The two Americas: Ringing sales, rattling tins

Retail sales rose solidly in November, beating expectations, to provide further evidence that the recovery is picking up. Combined with improving labour market conditions, this could provide the impetus necessary for the Fed to wind back some of its monetary stimulus.

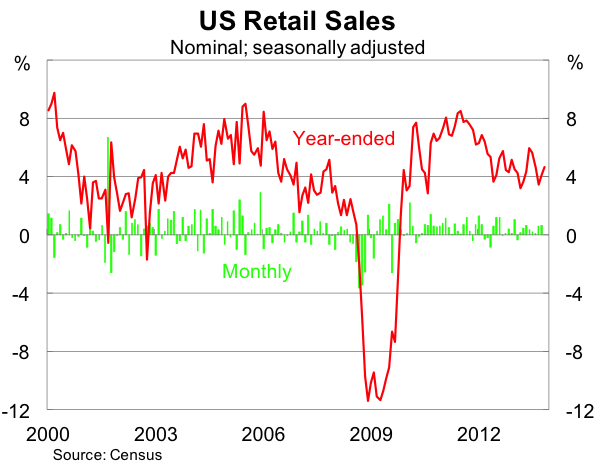

Retail sales were up by 0.7 per cent in November, from an upwardly revised 0.6 per cent gain in October, to be 4.7 per cent higher over the year. The data in October and November is already 1.1 per cent higher than in the September quarter, which combined with low inflation, points towards a 0.8 – 0.9 per cent gain in consumption in the December quarter so far.

With each major release it is becoming increasingly clear that the US emerged largely unscathed from the 16 day federal government shutdown in October. Retail spending and the labour market has barely skipped a beat since the shutdown commenced, indicating that there is a resilience in these markets that just wasn’t there a short time ago.

Renewed optimism in the household sector is welcome after a fairly tepid September quarter, which saw consumption rise by just 0.3 per cent and GDP growth largely driven by the accumulation of inventories. The October and November data point towards the strongest consumption growth in three years.

Retail sales excluding motor vehicle rose by 0.5 per cent in November and the data from October and November is up a healthy 1.0 per cent on the September quarter average. It indicates that Americans are increasingly willing to spend on discretionary big-ticket items, which is usually a sign that they are feeling better about the economy and job security.

The data for November contrasts with reports from retailers who indicated that the Christmas shopping season had begun slowly in November. Reports from earlier this month suggests that the Black Friday post-Thanksgiving sales – traditionally the most active retail period of the year – were disappointing. However, purchases online rose by 2.2 per cent – the highest in 18 months – which could explain the discrepancy.

The news wasn’t all good overnight though. Initial jobless claims rose by 68,000 in the week ending 7 December – the highest weekly increase in around a year. It is important to note that there are frequently high levels of volatility in jobless claims around Thanksgiving and the holidays. We shouldn’t discount the result entirely but I recommend putting more weight on the recent downward trend, which is consistent with job creation.

The unemployment rate is down to 7.0 per cent and, although a declining participation rate has certainly helped to get it there, it is clear that the labour market has improved significantly in 2013 (Slowing inflation tempers payrolls triumph, December 9).

The recent budget debates held in Congress might complicate matters for the unemployed though. Congress has so far failed to extend unemployment insurance for the long-term unemployed, who can claim federal benefits after they have exhausted state benefits.

Around 4.1 million people, or one-third of the unemployed, have been unemployed for 27 weeks or longer – 1.3 million will have their benefits cut off by 28 December and another 850,000 by March next year.

The budget deal announced a couple of days ago is obviously better than another prolonged period of uncertainty or government shutdown. But ideological posturing may stand in the way of the US recovery.

The Republicans who control the House of Representatives refuse to keep the aid for the long-term unemployed without additional budget cuts elsewhere. Extending these benefits would cost an estimated US$26 billion over the next two years, according to the Congressional Budget Office (CBO).

The CBO estimates that this could take off around 0.2 percentage points from growth and result in 200,000 fewer jobs in 2013. At current levels of job creation it will take around 3½ years to clear the backlog of long-term unemployed.

To put the budget posturing into perspective, US$26 billion amounts to a rounding error in the 10-year budget estimates, and is roughly the same as the token cuts announced in the budget agreement. So the only people losing out from the budget deal are the only people who cannot afford to lose out from the budget deal.

If unemployment benefits are not extended it will clearly weigh on both consumer spending and unemployment. The CBO estimates, if realised, would be a blow to an economy that is slowly gathering momentum. The last thing they need is an additional headwind, particularly one that is entirely man-made. Hopefully common sense will prevail.