The Ticker: Modern business life

On today's blog:

- Two maps that illustrate Australia's growing poverty problem

- Coca-Coal's main challenges: reinvention and brand loyalty

- China's latest weapon against coal pollution: a tax

- How Woolworths intends to use your shopping data

- The graphs Australia's top universities don't want you to see

- Three things you need to know this morning

- Welcome to The Ticker

Got something you would like to add to the blog? Email (harrison.polites@businessspectator.com.au) or get in touch on Twitter.

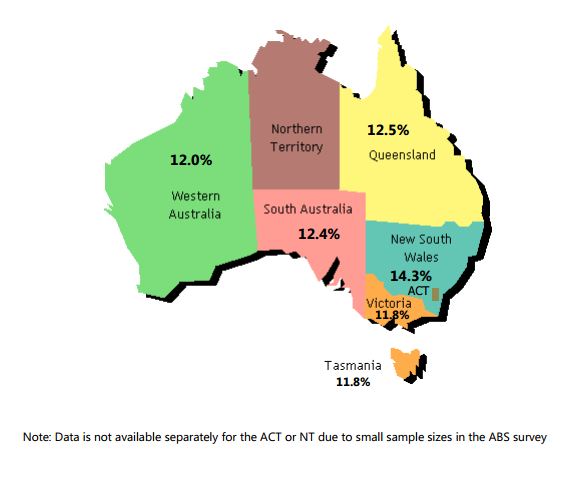

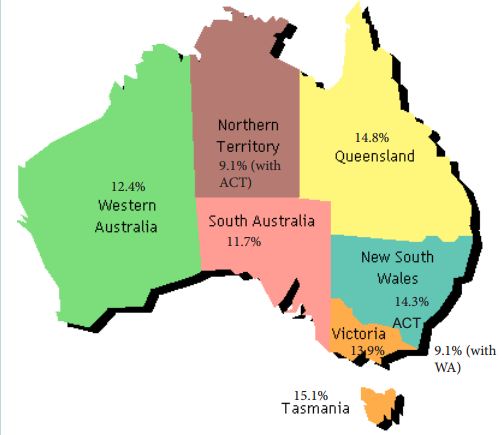

3.40pm - Two maps that illustrate Australia's growing poverty problem

According to the latest report (pdf) from The Australian Council of Social Services, up to 2.5 million Australians are living below the poverty line. A shocking figure when you consider that's 13.9 per cent of the Australian population.

ACOSS runs the same poverty study each year and it's always based off two-year old -- albeit the latest -- ABS data, possibly leading some to disregard the group's startling findings. But this report confirms a pattern -- poverty is indeed growing across the country. Here's how it has tracked since 2009.

2009-2010

2011-2012

1.10pm - Coca-Cola's main challenges: reinvention and brand loyalty

By Eli Greenblat, BusinessNow

White Funds Management managing director Angus Gluskie says Coca-Cola Amatil's problems including sweeping change in demographics, pricing and consumer tastes in local and international markets are here to stay for the medium term at least. His Australian equities fund is currently shorting the stock.

“That's an indication of how we are thinking about Coke,'' Mr Gluskie says. ‘'Previously it has been a fully priced stock and I suppose people were pricing it up because they were looking at the Indonesian growth opportunities, saying ‘this was fabulous, a big population up there', but Indonesia has been a problem area for them for many years…it's very hard to deliver against that, there are big competitors in the market place and they haven't been satisfactorily rolling out against that.''

Mr Gluskie said CC Amatil also faced massive changes in the beverages market.

“If we wandered back 10 or 15 years ago, bottlers were able to have strong loyalty from what they were offering and there was a small number of drink options, many of which were inferior to what Coke was offering. “What's emerged is people have lost brand loyalty, happy to move into different ranges of drinks, and new types of drinks coming out all the time and that means that these guys are having to continue to reinvent themselves in what they offer, which is an expensive process.'' CCL last down 1.1% at $8.34 after hitting a 5-year low of $8.19 this morning. The stock is down 33 per cent in the last 12 months.

12.40pm - China's latest weapon against coal pollution: a tax

From Peter Cai's story:

China's government has said it will impose a resources tax of between two and ten per cent on the country's struggling coal industry after last week's shock announcement of an increase in tariffs for both coking and thermal coals.

The Ministry of Finance said on Saturday that the country would allow provincial authorities to set their own resources tax according to their local situation after considering the tax burden on companies and their level of reserves.

“The coal resources tax range will be between 2 per cent and 10 per cent with the specific tax rates to be set by provincial level finance and tax departments,” the Ministry of Finance and the State Administration of Taxation said in statements posted on their websites, “provincial governments need to submit their proposed tax rates for final approval.”

11am - How Woolworths intends to use your shopping data

Here's an interesting excerpt from Robert Gottliebsen's piece today. Anyone's guess as to why Woolworths picked a name that sounds like a space mission for its transformation program.

Mercury One was about making the Woolworths supply chain equal to the best in the world. But it was focused on supermarkets as the retail outlet.

Mercury Two starts with the customer-buying pattern tracking information systems that Woolworths acquired when it bought 50 per cent of Quantium. The systems enable Woolworths to know not only what customers are buying but to anticipate what they will buy.

Woolworths will open talks with suppliers on the basis that they will be able to tailor their systems to these Woolworths-Quantium demand predictions. In other words, Woolworths will open its books to suppliers to improve the system's efficiency.

Also, Woolworths believes there is a coming transformation of the way people shop. Saying there will be a further swing to online purchasing is an over-simplification. An essential part of online trading is making sure customers can obtain delivery of the goods in a way that suits them. In this part of the transformation everything is on the table in Mercury Two.

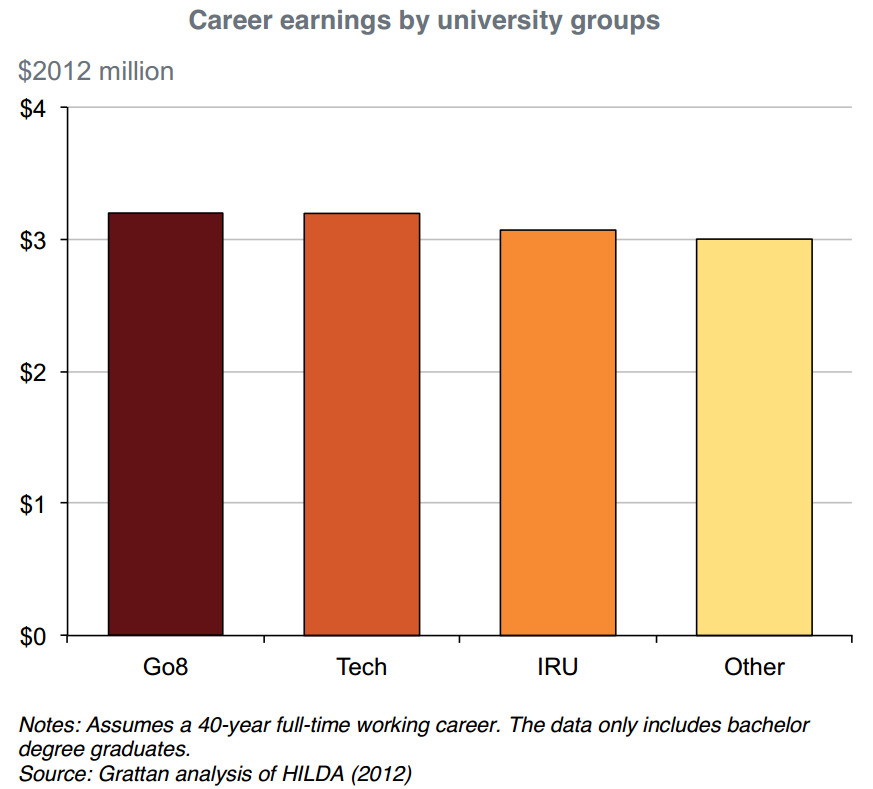

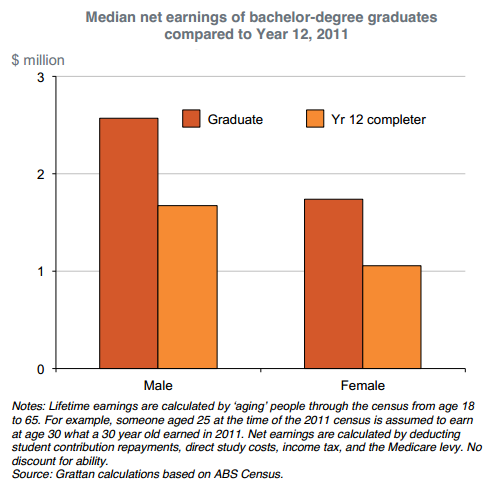

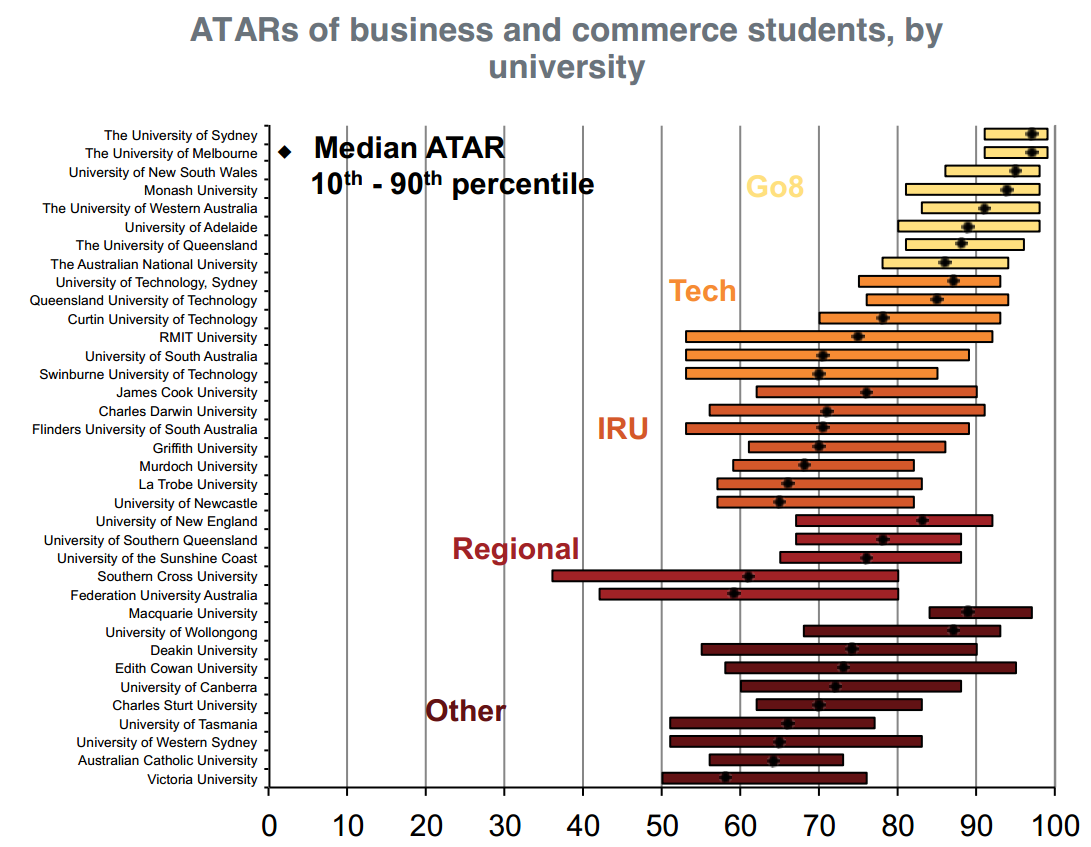

10.30am - The graphs Australia's top universities don't want you to see

The Grattan Institute's latest report has some good news for year 12 students fretting about their looming final exams: as long as you attain a degree, it doesn't necessarily matter which institution you attend.

According to the group's research, the average graduate will earn close to $3 million over the course of their career regardless of whether they attend a prestigious group of eight university or a technology university.

In fact, as a general rule, students are better off as long as they attain anything more than a year 12 qualification.

Quality of education is another matter altogether. But as far as wages are concerned, this is good news given the high entry requirements for Australia's top universities. For example, in NSW, only the top 25 per cent of students score an ATAR over 85.

*This post was edited after publication to reflect that the report is covering technology universities, not technology college.

9.10am - Three things you need to know this morning

1. A new investor scheme could see foreign investors looking to secure Australian visas target their money at priority areas of the Australian economy.

2. The chief economist at China's central bank says that he doesn't see any reason for large-scale fiscal or monetary stimulus "in the foreseeable future" despite slowing growth in the world's second-largest economy.

3. Ireland is expected to announce changes to its tax code that could eventually close one of the world's most famous corporate-tax loopholes, dubbed the Double Irish.

From elsewhere

Manufacturing in Australia isn't dying. It's transitioning, and here's why it needs to survive.

Here's a list of Apple's biggest mistakes and how you can learn from them.

Today's forecast: Listicles with a chance of LOLcats. Yes, even the Weather Channel is turning to clickbait.

Edward Snowden may not be the only one blowing the whistle. A new documentary hints at the possibility of a second NSA leaker.

Time to work on your networking skills. Word of mouth has been confirmed as the biggest driver of freelance work.

8.55am - Welcome to The Ticker

Good morning,

Welcome to Business Spectator's new live blog, The Ticker. This new section will produce rolling snippets of analysis, data and insight, all around the theme of modern business in Australia.

Each morning we'll start the blog with a 9am wrap of the top three business stories of the day, and a list of interesting articles from around the web. From there, we'll be running up until 4pm producing a mix of short unique stories, backgrounders, interesting charts and multimedia with our partner site The Australian Business Review's BusinessNow live blog.

Anyone is free to write to The Ticker, either through emailing me or through Business Spectator's Facebook page, but we will be looking to promote expertise rather than points of view. Are you an analyst who just produced the one graph that truly explains the drop in iron ore? Send it in. An academic who just produced some empirical research on how ICT is impacting Australia?. We'll feature that too. Are you a recognised expert with a unique take on the news? Shoot me a message. You get the idea.

Think of The Ticker as an open beta. It will evolve and change over time with your input and feedback. It should be an exciting journey.

For now, enjoy the section and please let me know what you think.

Harrison Polites

Editor

Get in touch via Twitter (@HarrisonPolites) or through email (harrison.polites@businessspectator.com.au)