The Ticker: Modern business life

On today's blog:

- How big data is taking the Victoria's Secret out of lingerie

- An amazing lesson in Japanese productivity

- Why Ramsay Health Care could thrive thanks to the China FTA

- Four charts that sum up the world's ultra wealthy

- Your midnight workout is cramping Australia's gym industry growth

- Why wait till March? The growing number of households already streaming Netflix

- Interesting reads from around the web

Got something you would like to add to the blog? Email (harrison.polites@businessspectator.com.au) or get in touch on Twitter.

4pm - How big data is taking the Victoria's Secret out of lingerie

Watch the interview above (Warning: just suitable for work)

By Jackson Hewitt

In the cutthroat $US12 billion lingerie industry, one player stands above all others: Victoria's Secret. The marketing behemoth, famous for its internationally televised fashion show, controls 40 per cent of the market, leaving the other 4,678 companies to fight for the rest of women's dollars.

But new startups think they have the secret to taking on Victoria's Secret. And, like every startup, they believe that big data will provide the answer.

True & Co thinks it can unlock billions of dollars in the underwear industry by offering women a way to determine the right bra size.

Ill-fitting bras are a common affliction, and things haven't changed much since Oprah told her audience that “you need to rise up and get a proper bra fitting” in 2005. So Michelle Lam, a former Bain Capital principal, decided it was time to take the latest in data science and apply it to an industry that hasn't changed all that much since the DeBevoise Company launched its bust support in 1904.

True & Co works on a similar model to glasses company Warby Parker, sending trial pairs to customers' homes, but they are getting most of their data from an online quiz of their users.

Since the company launched in 2012, more than 1 million women have taken the site's “fit quiz”. The results place each woman into a colour on the company's proprietary fit spectrum.

In addition to recommending big-name designers like Calvin Klein and Natori, as of October 2013 True&Co offers its own private label, which is where the money really starts to roll in. Revenue from the private label accounted for 20 per cent of sales and Lam predicts it will be 40 per cent by the end of the year.

True&Co reports that 7 million points of “boob data” have grown to 22 million within the last three months alone.

In a recent trip to Silicon Valley, I interviewed one of the original investors in the company who says the use of data is fast gaining traction, not just in fashion but also in lifestyle products.

2.40pm - An amazing lesson in Japanese productivity

By Chris Kohler, BusinessNow

Early in 2013, Tokyo's Shibuya train station was temporarily closed as engineers lowered the tracks to link it to a nearby subway line.

Converting the line from aboveground to underground was an enormous and complicated task, requiring a total of 1,200 engineers.

But here's where Japan makes other construction workers around the world look pretty hopeless - they finished the whole thing in one night.

Have a look at the time-lapse video:

1.05pm - Why Ramsay Health Care could thrive thanks to the China FTA

By Ric Spooner, chief market analyst, CMC Markets

International investment opportunities in high growth, emerging economies are an appealing idea but there's a lot of risk involved. It can pay to stick to companies with a proven track record in buying and managing international businesses.

Using this logic, Ramsay Health Care might be a stock to benefit from the free trade agreement with China. Under the agreement, Australian companies will be able to build wholly owned private hospitals in China. Superficially, this looks pretty attractive given China's aging population, the growing middle class and the need to develop expertise in hospital management.

Ramsay is a proven international operator that already owns and operates private hospitals in five different countries. It will be some time before the FTA is takes effect but Ramsay is already moving to develop a foothold in China. It recently completed a non-binding agreement to enter a joint venture involving five hospitals in Chengdu (population 14 million). This will give it a chance to develop expertise in the Chinese market and (importantly) find a local partner.

Ramsay has been a major success story for investors and has long been a market darling. It's had a magnificent uptrend and as the chart below shows it's been above its 40 week moving average for a long time. It's been a fair while since this stock could be bought at what could be termed ‘bargain basement' levels. Patient investors might keep an eye on support levels around the 40-week moving average and trend line support currently intersecting at about $48.

12.50pm - Four charts that sum up the world's ultra wealthy

It's not enough to be rich. Now, you need to be ultra-wealthy.

Each year, investment firm UBS puts together a study of the world's ultra-wealthy: individuals with net assets of over $US30 million. Only 1.6 per cent of the world's ultra-wealthy population live in Australia, which is why I'm going to focus on the global trends.

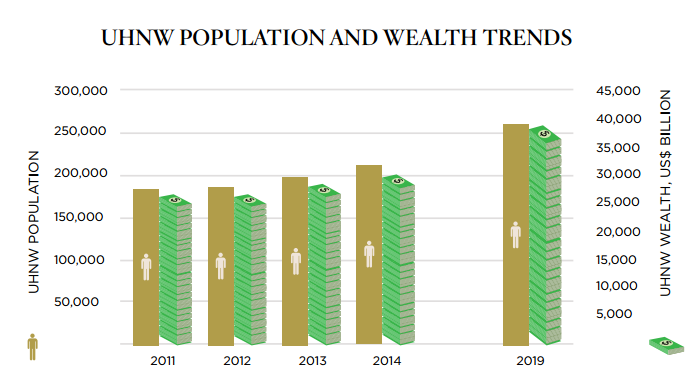

The number of ultra-wealthy individuals is growing, as is their combined wealth.

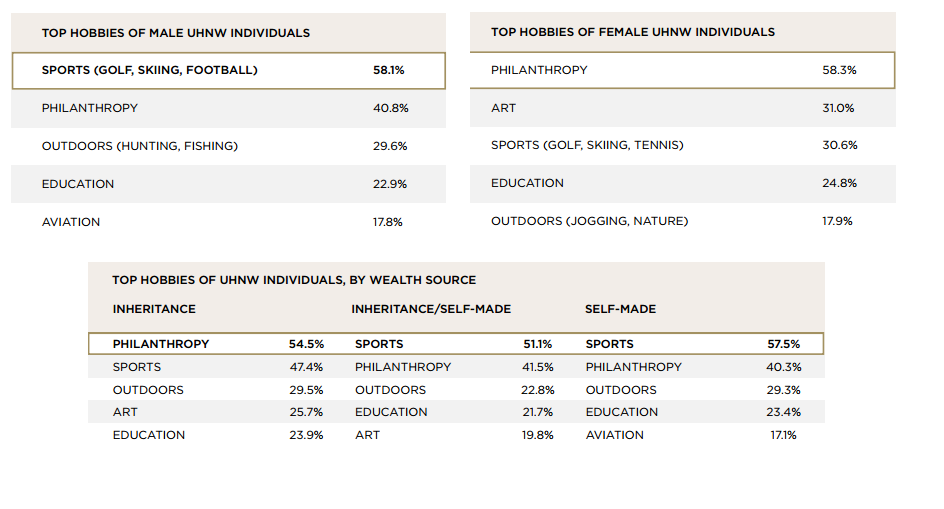

The ultra-wealthy have different interests depending on their gender and their source of wealth.

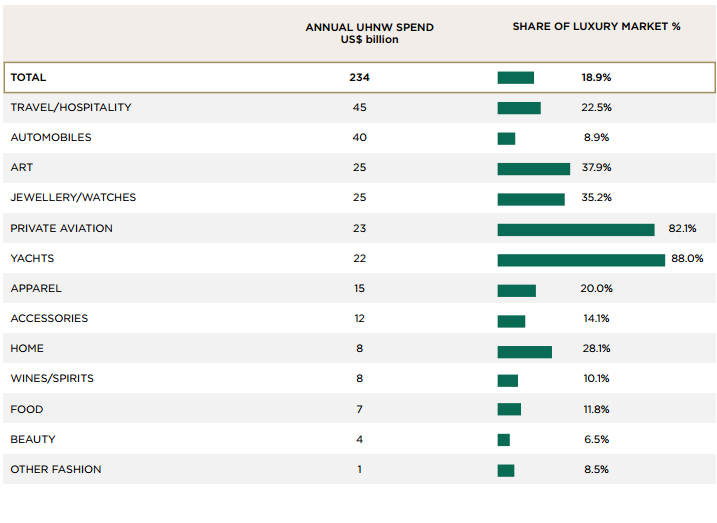

They prefer to spend money on travel and cars. But oddly enough, their combined spending only makes up 18.9 per cent of the luxury goods market.

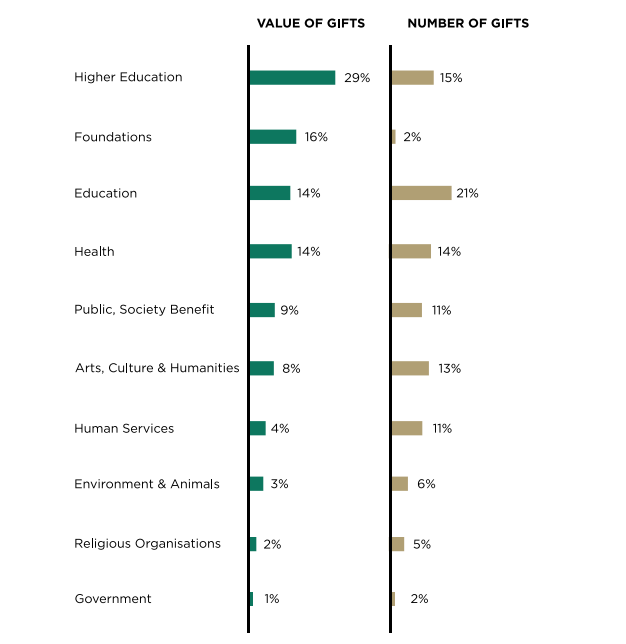

This last one is interesting: publicly, they tend to give more money to schools and universities than they do to charities and other public services. Below is a breakdown of where the money is donated based on public contributions. UBS estimates that over half of the ultra-wealthy publicly donated $1 million to philanthropic causes over their lifetime.

10.50am - Your midnight workout is cramping Australia's gym industry growth

The future focus of our fitness industry can now be boiled down to one word: convenience

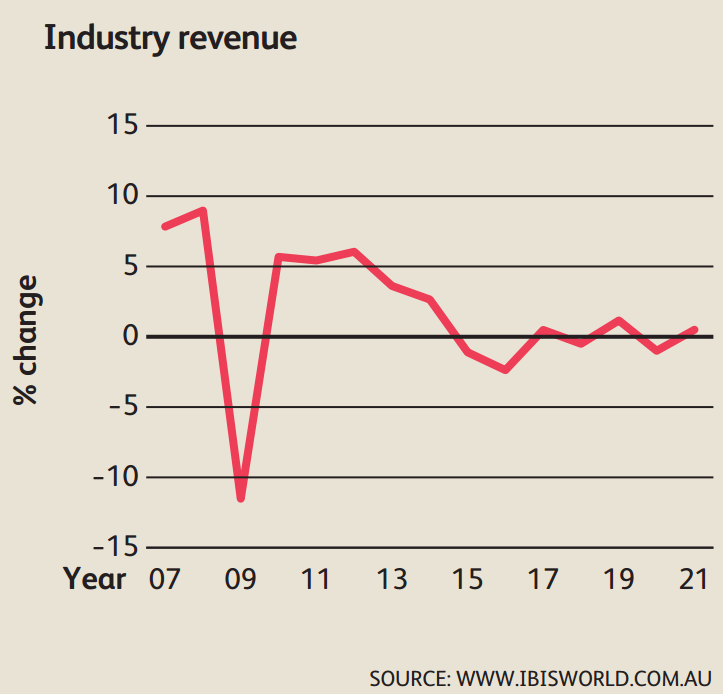

According to the latest IBISWorld report on the sector, 24-hour gyms and budget memberships will dominate the fitness industry for the next couple of years. But, it seems our desire to work out whenever we want is also set to stall the sector's overall revenue growth. Here's why:

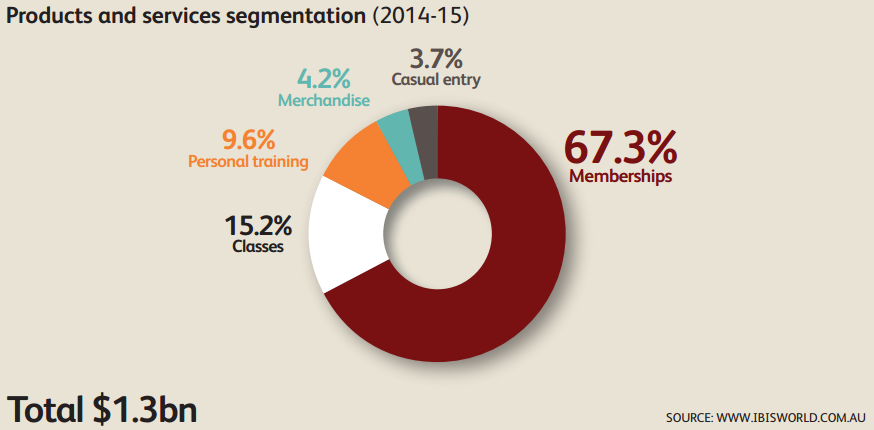

First off, the majority of the gym industry's revenue comes from memberships.

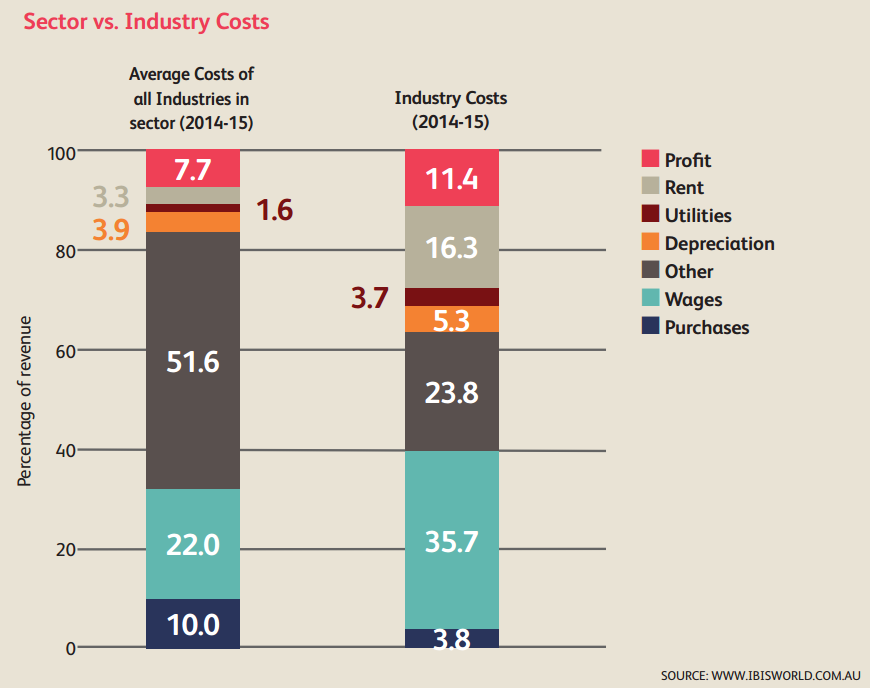

And the majority of its costs come from staffing.

So in a bid to maximise profit, gyms are cutting staff (or are simply opening un-manned gyms) and are maximising opening hours. With less staff they can offer cheaper memberships. But since memberships are the primary driver of revenue growth, the overall sector's growth is forecast to stall over the next couple of years.

In short, your midnight gym workout may make you feel great, but it isn't too healthy for the fitness industry.

10am - Why wait till March? The growing number of households already streaming Netflix

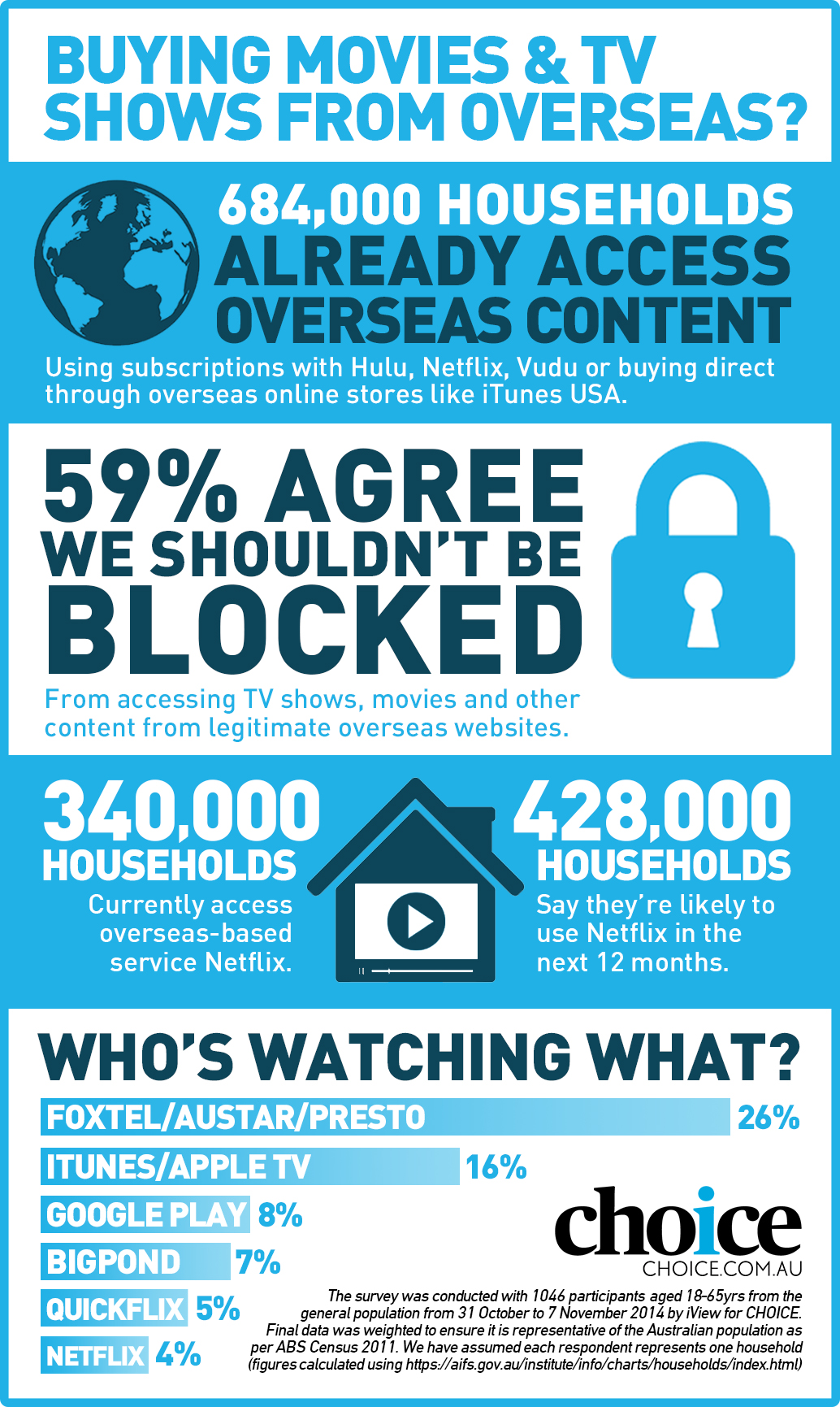

Netflix may be set to launch later next year, but a new study from consumer watchdog CHOICE has found that close to 340,000 households around Australia are already accessing the US version of the service.

Furthermore, the study found that the trend is growing, with another 428,000 household expected to sign up to use VPN's and proxy services to access the US service next year. The study was conducted before the company confirmed its Australian launch plans earlier this week.

To be fair, we should clarify these figures. CHOICE didn't survey millions of households; it conducted a population stratified study with over 1000 participants and extrapolated the results. It's the same approach used by all of the major polling companies in determining the leadership and political polls. So while it may not be exactly accurate, it's still a statistically valid indication of Netflix uptake in Australia.

Take a look at CHOICE's infographic below:

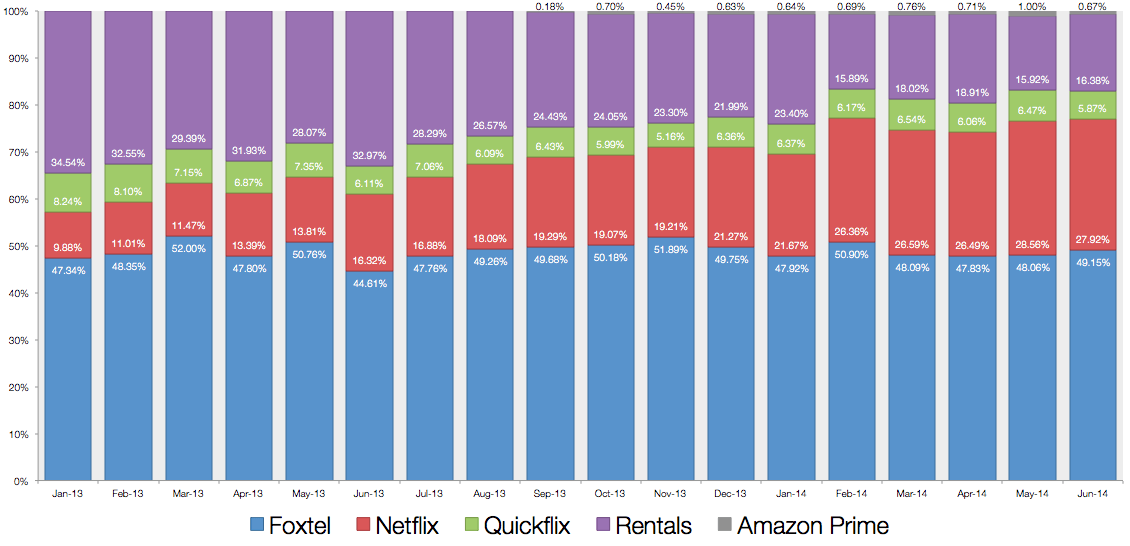

This is the second solid attempt at putting a figure on Netflix adoption – a difficult task given the process to access the US service sits in a legal (and perhaps moral) grey area. Earlier this year, Pocketbook pulled over 21,000 of its customer's spending data to measure the adoption of various video-on-demand services. Here's what they found.

So, why does this matter? Surely everyone can wait a couple of months for Netflix to arrive in Australia? Well, as we noted earlier this week, until we see Netflix's pricing plans and content line-up it's difficult to say whether the Australian offer will be a better value proposition than using a VPN to access the US version. And as CHOICE notes in its study, the main driving factor of this trend is bang for buck.

9am - Interesting reads from around the web

Tourism vs satellites: What role will Australia take in this emerging space race?

Fact-checking at its prime: G20 claims put to the test in this wrap of global fact-checking websites.

Who needs academic journals? An empirical study on how Buzzfeed's listicle tactics are the best way to communicate and spread research and complex ideas.

Rage against the machine: Algorithms are great, but don't forget they can also accidentally ruin lives.

Charting new heights: A quick guide on what makes for a good graph.