The RBA's crystal ball is clear as mud

The Reserve Bank of Australia has revised down estimates of economic growth in 2014, as a result of a faster than expected decline in mining investment and the Australian dollar appreciating since the RBA’s last Statement. But with so much uncertainty surrounding the forecasts it remains unclear what the RBA’s next move should be.

Most of the narrative contained within the Statement on Monetary Policy will be familiar to readers: mining investment is on the skids; unemployment is drifting higher; China and iron ore exports are supporting the economy; house prices and residential investment are on the rise; and the Australian dollar is uncomfortably high.

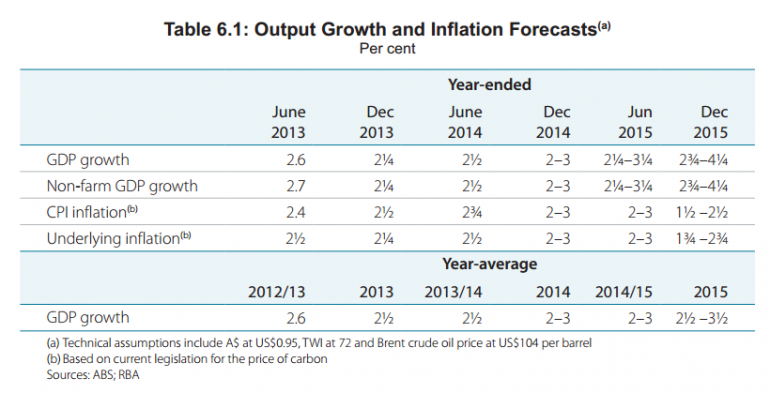

The Reserve Bank is estimating below-trend growth over the remainder of 2013 and into 2014. Growth is estimated to be around 2.5 per cent over 2013/2014 before picking up in 2015. Since the August Statement, growth has been revised down by 0.25 and 0.5 percentage points in 2013/2014 and 2014/2015, respectively. Inflation is expected to pick up a little in the near-term but to be a little weaker through to 2015.

It is important to recognise a few of the assumptions that form these forecasts. First, the cash rate is unchanged over the forecast horizon. Second, the exchange rate is assumed to remain at its current level over the forecast period ($US0.95 and TWI at 72). Third, the price of oil is assumed to be unchanged over the horizon. Fourth, the carbon tax is assumed to remain in place and become an exchange trading scheme during the forecast horizon, consistent with current legislation. Obviously these are big assumptions, which can become outdated within days of the SMPs publication. Nevertheless they should be taken into account when analysing the numbers.

The Reserve Bank expects the outlook for household consumption to be a little stronger than they expected in August, mainly due to strengthening conditions in the established housing market and higher equity prices. Growth in the near-term will rely on rising wealth given the outlook for household income growth is relatively soft. In my Wednesday column I questioned the sustainability of recent increase in house prices (Buyer beware of the house price bandwagon, November 6). If that eventuates, the outlook for consumption will be fairly subdued due to income expectations.

The government sector is expected to be a drag on spending, as governments at both the federal and state levels undertake fiscal consolidation over the next few years. However, more recent information suggests federal government spending may be higher than that expected by these forecasts (Govt braces for budget blowout, November 8).

Mining investment has been revised down, primarily due to a more pessimistic outlook for the coal sector. Investment in iron ore and LNG extraction has also been revised down a bit. The Reserve Bank expects that mining investment as a share of GDP will decline by around 3 percentage points over the next two and a half years. However, export volumes are expected to boost GDP growth over the next few years.

The labour market is estimated to continue to soften, but the Reserve Bank believes it will pick up in 2015 as non-resource sectors improve. Inflation is expected to remain contained. Treasury estimates suggest that the carbon tax added 0.7 percentage points to annual CPI when it was implemented. The Reserve Bank believes it is reasonable to assume that its removal would result in a similar reduction in the CPI in the 2014/2015 financial year, although I would not be surprised if the price change is asymmetrical, with firms preferring to pocket some of the savings.

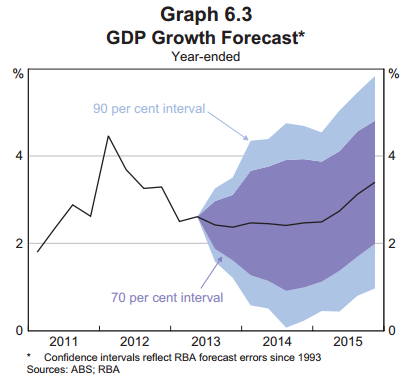

Although the narratives have barely changed, there is considerable uncertainty to the outlook both in regards to Australia and the global economy. As I read through the Economic Outlook section of the SMP it became increasingly clear that nothing is clear. Nowhere is that more apparent than when considering the confidence intervals surrounding real GDP growth.

The biggest uncertainty for the forecasts is the exchange rate. The value of the Australian dollar remains "uncomfortably high" according to RBA governor Glenn Stevens and it will likely remain so until the Federal Reserve begins to taper. The RBA acknowledges that a further depreciation could see "growth return to trend, or even above trend, sooner than forecast ... [and] ... could see inflation move into the top half of the target range for a time".

The sheer number of upside and downside risks contained in the SMP suggest that analysts will be able to derive a narrative that supports their position. The one thing that is clear though is that the outlook for the Australian economy is largely controlled by forces that the RBA cannot control.