The numbers behind the repeal bill

Prime Minister Tony Abbott was in full flight in parliament yesterday, extolling the benefits of his signature policy initiative, that of tearing down an emissions trading scheme.

It would help our manufacturers compete against overseas producers, he said. “Prices for groceries, for household items and for services will also fall” and the “carbon tax will go, but the carbon tax compensation will stay so that every Australian should be better off”.

In the explanatory memorandum accompanying the carbon price repeal bills there was what is known as a Regulation Impact Statement. The RIS are supposed to provide a detailed evaluation of why a regulatory change is being initiated, a consideration of alternatives to address the given problem, a cost-benefit analysis and also how the costs and benefits are distributed across different segments of community and economy.

While this RIS falls a long way short of the kind of detail and analysis you see developed to introduce energy efficiency standards on a refrigerator or buildings (in fact, it didn’t even evaluate the alternative of Direct Action) it did provide some interesting insights.

Firstly, households and pensioners will get to keep tax cuts and benefit increases equal to around $300 per annum, originally intended as compensation for the carbon price. But the government budget which apparently was so in the red it was an “emergency”, will be plunged a further $7.4 billion into the red over 2013-14 to 2016-17 as a result of loss of revenue from the carbon price. Of course, this debt has to eventually be repaid which will inevitably mean increased taxes in some other area to pay it back, it’s just it won’t be levied on pollution. So this benefit may be entirely transitory.

In addition, households should see a cut in retail electricity prices of 9 per cent and gas prices of 7 per cent. Using the latest 2012 ABS survey on household energy consumption, this will deliver them a huge windfall of about $35-$40 in their next quarterly electricity bill (the RIS says $50 but this is based on out-of-date data about household electricity consumption) and a whopping $17.50 on the quarterly gas bill (although ABS data suggests the saving is less).

The RIS, though, was not quite so confident as Abbott about savings in other bills. It said there should be savings, however:

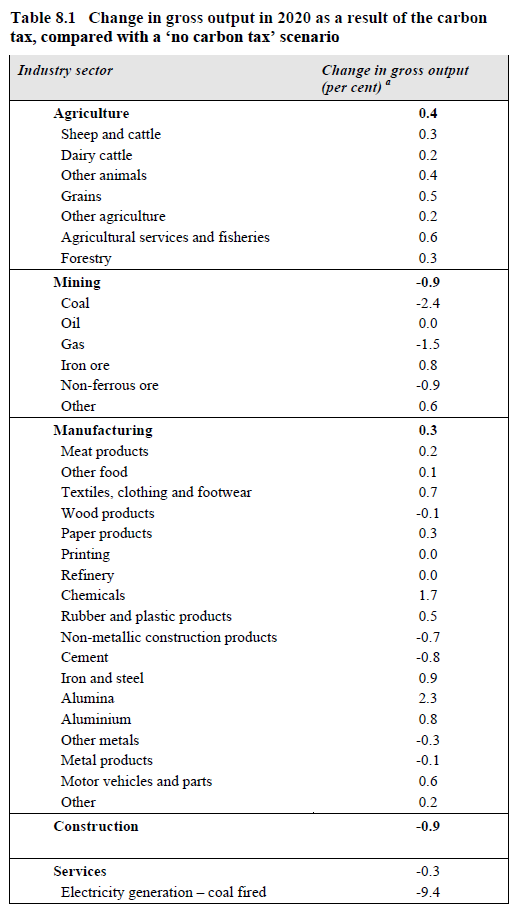

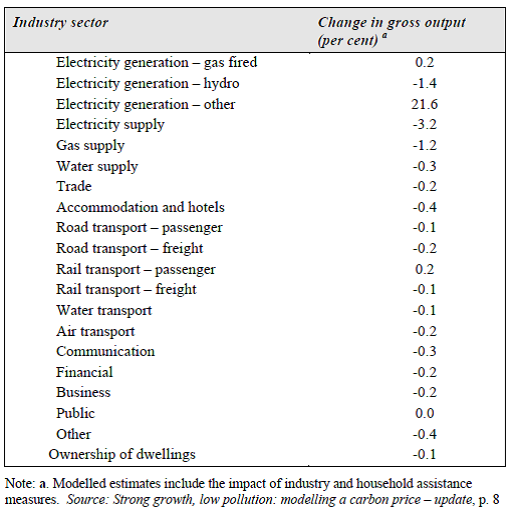

The RIS also contained a long table, shown below, which estimated how output in a range of industry sectors could be expected to change with the carbon tax relative to no carbon tax. Rather oddly, a range of industries – from agriculture to manufacturing – will actually be expected to contract a tiny bit with the repeal of the carbon price. But don’t worry, coal mining and gas extraction will increase output by a few percentage points and coal fired generation will be the big winner, expanding by 9.4 per cent. It seems that, thanks to provision of free permits for trade-exposed industry, the ability for agriculture to earn carbon credits, plus a decline in the exchange rate from contraction of coal mining, the boffins in Treasury think repeal of the carbon price won’t be such a good thing for manufacturing’s competitiveness.