The War on Terra

While many of us in Australia were celebrating Mother’s Day or just a lazy Sunday in early May, persons unknown triggered a wave of selling in UST (aka “Terra”) in massive volume. UST, a popular “stablecoin” had risen to become the third largest stablecoin behind Tether and USDC, with a market cap of $A26 billion at its all-time high earlier this month.

Like a large rock smashing into a still lake, this caused a shockwave that quickly spread throughout crypto markets. UST, supposedly pegged to the US dollar via financial engineering using smart contract technology and market incentives involving its native token Luna, broke its peg, causing tidal waves of rapid selling.

UST and Luna enjoyed a symbiotic, protocol-enforced relationship whereby Luna is created (aka “minted”) whenever UST is destroyed (aka “burned”). Burning UST always creates a US dollars’ worth of Luna, so whenever the price of UST falls, arbitrageurs will burn their UST to mint Luna to earn the profit which is the difference between the market price of UST and one US dollar.

Burning UST reduces its supply, which incentivises buying UST until the peg is restored. If all this buying causes UST’s price to exceed one dollar, it incentivises Luna holders to burn a dollar’s worth of Luna to receive a dollar’s worth of UST, allowing them to make a profit by selling the UST at the market price.

But on Mother’s Day Australian time, the waves of selling simply crashed through the Terra/Luna protocol causing the price of both tokens to fall. Luna’s market cap had reached an eye-watering $A54 billion in April, so as the selling of both tokens accelerated, the effect of this on the broader crypto market was profound.

It's still unclear as to whether this was a targeted attack on the Terra ecosystem by one or more entities intent on profiting from the ensuing chaos, or just the culmination of months of macro-induced anxiety causing a rush to the exit once the bell started to ring. Either way, the fear spread like a contagion.

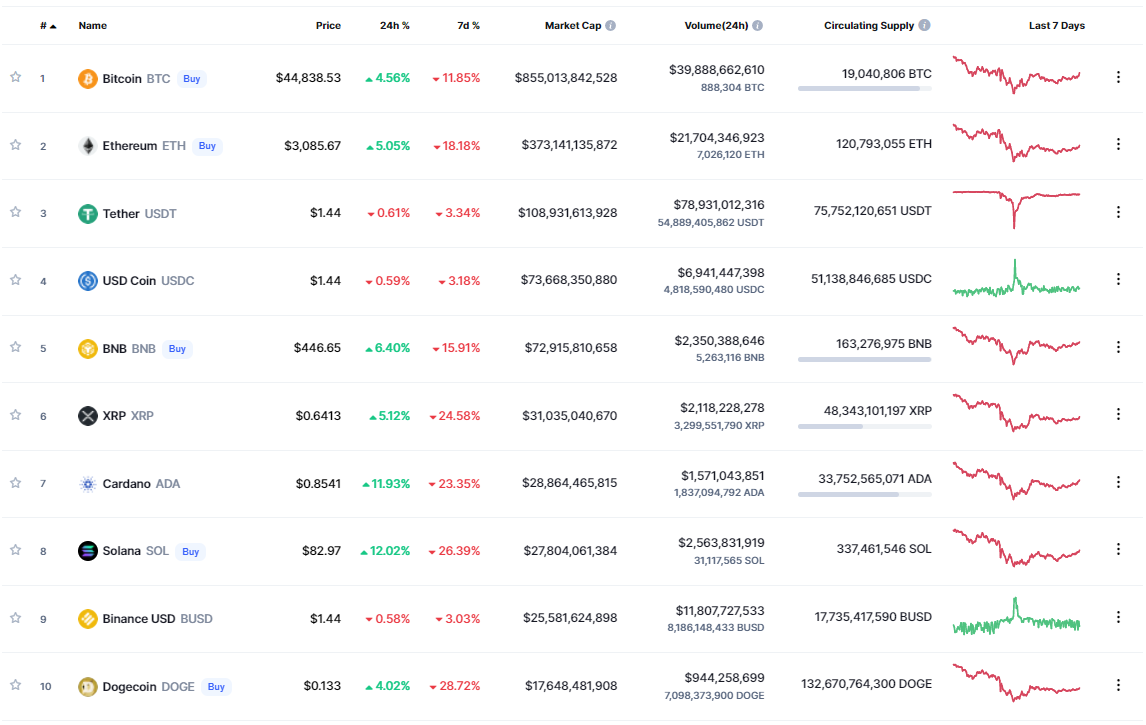

Bitcoin and Ethereum weren’t immune. Bitcoin fell from $A50,000 to $A38,000 by Thursday, before recovering somewhat to around $A45,000 as of writing. Ether at $A3,800 fell to $A2,600 before climbing back to $A3,100 as of writing. At the market nadir, almost $A300 billion had been wiped off the total crypto market cap from the high.

This graphic from https://coinmarketcap.com/ illustrates the effect on the top-10 as of writing:

While UST and Luna fell into a black hole, the 3 other major stablecoins held steady apart from a panic-induced fall in the price of Tether, the largest stablecoin, and its subsequent rapid recovery. Unlike UST, the other major stablecoins are collateralised with US-denominated assets and better able to withstand investors rushing for the exits (although Tether especially remains the subject of controversy around the extent to which it is fully collateralised).

Do Kwan, the Korean-born Stanford University educated visionary behind Terra/Luna, and his team initially tried to support the peg. Back in February, the team began buying Bitcoin to create a pool of collateral to support the UST peg (supplementing its algorithmic smart contract mechanism). The plan involved steadily adding Bitcoin (and other assets) as collateral until UST’s peg could withstand a “run on the bank”.

The team managed to raise over $A4 billion in BTC collateral, but as UST started to fall in response to the massive selling, the Terra/Luna team began to sell BTC to raise USD to support the UST peg. But BTC’s price also fell as panic ensued throughout the crypto world, resulting in a death spiral from which UST and Luna may never recover. (It’s suspected that the attackers were also shorting BTC to magnify their profits).

As of writing, Do Kwan announced that the market’s faith in UST has likely sunk so deep that it cannot be salvaged. He has suggested a possible “hard fork” of the Terra blockchain with a significantly reduced new token issuance to holders of UST and Luna, as well as the broader Terra community. Whether holders of the now essentially worthless Luna token or UST at $A0.23 as of writing will support this plan remains to be seen.

The Terra/Luna community, the broader crypto ecosystem, and pundits of financial markets in general will no doubt debate Terra/Luna’s rise and spectacular fall ad nauseum. Smart investors will analyse what lessons may be drawn to provide actionable strategies for the next crypto boom and bust cycle that will inevitably follow in future.

What might these lessons be?

- Stablecoin by name does not mean by nature unless the tokens are collateralised with hard low volatility assets, and ideally one-for-one. Terra/Luna’s market incentive mechanism to maintain UST’s peg to USD relied upon the ongoing willing participation of the market to arbitrage away price differential between the UST/Luna token pair rather than the assurance of hard collateral. At least for now, investors are likely to be wary of such algorithms to replace hard assets (although some supporters of algorithmically-backed stablecoins remain).

- Bitcoin may be the crypto market’s digital gold, but it is not yet sufficiently stable to act as collateral during a market liquidity crisis. Perhaps one day it may be if “hyperbitcoinisation” occurs (where Bitcoin is adopted as a kind of decentralised global reserve asset), but this remains very much in the realm of speculation.

- Crypto yields that look too good to be true are likely unsustainable. The UST ecosystem’s ability to payout almost 20 per cent per annum in UST “interest” attracted enormous capital and created an illusion of relative stability compared to most other crypto assets. Investors treated UST as if it were USD sitting in a bank account earning interest. But once the selling started, investors withdrew their UST from yield programs to sell it for actual fiat currency, feeding the maelstrom.

- Crypto as an asset class is at the very pointy end of risky asset classes and still predominantly a retail investor asset class (enhancing mood swings from euphoria to fear and back again). Smart investors should allocate according to their objectives, timeframe, and risk appetite for highly volatile assets.

- Crypto assets are akin to risky tech start-ups in that many attempts to create disruptive innovation are genuine, but nevertheless brimming with risks. Some are outright scams or Ponzi schemes. Opportunities and risks abound in equal measure.

The Terra/Luna implosion may well be the crypto market’s Lehman Brothers moment, and a watershed moment for future historians to debate. Long-time crypto participants may well shrug off the recent chaos, safe in their belief that this is history repeating itself and that patient, prudent investment in quality projects and assets will pay off in the long run. Bitcoin enthusiasts have endured many previous market routs and seen all-time highs broken eventually, and no doubt many will consider the current price action as a buying opportunity for the crypto king.

Either way, investors have been warned.

Frequently Asked Questions about this Article…

The crash in Terra and Luna's value was triggered by a massive wave of selling in UST, a stablecoin linked to Luna. This selling broke UST's peg to the US dollar, causing a rapid decline in both UST and Luna's prices. The situation was exacerbated by panic in the broader crypto market, leading to a significant drop in value.

The Terra/Luna mechanism relies on a symbiotic relationship where Luna is minted whenever UST is burned. This process is designed to maintain UST's peg to the US dollar through market incentives and smart contract technology. However, this mechanism depends on market participation to arbitrage price differences, rather than being backed by hard collateral.

The Terra/Luna team bought Bitcoin to create a pool of collateral to support UST's peg to the US dollar. The idea was to supplement the algorithmic mechanism with Bitcoin and other assets to withstand a 'run on the bank.' However, as UST's value fell, the team sold Bitcoin to support the peg, which contributed to the broader market panic.

Investors can learn that stablecoins need to be backed by hard, low-volatility assets to maintain stability. The Terra/Luna collapse also highlights the risks of relying on algorithmic mechanisms without collateral, the unsustainability of high crypto yields, and the inherent volatility and risk in the crypto market.

Yes, the Terra/Luna collapse is being compared to the Lehman Brothers moment for the crypto market. It represents a significant event that may lead to increased scrutiny and debate about the stability and future of crypto assets. However, long-time crypto enthusiasts believe that patient investment in quality projects will eventually pay off.