The retail property pinch

Summary: Retail property returns have fallen, but the data isn't so cut and dry.

Key take-out: With vacancy rates north of 20 per cent in some inner-city locations, and yields sub-2 per cent, retail property investors shouldn't expect stellar returns in the near future.

With consumer confidence dropping to its lowest level in over a year, and anaemic retail sales growth, the pressure keeps mounting on listed retailers.

At the same time, large retail groups are investing in shopping centre revamps and taking shine off high street shopping experiences. More and more retailers are seeing out, sometimes breaking, their leases and simply closing the books – some for good.

None of this is news to commercial property investors. In many cases, where investors once let space to retailers, they are now leasing to bars, cafes and restaurants. Some are becoming more flexible in their tenancy agreements, slashing rents or taking on shorter-term tenants, even allowing pop-up store opportunities.

But there are many holding out for better heeled tenants to come along. Perhaps it's already taking shape. Take high street Melbourne as an example. Overall, the average vacancy for surveyed strips in June 2018 was 8.2 per cent, up from 7.8 per cent one year before. The surveyor, commercial property services firm CBRE, notes this is well above the average vacancy rate of 4.2 per cent.

What to watch for

However, as pointed out by the Head of Research for JLL Australia, Andrew Ballantyne, the biggest challenge isn’t between Melbourne, Sydney and Brisbane, but the high streets within our major cities. And Ballantyne still believes a strong residential market is a strong proxy for the retail market.

“The Victorian economy is much stronger than QLD generally, and there is much stronger population growth too, but you still have retail strips in QLD that are far outperforming retail strips in NSW and Victoria,” says Ballantyne.

“It’s very difficult to make big macro comments around the sector. It’s very asset specific, so you must consider the surrounding trade area, whether it’s one that’s growing, or maybe it’s an area where working class people work every day, the same people with mortgages who are greatly influenced by rising rates.”

Some of the figures are outstanding. Vacancy on Bridge Road, Richmond, near the Melbourne Cricket Ground, shot up 4.1 per cent to 24.6 per cent in the year to June.

This is while Melbourne experiences the strongest population growth in the country at a rate of 1.8 per cent per annum.

Structurally, things have changed, where strips with a higher proportion of grocery and hospitality tenants are now experiencing lower vacancy rates than areas where retailers primarily call home.

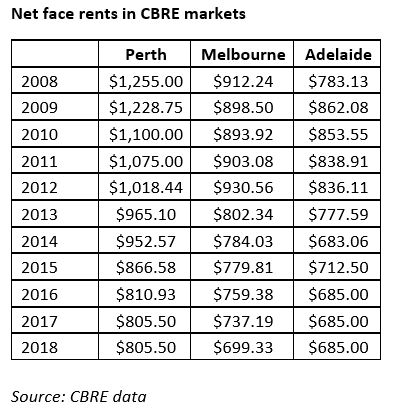

“Rent growth on the majority of prime strips in Melbourne has been limited, with most seeing a decline in net face rents over the past year, driven by the historically high vacancy rates across these strips,” says Kate Bailey, Head of Retail & Logistics Research at CBRE.

“As tenancy mixes adjust to new customer desires, rental growth should eventually improve in conjunction with lower vacancy. Average incentives recorded for Melbourne retail strip leases are currently the lowest of all major Australia metro city regions.”

Sub 2-per cent yields

It’s an interesting situation. Investor demand seems unquestionably strong, with shops transacting at sub-2 per cent yields in tightly-held established precincts. Clearly, there’s an overarching expectation for eventual rental growth built into these purchases.

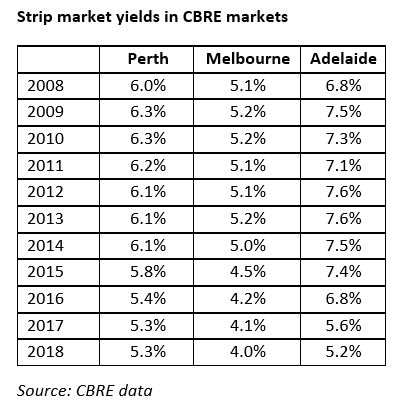

Bailey adds that, overall, prime strip yields were sitting at an indicative 4 per cent in June 2018 – although, even that’s a 100bps tightening on a year earlier. These yields are not the norm.

“We’re expecting the market to remain soft and steady, there are some risks around the retail sector, but we’re expecting everything to plod along for the next two years or so,” says CBRE.

“We aren’t expecting yield expansion anytime soon. In the retail sector, we think we’re at the bottom of the market particularly in Melbourne, and Sydney too, where there are relatively strong fundamentals with retail trade performing well, low unemployment and strong population growth.”

However, she senses this is “the new normal” where retail trade won’t reach pre-GFC levels.

Vacancy rates have been rising in every capital city since the middle of last year, while regional areas have been holding up comparatively.

But heading west may not be your best bet. As CBRE will point out, things tend to change suddenly, or not at all, in some country towns – a fall in the broader market could trigger a much steeper downturn in previously isolated pockets.

Many will look to retail trade sales as a leading indicator, and while they have been picking up, the recovery is patchy.

We have also witnessed a surge in corporate activity in the listed property sector this year, and fund managers will point to elevated levels of M&A activity as a late cycle indicator.

And yet, unlike office and industrial, retail portfolios haven’t been the beneficiaries of much of this activity, which may imply they’re running off a different clock.

A 'micro asset class'

Beyond the structural change that Bailey suggests, JLL’s Andrew Ballantyne offers that "retail has always been a micro asset class" where you can’t take a broad-brush macro’view as an investor.

“Although post-GFC it now has structural headwinds, which now make local characteristics the most important thing when selecting a retail asset,” says Ballantyne.

Taking a broad view, retail property funds aren’t standout performers in the broader Australian property fund space right now. Only four funds with a dedicated retail profile are included in the top 50 listed managed funds tracking the S&P/ASX 200 A-REIT index on a 1-year returns basis.

According to InvestSMART Compare Your Fund data, retail property funds that were delivering outsized returns a couple of years ago are now performing in line with peers. This may suggest opportunities in the space are also narrowing.

Australian Unity’s Retail Property Fund, for example, has long been a consistent performer, boasting a 5-year return of 16.43 per cent. Its 2-year return is even more impressive, at 23.38 per cent. However, its returns have since come back and we’re now seeing a much more level playing field.

This may seem contrary to the fact that our high streets have been a mixed bag of performers, but many of these funds are now only holding regional properties. Besides, it speaks more to the idea that returns are levelling off overall, and therefore, it’s much riskier to ‘do it yourself’ than draw on the expertise of a fund manager with a track record.

A quality fund manager will shift out of positions much more easily than a retail investor can move a lumpy asset. They also have a better ability to ride out downturns – cyclical or structural – as we seem to be experiencing now.

In the meantime, it could present an opportunity to taper your positions in property funds – especially if you’re shopping around and spotting potentially outsized returns elsewhere.

For further commentary on the investment implications of current trends in the residential property sector, also read Editor Tony Kaye's article Dealing with the property downturn, REA Group Chief Economist Nerida Conisbee's article, Property is on a political tightrope, and our latest Property Point video.