The Ticker: Modern business life

On today's blog:

- Two graphs on the media's bleak advertising future

- HSBC lays out its predictions for the Murray Review

- Twitter reacts to the ABC cuts

- The RBA moving closer to cutting rates: Credit Suisse

- The latest victim of digital disruption: The Australian government

- Interesting reads from around the web

Got something you would like to add to the blog? Email (harrison.polites@businessspectator.com.au) or get in touch on Twitter.

3.25pm - Two graphs on the media's bleak advertising future

Given the job cuts at the ABC, it's now fair to say the entire sector is in dire straits.

As far as the advertising market is concerned, publishers are no long competing against one another -- they are competing against every other ad-driven website and service on the planet.

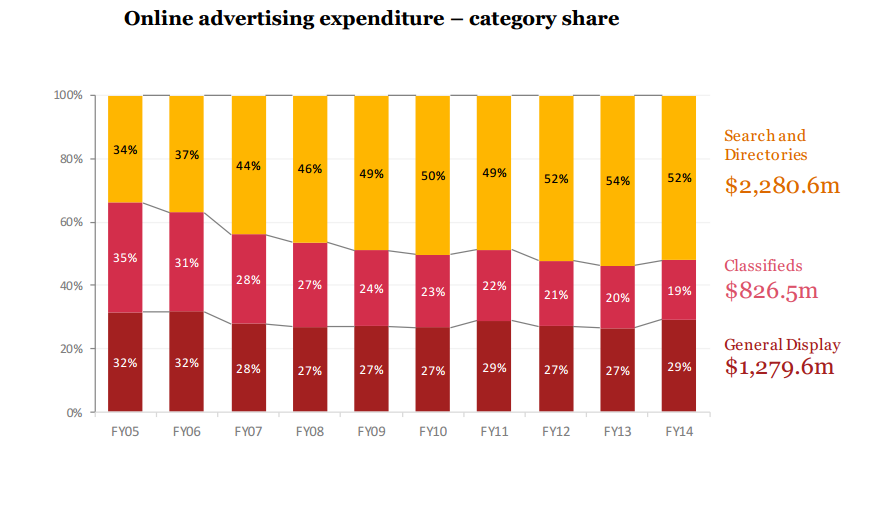

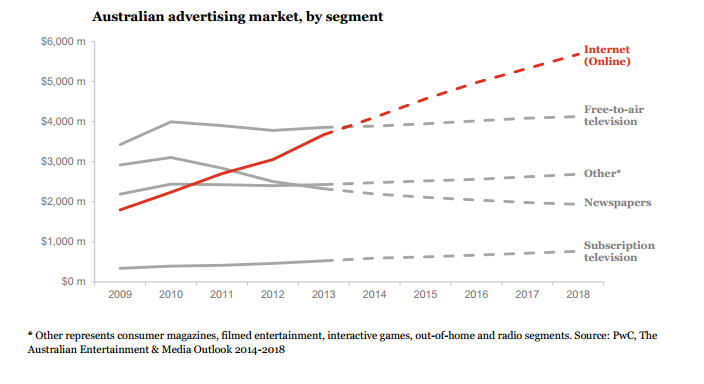

This point is best demonstrated by this graph from the Interactive Advertising Bureau of Australia shows the ongoing growth of search advertising (largely Google) and the stagnation of display advertising (media organisations, but also any other website).

The only good news is that the overall pie (total online ad spend) is growing exponentially and will soon overtake TV advertising. But so is search's share of the market.

As The Australian's Jackson Hewett pointed out earlier today, the media may find some hope in the rise of programmatic trading -- a real-time ad system that emulates Facebook's strategy of attaching relevant ads to relevant eyeballs. The higher the relevance, the more money a publishing outlet can charge. But it's no silver bullet to the media's online advertising woes, as it benefits all websites -- not just media outlets.

1.40pm - HSBC lays out its predictions for the Murray Review

It's the document that has some of our largest companies, the four major banks, quaking in their boots.

The Murray review into the banking industry is expected later this week, and its recommendations could reshape our financial services sector and the costs paid by consumers for housing loans. Ahead of its launch, HSBC's chief economist Paul Bloxham today put out a note on his key predictions. We'll keep an eye out through the week to see if other banks follow suit, but for now here's the crux of what HSBC had to say.

The majority of the recommendations will be mild

“Although the terms of reference in the Murray Review are wide-reaching, we do not expect recommendations that would change Australia's fundamental financial arrangements: an independent central bank, a floating currency, or to the financial infrastructure underpinning Australia's bond and equity markets.”

Banks will be forced to hold more capital

“We expect that the final report is likely to recommend that banks hold more capital. In particular, there could be adjustment to the capital buffers for banks that are deemed ‘too-big-to-fail', which would include Australia's major banks, with the prudential regulator currently applying a capital buffer of only 1 per cent, which is low by global standards."

It will suggest reforms to boost access to finance for small- and medium-sized businesses and to assist the development of a deeper local corporate bond market

“The interim review noted that information asymmetries could constrain access to finance for smaller businesses and a possible policy solution was the creation of a database to reduce these asymmetries.”

“On the issue of depth of Australia's corporate bond market, the interim review discusses removing the requirement for bond issuers to publish prospectuses on new issues, given already continuous disclosure requirements … All in all, we do not expect the recommendations to be significant changes in the face of these two issues.”

Existing government restrictions on lending (macro-prudential tools) will be tweaked; new radical tools will not be introduced

“As we have noted previously, however, we expect that any changes in this regard are likely to be incremental, rather than revolutionary and more akin to adjustments to the current prudential tools than a ‘macro-prudential overhaul”

“We do not expect restrictions on loan-to-valuation ratios, countercyclical capital buffers, dynamic provisioning or dynamic leverage ratios -- all of which are typical ‘macro-prudential' tools.”

And finally, HSBC adds there's no certainty that Treasurer Joe Hockey will implement any of the review's recommendations.

12.50pm - Twitter reacts to the ABC cuts

It's a bleak day for our national broadcaster.

The ABC's managing director Mark Scott has today handed down a blueprint for how the national broadcaster will save up to $250 million over the next five years. Around 400 staff (or 10 per cent) of the media group's workforce will be made redundant, several regional bureaus will close and a handful of national TV shows and radio programs will be axed. You can read Mark Scott's full statement (as published by the ABC) here.

Twitter has been flooded with comments on the cuts, with most people expressing their sadness or anger at the government's latest attempt to make savings. Others simply sympathised with those who are set to lose their jobs. But as you can see below, some interesting points have been raised in the torrents of tweets. We've also included one on the less-talked-about SBS cuts.

Restoring local ABC services will be a powerful campaign platform in dozens of electorates next time around. #OurABC @TurnbullMalcolm

— Marcus Westbury (@unsungsongs) November 24, 2014@jessradio ABc execs and mega-stars should take a pay cut to save jobs #ourabc #ABCbudgetcutshows

— Margo Kingston (@margokingston1) November 24, 2014Mark Scott confirms 300 redundancies immediately, over 400 all up at the ABC. Now a push to invest in online and mobile. #OurABC #abccuts

— Gemma Deavin (@gemmadeavin) November 24, 20141st question to @mscott "Can we report on this or is it confidential?" #OurABC

— Mark Doman (@MarkDoman) November 24, 2014Fun fact: Annual #OurABC cuts of $50m would fund less than 4 days of Abbott's PPL scheme.

— Paul Syvret (@PSyvret) November 24, 2014SBS MD @michaelebeid on the SBS budget cuts: "We should all be reasonable happy", "It could have been a lot worse for us."

— Karen Barlow (@KJBar) November 24, 201410.40am - The RBA moving closer to cutting rates: Credit Suisse

By David Rogers, BusinessNow

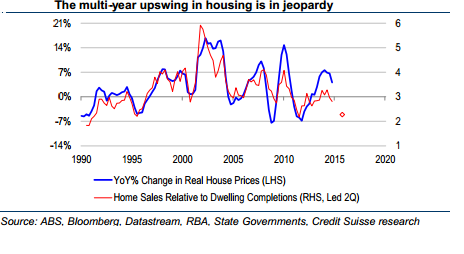

The Reserve Bank of Australia is moving closer to cutting rates according to Credit Suisse.

“Recent comments from RBA Governor Stevens suggest that the Bank is more concerned about the growth outlook than financial stability in the abstract,” Credit Suisse strategists Damien Boey and Hasan Tevfik say in a report. “The unwillingness of the RBA to implement macro-prudential tightening suggests to us that the Bank is worried about overtightening, which in turn implies downside growth risks.”

“We believe that the Bank's next step will be to cut rates, especially if its goal is to support a multi-year upswing in the residential investment cycle. As it stands, rate settings are not accommodative enough to support this, because the housing market is tipping into marginal oversupply despite the stimulus delivered to date.”

They say shallow rates cuts of 25 to 50 basis points would support the dividend trade within the equity market and de-equitisation, while deeper rate cuts of 100basis points or more would signal a hard landing consistent with earnings cuts and more defensive positioning.

10.30am - The latest victim of digital disruption: The Australian government

The fallout from Jacqui Lamble's resignation, the Murray banking review and the anticipated de-regulation of university fees are just a few of the issues that are set to hog the headlines over the final couple of sitting weeks of parliament.

For something different, we thought we would start this week's blog with an issue that affects all of Canberra, but will still likely fly under the radar: the mounting challenge of e-government initiatives -- also known as Gov 2.0.

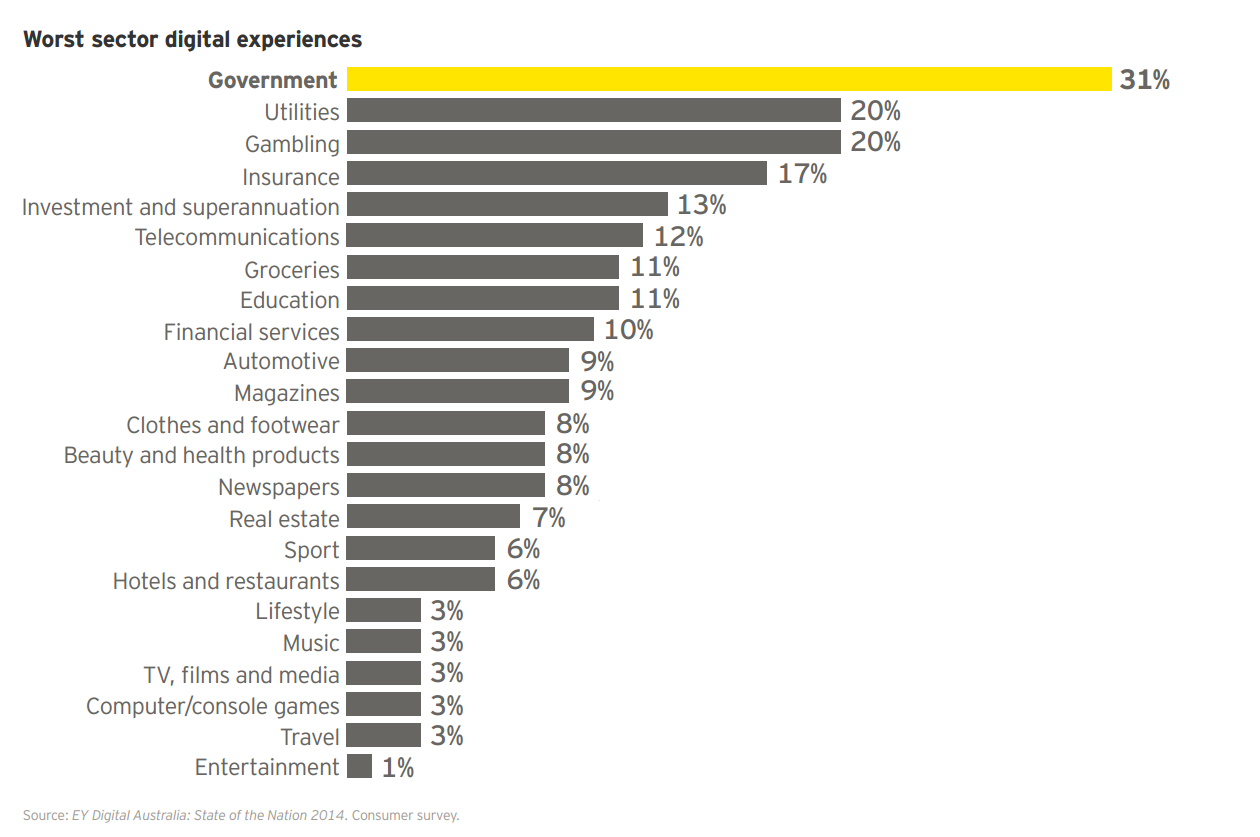

Gov 2.0 is a broad topic, encompassing everything from secure data storage, driving government efficiency though new technologies and using digital tools to improve existing citizen services. A new Ernst & Young study has underscored the need for a deeper debate on that last point.

Plenty of companies underperform when it comes to digitising their customer services, but as you can see from the graph below, Australian's see the government as one of the worst offenders in creating un-usable apps and digital services.

It's a timely finding. It comes just days ahead of the government's annual Gov Innovate Summit in Canberra -- where this topic is on the agenda.

Issue around the transition to Gov 2.0 typically revolve around the mindset of particular departments or services. As Ovum's Kevin Noonan pointed out on Technology Spectator earlier this year, there are some departments that have embraced digital and there are others who simply want the internet to disappear.

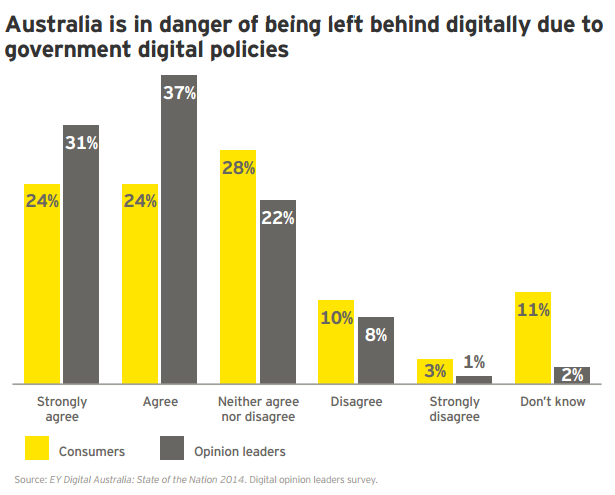

One party who may desire the latter is the Abbott government itself. The same study from E&Y also measured voter sentiment around the government's digital policies and how they compare globally. The findings were far from glowing.

9am - Interesting reads from around the web

A cautionary tale for tech IPOs: One year on from listing and Freelancer.com's share price is almost back where it started.

Stabilising growth: How China's surprise interest rate cut underscores the importance the country is attaching to the goal of putting a floor under 7 per cent annual GDP growth.

Out of the abyss: Could political turmoil trip up Greece's surprising economic recovery?

Would you work for a company with a salary cap? Why Amazon needs to reassess its $US160,000 staff pay limit.

Heartbeat vs fingerprints: The emerging battle in identity verification technology.