The Ticker: Modern business life

On today's blog:

- Throwing money at R&D doesn't guarantee innovation, but in Samsung's case, it helps

- It's not just insurance -- many of Australia's major industries have trust issues

- The climate change picture that will forever haunt the Coalition

- Incoming chief has sold over $10m worth of Westpac shares since 2012

- Twitter reacts to Westpac CEO Gail Kelly's departure

- Minimum wage earners are now driving Australian wage growth

- Interesting reads from around the web

Got something you would like to add to the blog? Email (harrison.polites@businessspectator.com.au) or get in touch on Twitter.

3.10pm - Throwing money at R&D doesn't guarantee innovation, but in Samsung's case, it helps

More innovation with more effective R&D spending: that appears to be the message in this year's Strategy&'s R&D report. In case you haven't heard of them; Strategy& is a consulting arm of professional services firm, PwC.

It's possible to interpret the theme as an indirect dig at Samsung; its R&D spend has more than tripled in the past decade. But looking at the history of Samsung's ramp-up in R&D spending reveals that increased funding can make a dent in the long term. According to the study, it's still not as innovative as R&D-savvy Apple. But the increase in R&D funding has improved its ranking over the past five years.

Here is Strategy&'s innovation ranking for 2010.

Now, here's the major tech giant's annual spend on R&D over the past decade. Note how Samsung increased its spend over the entire period, while Microsoft's spend slowed after 2010.

And here's Samsung's ranking today. It's an improvement from its 2014 result, albeit a costly one given that it more than doubled its R&D funding since 2010.

It's also worth noting that Samsung's spend may be inflated by the fact that its product range straddles everything from whitegoods to wearables

Read more on Strategy&'s latest annual global R&D study here.

1.10pm - It's not just insurance -- many of Australia's major industries have trust issues

Advisory firm Ernst & Young was out to prove a point on a lack of trust in the insurance industry with its latest consumer behaviour report. But its global survey inadvertently uncovered broader concerns about trust across a diverse range of industries.

The firm's figures on Australian consumer trust look good on the surface -- most are around the 70 per cent mark. But compared to the rest of the world, we're underperforming.

We've already reported that Australia is tied with the UK in holding the lowest level of trust in insurance firms. But according to the chart below, Australians' trust in several sectors is below the global average in all but one -- pharmaceuticals.

Australians hold the lowest level of faith in two sectors: supermarkets and online shopping websites.

Ernst & Young is right. The insurance sector has its work cut out for it if it wants to win back consumers. But other local industries should take note: compared to overseas players, they are not in their customers' good graces.

11.30am – The climate change picture that will forever haunt the Coalition

Back when the Abbott government repealed the carbon tax (and thus failed to put a price on carbon) Crikey political correspondent Bernard Keane tweeted out this photo.

Dear 2050: this is a picture of our legislators celebrating ending a cheap, effective scheme to reduce CO2 emissions pic.twitter.com/mZut9AaFZQ

— Bernard Keane (@BernardKeane) June 26, 2014It went viral.

Now, whenever the Coalition stumbles on climate this photo makes a re-appearance. As Labor MP Tim Watts found when he tweeted it out in response to the US-China climate deal, it doesn't even need a caption anymore.

— Tim Watts (@TimWattsMP) November 12, 201410.55am - Incoming chief has sold over $10m worth of Westpac shares since 2012

By John Durie, BusinessNow

Incoming Westpac boss Brian Hartzer has sold over $10 million worth of Westpac shares over the last two years to leave him with just 25,000 shares at the end of the financial year.

Hartzer was awarded 332,000 Westpac shares when he signed on in 2012 from RBS but it seems all those shares have now been sold.

The latest annual report shows he sold 176,681 shares in the last year and he sold a similar number the year before.

Obviously the incoming boss saw cash as a better place to be than Westpac shares over the last couple of years but will no doubt change his mind in the new job.

Outgoing boss Gail Kelly was required to own five times her base pay in Westpac shares, which she covered easily as Hartzer will be able to with his executive share grants.

Institutional boss Rob Whitfield owns 290,971 Westpac shares even after selling $12.2 million worth or 370,000 last year. Hartzer has unvested performance rights covering 116,608 shares and Whitfield some 151,029.

Hartzer will start his new job $2.7 million which is more than Ian Narev's starting pay as CBA boss of $2.5 million.

Narev's fixed pay now if $2.7 million which compares with ANZ's Mike Smith who including insurance is paid $3.3 million fixed pay and Kelly who is on $3.2 million.

Hartzer was also paid $1 million in relocation expenses last year.

10.30am - Twitter reacts to Westpac CEO Gail Kelly's departure

Australia's most prominent female CEO, Westpac's Gail Kelly, announced her retirement this morning. She will leave the bank next year. You can read our full news story here, but here's how Twitter reacted to the news. Hat tip to BusinessNow's Chris Kohler for finding some of these tweets.

"I don't try and do things to the nth degree. I know what's important and what's not" - Gail Kelly in 2005, inspiring to so many women $WBC

— Rebecca Jones (@GdayRebecca) November 12, 2014Gail Kelly leaves an important legacy at Westpac: a target of 50% of women in leadership roles by 2017. Let's hope this is retained.

— Tracey Spicer (@spicertracey) November 12, 2014Good on you Gail Kelly for doubling market capitalisation of Westpac from under $50 billion in 2008 to $104 billion in 2014.

— Dr. Abul Jalaluddin (@abuljalal) November 12, 2014Gail Kelly's resignation sees female CEO representation in ASX Top 50 drop by a third. Now there will be two. Shame #ausbiz @LizBroderick

— Elysse Morgan (@ElysseMorgan) November 12, 2014Can't wait to see what Gail Kelly does next. Westpac will miss her. A great leader.

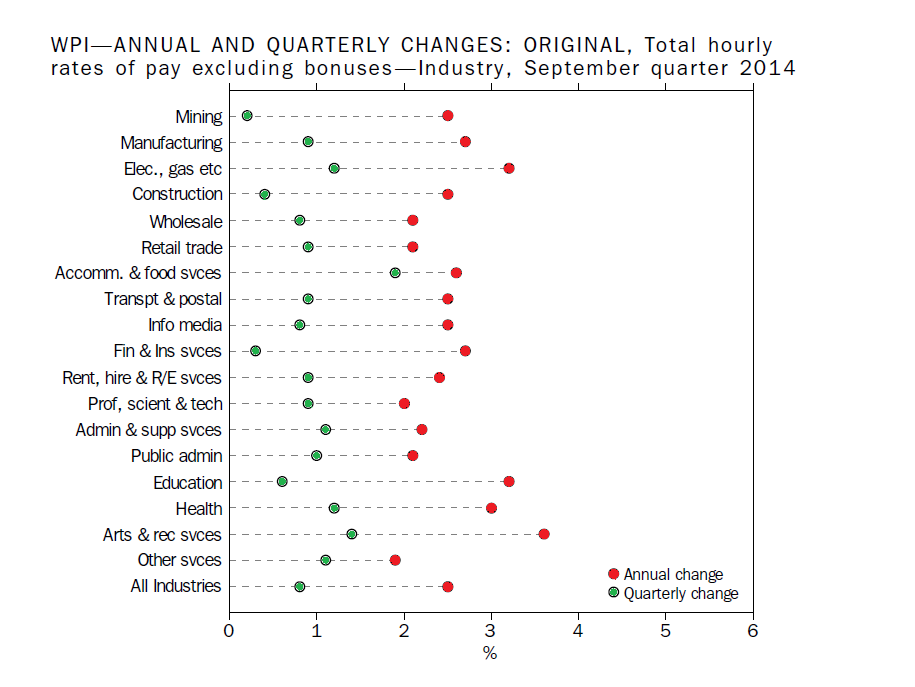

— Emma Foster (@TheShiningOpal) November 12, 201410am - Minimum wage earners are now driving Australian wage growth

Are you on the minimum wage? If so, then congratulations; you're most recent pay rise more than likely drove the majority of wage growth in the September quarter.

It's telling that the private sectors that typically drive wage growth -- mining and the financial services sector -- grew slower than inflation (0.5 per cent) in the September quarter.

“Mining recorded the smallest rise of 0.2 per cent, which is the smallest quarterly rise recorded for Mining in the Wage Price Index series,” the ABS noted in its data release.

Read more: Mining's payday perks finally dry up

Meanwhile, the private sector that benefits the most from increases in the minimum wage, namely the accommodation and food services industry, generated the highest wage growth over the same period. The ABS didn't spell this out, but it noted that the 3.0 per cent minimum wage increase decided by the Fair Work Commission earlier this year, impacted this release.

So, did your industry benefit from this year's pay reviews? Take a look at the ABS' industry breakdown below.

While Australia's wage growth is lagging, it's also worth noting that growth worker's pay in the UK beat inflation for the first time in five years yesterday. It's good news for the UK, but makes one wonder whether wage growth in Australia could follow the same bleak trend given we're already heading in that direction.

How will this data impact the Australian economy? Read Callam Pickering's piece on wage growth here.

9am - Interesting reads from around the web

Gail Kelly just retired from Westpac. Here's a recent interview where she shares the secrets to her success.

Here's a list of the top 10 business schools by the number of billionaires they have produced. Surprise, surprise, seven of them are in the US.

Forget The Economists' Big Mac index. We can now use global iPhone prices to measure inequality.

Made to order. The psychology behind personal product customisation and why bespoke goods are on the rise.

Technology should have helped us reduce our workloads and increase our leisure time. But here's why it has done the opposite.