The RBA must ease Australia's labour pains

The Australian labour market continues to drift along, but with resource-related employment set to plunge, the labour market will soften further before it recovers. Despite strong population growth, there is precious little momentum in the non-mining sector, indicating that households and businesses will need further rate relief to lower the dollar and boost our prospects.

On a seasonally-adjusted basis, the unemployment rate ticked up to 6 per cent in June and is 0.3 percentage points higher over the year. The trend measure remained at 5.9 per cent and is largely unchanged over the past six months, indicating that while the labour market remains weak, it hasn’t necessarily deteriorated further.

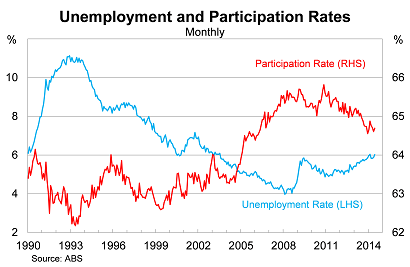

As always, a correct assessment of Australia’s labour market requires consideration of both the unemployment and participation rates. Considering either one in isolation is often misleading.

The participation rose modestly in June, offsetting much of the rise in the unemployment rate. The participation rate remains at around its lowest level in eight years and has put some downward pressure on the unemployment rate over the past year. Although some of this reflects retirements, it shows that there is more spare capacity in the economy than is indicated by the unemployment rate.

The bad news is that the participation rate will continue to decline, as more baby boomers hit retirement age. The downward trend has also been exacerbated by our strong population growth, which has outpaced employment growth for a number of years now.

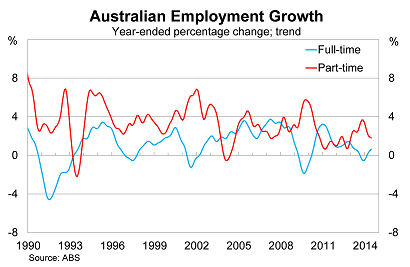

Employment rose by 15,900 in June, modestly beating expectations, which was entirely driven by part-time employment. Female employment outpaced male employment, rising by 11,400 in June, and has done so for four consecutive months.

On a trend basis, employment rose by 10,600 in June, with the pace of growth slowing over the past four months. Recent trend growth peaked following a somewhat dubious and upwardly biased February outcome. The trend estimates are less widely reported but it provides a greater indication of labour market conditions than the seasonally-adjusted estimates.

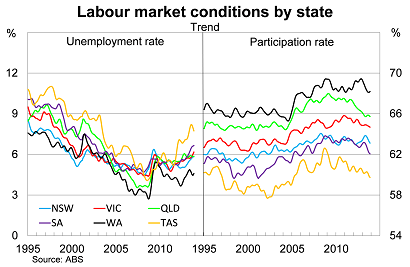

Employment growth was driven by New South Wales but rose in every state bar Victoria, where employment declined by 15,300. Queensland and Western Australia have been the most active labour markets over the past year, with employment rising by 104,000. By comparison, employment collectively declined over the past year in the other states and territories.

Today’s result is simply a continuation of the poor employment growth that has characterised our economy following the global financial crisis. Although economic growth has been solid, the non-mining sector has struggled and that is typically where the jobs are.

There is little reason to believe that this will turn around in the near term. The Australian economy is rebalancing but progress has been slow. The non-mining sector remains cautious, weighed down by a high Australian dollar and uncertainty surrounding the broader economy.

If anything, the near-term outlook points to employment slowing further and unemployment rising. According to ANZ research, up to 75,000 resource-related jobs could be lost over the next couple of years (The jobs picture is starting to look ugly, July 2). Earlier this year, NAB estimated that as many as 100,000 jobs could be lost.

Most of these jobs will be lost in Queensland and Western Australia, which have accounted for 100 per cent of employment growth over the past year. With population growth rising at a near-record pace, there will be significant spare capacity throughout the labour market. This suggests that wage growth could soften further, from its current historic lows, and that will put downward pressure on inflation.

The Reserve Bank of Australia maintained its neutral stance at their last board meeting, but it is becoming increasingly obvious that the non-mining sector is poorly placed to offset the impending collapse in mining investment. The economy has deteriorated throughout the June quarter, with growth set to contract for the first time since March 2011.

If the RBA is serious about rebalancing the Australian economy, then it has little choice but to shift to an easing bias at its August meeting and cut rates by the end of the year. If they fail to do so, then it -- combined with our federal government -- will leave the Australian economy exposed to a number of headwinds that it is ill-equipped to navigate.