expected, well above the reading of 50 that separates expansion from contraction in the sector.

Sharemarkets, interest rates & the Aussie dollar

Mid-sized companies have out-performed over 2013/14 with the MidCap50 index up by 16.9 per cent, ahead of the 12.2 per cent growth of the large cap ASX50 index and the 9.9 per cent increase of the smaller company index, the Small Ordinaries.

Of the 20 current industry sub-sectors, all but one has grown over 2013/14. The under-performer was Food Beverages & Tobacco Manufacturing, down by 24.7 per cent. Strongest growth has been by the Diversified Financials (up 34.6 per cent) followed by Consumer Services (up 18.1 per cent) and Banks (up 17.0 per cent). The Resources sector has grown by 14.7 per cent while the A-REIT sector (Property Trusts) has lifted by 4.6 per cent.