The truth behind Hockey's magic number

In his speech to a Sydney audience on Thursday, Treasurer Hockey reminded Australia that spending growth was built into the budget he inherited from Labor, so that “[if] Commonwealth spending follows the same path as outlined in our most recent Budget statement ... spending as a share of GDP is projected to reach 26.5 per cent by 2024”.

The reason that needs to be addressed with budget cuts, he said, was that the Abbott government’s own commission of audit is working on the assumption that “tax receipts are capped at 24 per cent of GDP with ‘bracket creep’ being returned to taxpayers through periodic income tax cuts”.

Obviously, increasing spending to 26.5 per cent of GDP while the government collects only 24 per cent of GDP in tax will add a lot of money to the stock of federal debt.

So while ballooning health and pension costs are pulling the expenditure figure up, Mr Hockey is going to have to cut pretty deeply to bring spending to equilibrium with revenue – or at least that’s the story we’re being told.

There are a couple of things that need to be said about that story.

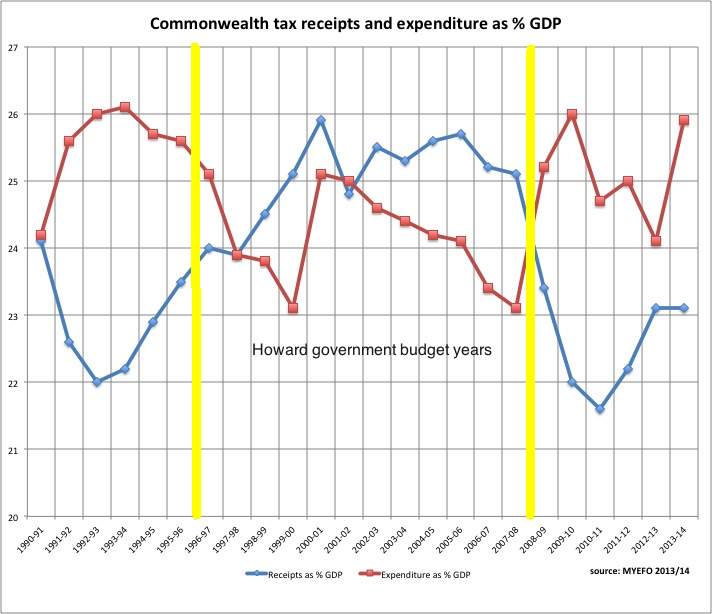

The first, is that there’s no particular magic about the “24 per cent” figure for tax revenue, or spending. As the chart below shows, the Howard government saw spending fall below 24 per cent in only five of the 12 years in which Peter Costello handed down the budget (his last budget was handed down five months before the Rudd government came to power).

Across all the years since the last recession, the expenditure to GDP average has been 24.75. The average across the Howard years was 24.15, and over the Rudd/Gillard years it averaged 25.15.

On the tax side, the average in receipts since the last recession was 23.89 per cent. The Howard government taxed harder, taking an average 25.05, and the Rudd/Gillard governments averaged the lowest tax as a proportion of GDP – 22.57 per cent (with revenue pushed down considerably by the GFC, even before the commodity-price collapse of 2012 caused huge revenue write-downs).

One often overlooked point is that in good times, such as the bounteous ‘mining boom mark I’ years of the Howard government, revenue swells but many fixed costs in the public sector do not.

Health care and pension costs, for instance, rise at a fairly steady and predictable rate, so a sudden spike in revenue leaves more scope for cutting taxes. What is historically curious about the Howard-era boom is that taxes stayed well above 25 per cent of GDP for the last five years of the Coalition government.

It would not be difficult, therefore, to mount an argument that the Commission of Audit should have been given the Howard-era tax figure of 25 per cent of GDP -- especially since bracket creep would easily deliver that to Hockey without too many punters noticing.

The second thing to note about Hockey’s budget story is that the projected expenditure of 26.5 per cent of GDP has been massaged up to a considerable degree.

When Wayne Swan handed down his last budget last May, projected expenditure for the current fiscal year was 24.5 per cent. When Hockey and Treasury officials prepared MYEFO, that figure jumped to 25.9 per cent of GDP.

While the Coalition faithful will interpret that as the ‘discovery’ of Labor lies about what the budget outcome would have been under a re-elected Rudd government, and believe the Hockey figure is accurate, the truth undoubtedly lies in between, for two main reasons.

Firstly, between the stimulus blow-out of the 2009/10 fiscal year (taking expenditure to 26 per cent of GDP) and 2012/13, there was a full two percentage points of GDP shaved off expenditure. Labor did achieve a rapid fiscal consolidation in that period.

While Swan got clobbered by revenue write-downs in his final budget, the outcome for the current financial year would not have been massively blown-out. It’s likely that a level of 24.5 per cent of GDP might have risen to a bit over 25 per cent, but less likely that it would reach 26 per cent as the MYEFO estimates stated.

However, the percentage point of extra expenditure is not conjured out of thin air. Treasurer Hockey has added about $10 billion in new spending to Swan’s last budget, primarily by the $9 billion recapitalisation of the RBA, plus the scrapping of Labor’s plans to rein in the tax relief on leased vehicle and tax super incomes above $100,000 a year.

Labor has also voted down some of the savings measures that Hockey wanted to use to offset this extra spending. The end result is a budget blown out by more like $20 billion, and a likely expenditure result for 2013/14 that is much higher than even a chaotic Rudd government would have made it.

Hockey’s budget plans, and cost cutting, is predicated on a magic number that his own side of politics rarely hit, and that Labor would have come much closer to hitting had they retained power.

Perhaps the magic 24 should be a magic 25.