The Value in the Crypto Crackdown

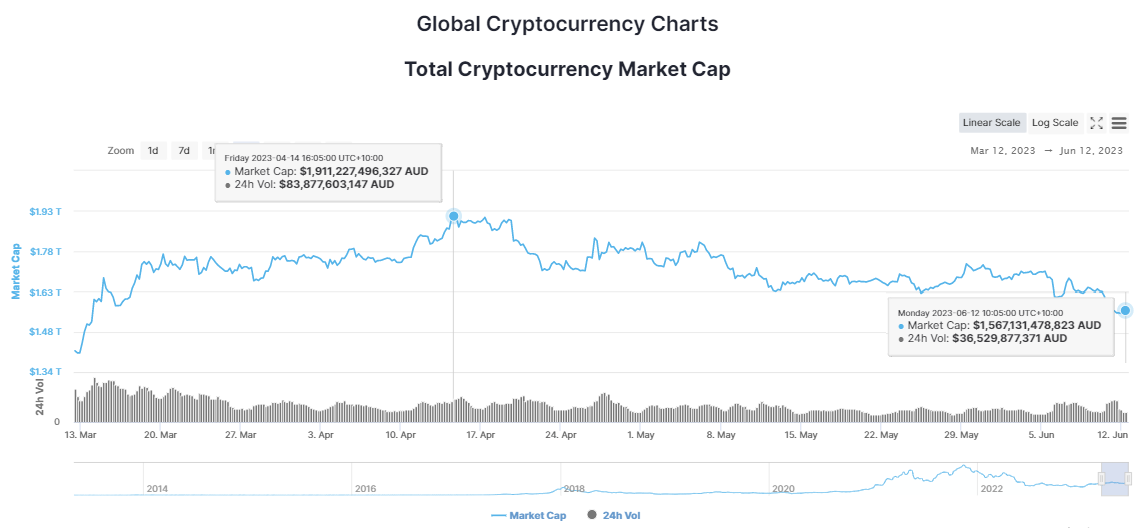

Crypto exchanges and tokens have recently come under sustained pressure from both regulators and financial institutions both at home and, especially, in the US. The crypto crackdown has contributed to a fall of the total crypto market cap of some 18 per cent since mid-April:

Source: https://coinmarketcap.com/

The crypto industry is united in seeking greater clarity from lawmakers and regulators and the present state of flux will, in the end, create environments that benefit both consumers and investors. Jurisdictions that find the right balance will likely attract entrepreneurs, innovators and investors seeking to drive crypto and digital asset innovation.

In the US, the Securities and Exchange Commission (SEC) launched lawsuits against both Binance and Coinbase alleging breaches of several securities laws.

In Binance’s case, the alleged breaches include operating unregistered exchanges, broker-dealers, and clearing agencies; misrepresenting trading controls and oversight on the Binance.US platform; and the unregistered offer and sale of securities.

The SEC charged Coinbase with operating its crypto asset trading platform as an unregistered national securities exchange, broker, and clearing agency, and also for failing to register the offer and sale of its crypto asset staking-as-a-service program.

Closer to home, several banks and payment services providers have acted to limit or cease providing banking services to certain crypto exchanges. The CBA recently announced that it would hold deposits to certain exchanges for 24 hours and that it plans to impose a monthly transfer limit of $A10,000 to at least some exchanges (it has not yet named any specific exchanges).

This follows the suspension of payment services by Cuscal to Binance’s local arm back in May, thereby closing off the exchange’s ability to allow customers to buy and sell crypto using AUD, and a report suggesting that Westpac had also acted to prevent AUD deposits or withdrawals to-and-from Binance Australia.

Restricting crypto exchanges of the ability to accept and pay cash for deposits and withdrawals respectively means that buyers and sellers must use other digital assets such as stablecoins to do so. This creates friction for the buyer/seller as they will also incur a capital gain/loss on first acquiring and then disposing of the stablecoin to buy another crypto token. This friction is likely to dampen enthusiasm amongst some investors/traders due to the extra effort and tax implications.

Crypto tokens have also faced the ire of the SEC in being classified as securities under US law, including some of the largest and most widely traded tokens such as:

- Solana, SOL.

- Cardano, ADA.

- Polygon, MATIC.

- Binance, BRB.

- Ripple, XRP.

- Cosmos, ATOM.

- Near, NEAR.

- Axie Infinity, AXS.

- The Sandbox, SAND.

As of writing, the SEC has classified some 68 tokens as securities, or around $A150 billion in crypto market cap. In doing so, any unlicensed exchanges providing exchange services for those tokens put their operations at risk of being pursued by the SEC.

SEC Chair Gary Gensler has previously stated publicly that Bitcoin (BTC) is not a security, but a commodity, and therefore should be regulated (in the US) by the Commodity Futures Trading Commission (CFTC). Gensler hasn’t publicly stated a position on Ethereum (ETH) but also hasn’t ruled out classifying ETH as a security in the same manner as BTC (i.e. as a commodity).

The SEC filing against Binance described certain elements attributable to being classified as a “crypto asset security”, including: the process of initial coin offerings (ICOs), vesting of tokens, allocations for the core team, and the promotion of profit generation through token ownership.

While pundits speculate, the answer may simply be that Ethereum’s history and current use cases defy simple classification. The Ethereum ecosystem and the ETH token represents both technological and financial innovation, and its several use cases blur the boundaries between being investment vehicles and a medium of exchange. The CFTC has stated that it does not consider ETC to be a security, but as long as Chair Gensler and the SEC remain silent on the question, uncertainty remains.

BTC’s status seems unambiguous since its pseudonymous creator Satoshi Nakamoto did not raise funds to launch the project, and there is no ongoing centralised organisation that is seeking to issue more tokens as a way of raising additional funds. The Bitcoin network protocol has a predictable and fixed supply schedule without centralisation and is often called “digital gold” given the similarity of its attributes in many ways to physical gold.

Nevertheless, BTC’s price hasn’t been immune to market sentiment due partially to the heightened regulatory action, having fallen from a high of around $A45,000 in late April to $A38,000 as of writing. This 16 per cent fall is only slightly less than the fall in total crypto market cap over a similar period.

The crypto industry is united in seeking greater clarity from lawmakers and regulators. Several jurisdictions including Australia are evolving their laws and regulations to create environments that both protect consumers and encourage innovation.

Frequently Asked Questions about this Article…

The recent crypto crackdown by regulators and financial institutions has led to an 18% drop in the total crypto market cap since mid-April. This regulatory pressure has affected both crypto exchanges and tokens, contributing to market volatility.

US regulators, particularly the SEC, have launched lawsuits against Binance and Coinbase for alleged breaches of securities laws. These include operating unregistered exchanges and failing to register certain services, which has put significant pressure on these platforms.

Banks are limiting services to crypto exchanges to mitigate risks associated with regulatory scrutiny. For example, the CBA has announced plans to hold deposits for 24 hours and impose monthly transfer limits to certain exchanges, aiming to manage potential financial risks.

Classifying crypto tokens as securities means that exchanges offering these tokens must be licensed to avoid legal action from regulators like the SEC. This classification affects major tokens such as Solana, Cardano, and Ripple, and can lead to increased regulatory compliance costs and operational risks for exchanges.

Bitcoin is considered a commodity by the SEC and is regulated by the CFTC, which provides some clarity. However, Ethereum's classification remains uncertain, as its diverse use cases blur the lines between being a security and a commodity. This ongoing uncertainty affects investor confidence and market stability.