The trap of term deposits

Summary: I recently had a term deposit mature and had to complete a surprisingly labour-intensive process to transfer the money to my transaction account. I discovered that Westpac systems are way behind, and I'm not sure you won't have a similar experience at other banks. Meanwhile, NAB is selling its UK business to improve its capital, while ANZ is looking at selling ESANDA. |

Key take-out: In order to improve their capital position, banks will lessen the goodwill they have with depositors and will make decisions that may adversely affect shareholders in the longer term. |

Key beneficiaries: General investors. Category: Cash, bank stocks. |

A lot is happening in the banking business and it is important for depositors and shareholders to understand some of the forces taking place. To illustrate what is happening in bank term deposits let me relate an experience I had during the January break.

We all know that deposit rates are falling which reflects the slowing of the Australian economy and events overseas. That is a commentary in its own right for another time.

What I want to describe is how the new mechanisms on bank deposits require much more vigilance from all those that use the bank term deposit system.

Way back five years ago my superannuation fund put money on deposit with Westpac for five years at 8% – it was a wonderful five years! But good things come to an end and it matured this month.

In advance of the maturity I received a volley of letters from Westpac and other banks saying that unless I gave specific instructions my term deposits would simply roll over into another five-year term. The same rules apply to all term deposit currencies whether they be six months or five years.

I had no desire to roll over that money at current rates so I knew I had to be active. But the written correspondence arrives very late and it is very easy to forget to give the bank instructions and have your term deposit money returned to you in cash.

And once a term deposit is locked in the flexibility that the bank manger now has to pay it out early has been greatly reduced and that is going to create a lot of inconvenience for people. And so term deposits require greater management and therefore are less attractive, especially to older people.

Banks are doing this because with stricter maturity rules term deposits can be much more attractive in the bank's capital ratios.

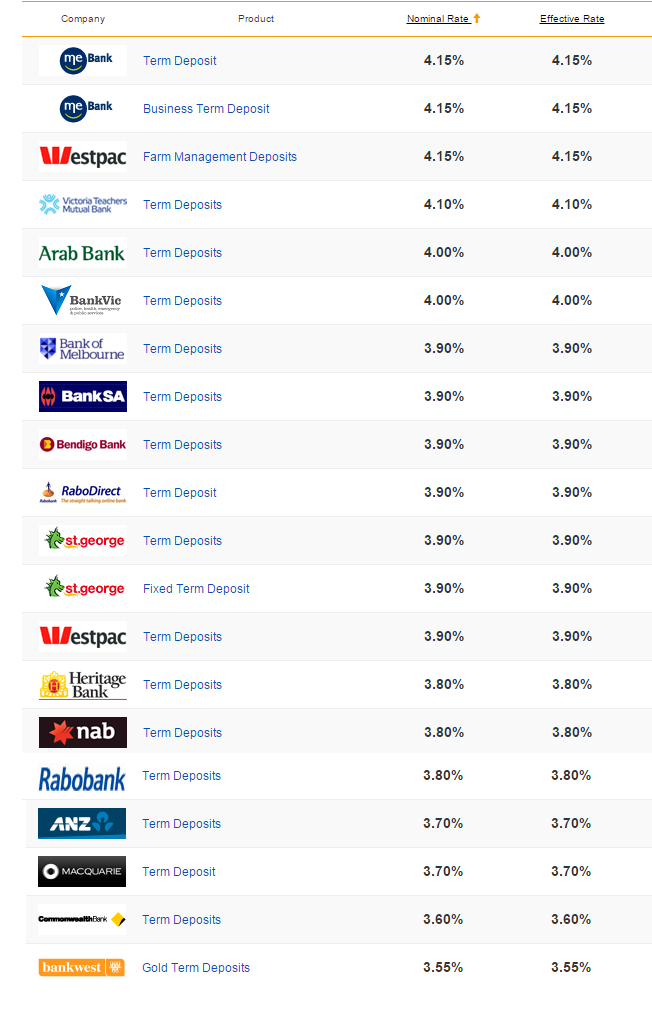

The table below shows term deposit rates on offer for a five-year term now.

Figure 1: Top 20 bank term deposits by nominal rate, for $10,000 invested for 5 years, with interest paid annually

Source: RateCity

But now let me relate my adventure as I moved to get my superannuation fund's five-year Westpac term deposit into my superannuation fund's transaction account, which is not with Westpac.

My first attempt was to ring them up about two or three weeks before the deposit was due hoping to issue the instruction and the matter would close. It was soon clear that this phone process was not going to be reliable and the advice from the Westpac phone answering service was to go in person to the branch where I deposited the money.

So I went to the Westpac branch and spent over half an hour with the help of a very cooperative staff member in filling out a mass of forms. The labour intensity of the process stunned me but more was to come.

I had perhaps foolishly made some investments which required settlement the day after the term deposit money was to be transferred to my superannuation transaction account. So on the day of maturity I phoned the officer and discovered that the process was actually going to take place manually and the helpful staff member explained that he had a series of term deposits which he had to manually transfer into transaction accounts as they matured. He carries out this task every day. It so happened that earlier a customer had come in at 9am carrying coffee which had spilled onto my form so the Westpac staff member was about to ring me back to get details that had been obscured. We managed to sort it out and he turned a “mistake” into an advantage by offering me a free fast transfer which was exactly what I wanted. But it's not exactly how you run a bank in 2015. (Indeed one Westpac employee who was particularly helpful told me she was actually ex-CBA and she was appalled at how far Westpac had dropped behind.)

The point of describing this is to illustrate that Westpac systems are way behind and they need very helpful people to cover the gaps. Westpac are of course improving their systems but they need to.

And I am not sure you won't get a similar experience at other banks. So bank term depositors: you must be very vigilant and hope, like me, that you encounter a helpful staff member. That will not always be the case.

The end result of this process is going to be that to improve their capital position, banks will lessen the goodwill they have with bank deposit customers. They are also making other decisions to improve their capital that may adversely affect their shareholders in the longer term.

Clearly National Australia Bank is selling its UK business to improve its capital. That may be a good decision strategically but the timing might be wrong. The UK is generating a lot of jobs through smaller enterprises and good bankers are going to have a great time.

NAB also sold its US business which was minor but was set up there to begin a process to make NAB a global agricultural bank. No other Australian bank had that opportunity and NAB threw that away simply to improve its capital.

ANZ is looking at selling finance business ESANDA. The customer base of ESANDA incudes an enormous array of smaller businesses, which is exactly what ANZ needs. The ESANDA staff, of course, know how to handle these customers and have techniques that simply don't exist in ANZ, or for that matter at any other bank. Back in the past each of the banks had its own finance company that like ESANDA served the needs of smaller enterprises. When they were merged with the parent bank the skill was lost.

ANZ kept the skill but now plans to sell it. Longer term for the bank it is the wrong move. We will see other moves by big banks to improve their capital which may not be in the interest of shareholders longer term.

And increasingly we are going to see groups move into the higher margin areas of the banking business. Banks make good money in personal loans and credit cards and peer-to-peer groups are emerging to make money by charging better rates. Australian banks are not in danger but they are paying more of their profits in dividends than they should and they need additional capital given the changes in the rules. What they are doing to avoid issuing more shares is not necessarily always in the best interest of their customers and shareholders.