The looming fall in unlisted asset prices

Robert Gottliebsen

The looming fall in unlisted asset prices

At the moment world markets are hailing a US-led boom. Let's hope the markets are right. My view is that markets will fall in and out of love with Donald Trump several times during the course of 2017.

The US bond market has taken a terrible beating and that has transferred to infrastructure and secure income property portfolios, where yields are rising. And that's where I want to focus today.

Around official valuers in the asset infrastructure and secure income property markets there is a belief that the share market is mispricing many of the listed assets.

And so we are seeing vast sums spent on infrastructure assets, like Ausgrid and the Port of Melbourne, plus large property transactions where there are secure long-term tenants. The prices at which these transactions took place now look out of line with the share market.

The Port of Melbourne lease sold for $9.7 billion this year.

I have been around a long time and where you have a sustained move in the share market in an asset class – either up or down – then it is a precursor to a similar move in unlisted equivalent assets. They cannot stay out of line longer term.

At this stage it is still possible that the 10-20 per cent fall in infrastructure and secure property stocks that we have seen on the share market is a passing phase and they will recover.

That would certainly be so if the American 10-year bond rate suddenly slumps and we go back to the interest rate pattern of three months ago.

I will discuss later some of the stimulatory ideas US president-elect Trump is now considering which, if implemented, would deliver a surge in the American economy and further increase bond yields to widen the gap between listed and unlisted assets. But Trump is not yet President and if he turns out to be just another hot-air leader and does not take the sort of actions he has promised then, of course, American interest rates will fall and our infrastructure and property asset stocks will recover.

I could be wrong but I think Trump will give considerable stimulation to the US economy. If that happens US bonds will not go back to their old levels, and so the fall in the value of our listed securities will lead to a fall in the value of unlisted secure income property and infrastructure.

The 1 per cent rise on yields for American 10-year bonds that we have already seen in the market affects the value of our infrastructure properties in two ways.

First, most of the infrastructure and secure properties are highly leveraged and, while much of the debt is longer term, over time it will be replaced by higher interest bearing debt. If that is not also met with higher income it means the returns will be lower. And remember, global interest rates are being set by events in the US and other countries, so they are not necessarily correlating with our local Consumer Price Index, which often governs the return on our infrastructure and property securities.

And, of course, the second reason for the valuation change is that if greater returns are available from interest-bearing securities, either globally or domestically, then the returns on Australian infrastructure assets must also be increased. In assessing these values some note must be taken of the growth prospects of a particular property or infrastructure asset.

So if you are holding a stake in an infrastructure or a property group investing in new high return assets, then there will be a degree of insulation from the interest rates change, although there is a construction risk.

The bottom line is that portfolios that have a large percentage of unlisted property and infrastructure have been enjoying their values rise sharply with falling interest rates. Accordingly, those unlisted investments are now vulnerable to a fall.

If you have those securities in your portfolio you don't have to rush out the door and sell them, but you should be aware that you are taking a higher degree of risk, and watch very closely what happens in the US in the early months of 2017.

If Trump delivers on his promises and US bond interest rates continue to rise, then it will be time to consider an exit strategy.

One of the reasons why so many of the industry superannuation funds have performed better than retail funds like AMP, MLC and the like is that the industry funds have a bigger proportion of unlisted investments, which have benefited from higher valuations. The industry funds now carry a higher risk.

Traditionally, valuers have been notoriously slow in issuing downgrades when there is a change in the market. It is a while since we have had a really good non-residential property fall but in past decades inflated valuations were called "valuers' value" – in other words, the valuers were not doing their job.

This time around we have to hope that the valuers take notice of what is taking place locally and around the world, and if that reveals a downward spiral they have to make adjustments in 2017 and not in subsequent years. Industry superannuation fund units are changing hands every day on the basis of these values.

US tax changes

And talking about the US, out of Washington this week, an amazing tax plan was described as "being considered" by the Trump administration.

Basically the scheme would involve taxing cash flows, so there is no depreciation and accruals in the accounts but the capital investment becomes a tax deduction. But under the plan the only capital investments that would carry a tax write-off would be goods made in the US (whatever that might mean). And so, if you purchased a car or a piece of equipment made overseas you would get no tax deduction.

As part of the plan US corporate tax rates would be reduced to around 15 or 20 per cent. It would be another way of putting a 15 or 20 per cent ‘tariff' on equipment and raw materials imported for American industry. Strangely cash accounting was advocated by Ken Henry in his set of Australian tax proposals in 2009. The plan didn't go anywhere and did not include non-tax deductibility on imported goods. But Trump is thinking outside the square. It's another case of how the new leader will need to be watched very carefully.

It goes without saying that such a tax would be a huge blow to Australia, because we provide the raw materials that are used to make Chinese and Japanese equipment for the US market. Our iron ore, coal and other exports will be much more dependent on the domestic Chinese and Japanese market.

BHP priorities

And, finally, BHP Billiton has been a long-term bull in the oil market for a long time. It believes passionately that longer term the world demand for oil is going to absorb the current surpluses and, given that many fields are set for decline, a lot of production is needed.

That is why it outbid BP in the Gulf of Mexico battle. Paradoxically BHP is less bullish longer term on iron ore, and my guess is it is a little surprised at the sharp rise. But no one is complaining.

Readings and Viewings

The headlines were firmly focused on the Australian economy this week with the release of the worst set of national accounts since the GFC.

In case you missed the ABS numbers, you can click here. But the charts below really tell the story:

But don't despair, investors. Some US financial pundits believe the share market there is in melt-up mode. And that's should be good news for us.

As usual, during the week there were lots of happenings around the world.

Two unlikely players – Glencore and Qatar – have emerged with a sizeable stake in Russia's largest oil company, Rosneft.

Francis Fukuyama, having to eat even more humble pie, did a podcast on Donald Trump.

After traders wiped $1 billion off the value of Boeing's share price after a Trump tweet, CNBC asks whether algorithms can trade the US president-elect's tweets.

And, not finished, Trump has taken another swipe at Boeing's massive Air Force One bill.

Meanwhile, this billionaire is just as well known to investors, and now HBO is making a movie about him – Warren Buffett, that is. It will go to air in January.

And Berkshire Hathaway is about to join the exclusive $US400bn club.

Poor old Europe. In this video, Bank of England governor Mark Carney laments the first ‘lost economic decade in 150 years'.

Canada's big six banks have had another strong year, despite hiccups elsewhere across the economy.

But HSBC, JPMorgan and Credit Agricole are in hot water over interest rate derivatives.

And who was behind the UK sterling flash crash in October?

Eminent business reporter Ambrose Evans-Pritchard delivers his take* on the economic consequences of this week's ‘no' result in the Italian referendum. (*requires free sign-up.)

The outsider in the three-way race for outgoing NZ PM John Key's job puts forward her plan: ‘No tax cuts'.

In the UK, 2 million employee reviews reveal the top choices for the best employer.

When you're feeling under pressure, imagine what it's like to be in the shoes of the social media gatekeeper on London's underground.

The Japan Times on Shinzo Abe's announced visit to Pearl Harbor: “For Obama, the trip by Abe is a chance to burnish his legacy ... Experts, however, agree that the big winner of the visit will be Abe."

Starbucks says it expects China will eventually overtake the US in business.

And as Beijing battles to keep yuan at home, many Chinese are trying to convert their savings into US greenbacks.

Here's a nice visualisation of humanity's path to 7 billion.

And The New York Times paid tribute to John Glenn, the former test pilot and astronaut who later became a national political figure in the US Senate, who has died at the age of 95.

Lastly, Mitchell Sneddon's recipe of the week: "Mozarella alternatives are making a comeback, and this burrata cheese with peppers, olives and capers is an ideal summertime introduction to the genre."

Last Week

Shane Oliver, AMP Capital

Investment markets and key developments over the past week

The past week saw most major share markets rise with a new record high in US shares, a breakout in Eurozone shares led by banks, Australian shares nearing their August high and Japanese shares continuing to surge. The main drivers have been continued good global economic data, the prospect of help for Italian banks, a dovish ECB and expectations of lower interest rates in Australia. Bond yields were mixed and commodity prices softened a bit. Despite a stronger $US the $A was little changed.

Bad news is good news. It seems that ever since the Brexit hoopla seemingly bad outcomes for share markets have seen a brief dip in markets – often in our time zone – only to be followed by a surge higher. This has been the story with Brexit, Donald Trump's election, the Italian “No” vote and even Australia's recent poor growth news. There are several reasons for this seemingly perverse response.

- First, many share markets had 20% plus falls into earlier this year so bad news was sort of factored in.

- Second, many of these events have seemed less negative than feared once they transpired – Britain and more importantly Europe did not collapse after the Brexit vote, many of Donald Trump's policies are positive for growth and hence share markets and even though Italy voted “No” there is a long way to go to get to an Itexit.

- Third, the macro economic backdrop globally – with rising business conditions PMIs, still easy monetary policy and the end of the earnings recession in several key markets – are positive in contrast to say a year ago.

- Fourthly, each event has held out the prospect of more pro-growth economic stimulus.

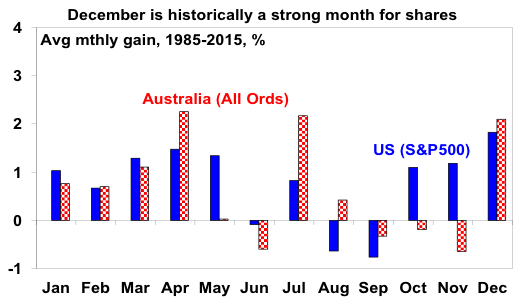

- Finally, December is one of the strongest months of the year – see next chart. Normally the Santa rally doesn't come till mid-December but he seems to have arrived early this year!

A lesson in all this is to turn down the noise – the coverage around Brexit, etc, was huge but investors would have been better off doing nothing but sticking to their long turn strategy. Or if you are going to do anything be contrarian & buy the dips.

Source: Bloomberg, AMP Capital

The Italian “No” vote is a case in point. It was no more a sign of increased support for the populist anti-Euro Five Star Movement than a “No” vote to a similar neutering of our Senate in Australia would signal support for One Nation. And in any case a lot will have to occur before Italy leaves the Eurozone, if at all. Meanwhile, Austrians voted against their anti-Euro far right presidential candidate in greater numbers than was the case pre-Brexit. I remain of the view that a break-up of the Eurozone is unlikely and that the various European elections in the year ahead could simply prove to be buying opportunities.

Meanwhile, the ECB provided more support for financial markets. While it cut its quantitative easing program to €60bn a month it extended it to the end of 2017 which was more than expected and President Draghi's comments were dovish.

Major global economic events and implication

US economic data remained solid with the non-manufacturing ISM business conditions index rising to a strong 57.2, job openings and hiring remaining strong and jobless claims remaining low.

Meanwhile, Donald Trump's appointments are continuing to be market friendly with his pick for head of the Environmental Protection Agency consistent with a roll back of EPA regulations and his choice of a China friendly ambassador to China could help soothe relations with China. Meanwhile, although Trump's tweets have created some angst the trick as borrowed from US political commentator Salena Zito is to treat his comments seriously but not literally.

While German industrial production was soft in October, a 4.9% mom surge in factory orders points to a rebound ahead and a broader pick up in German growth.

Japan wages growth remains weak but an economic sentiment rose to levels last seen before the sales tax hike.

In China, export and import growth improved far more than expected and producer price inflation rose further to 3.3% yoy adding to the message of improvement seen in other Chinese economic indicators.

Australian economic events and implications

As feared the Australian economy contracted in the September quarter – with broad based weakness across housing, business investment, public demand, net exports and consumer spending – but here are seven reasons why it's unlikely to signal the start of a recession.

- First, it looks to be a bit of payback for stronger than expected growth over the year to the June quarter.

- Second, the fall in housing and non-dwelling construction looks to have been partly bad weather related which should reverse with approvals for both pointing up in the short term.

- Third, public capital spending projects point to a rebound in public demand.

- Fourth, the boom in resource export volumes has further to go as various mining and gas projects complete.

- Fifth, recent retail sales data point to a strengthening in consumer spending.

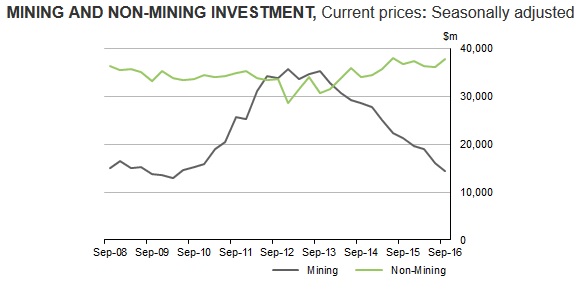

- Sixth, while the drag from unwinding mining investment has further to run its impact is declining as it falls as a share of GDP and it should reach a bottom in the next year or so.

- Finally, it doesn't feel like the start of a recession. The traffic is jammed up, shopping centre's seem full and there is not the sense of foreboding seen in 1989-1990 that went into the last recession (yeah – I was around back then!). Sure it's a recession in WA but that's been the case for a while now and is a direct result of the mining investment slump, but that's not the whole of Australia.

In other data the trade deficit was worse than expected, housing finance fell but continues to bounce back for investors, ANZ job ads remain solid and the AIG's services PMI rose which along with the already reported rise in the manufacturing PMI adds to confidence growth has picked up again.

But while a recession is unlikely, underlying growth looks like its running below the RBA's assumed circa 3% pace which along with chronic low wages growth means inflation is likely to be weaker than it expects too. This is also not a good time for the banks to be raising mortgage rates (as they have started to lately with the high risk standard variable rates will go up too) and the $A remains too high. As such, we remain of the view that the RBA will cut rates again next year. It could come as early as February.

Finally, New Zealand continues to impress. Its latest budget update showed an ongoing surplus despite its latest earthquake whereas our budget updates seem to just go from bad to worse and we seem to go from one silly debate to another – eg whether to levy a back packer tax at 15% or 13% or around in circles over carbon pricing. No wonder NZers are going back!

Shane Oliver is the chief economist of AMP Capital.

Next Week

Savanth Sebastian, Commsec

Jobs, jobs, jobs

Another big week of economic events is in prospect in Australia and overseas. In Australia the focus will be on the labour market. In China, the broader economic activity indicators are released. In the US, no doubt most interest will be on the US Federal Reserve interest rate decision.

In Australia, the week kicks off on Monday with the Reserve Bank release of the latest data on credit and debit card lending. The average credit card balance is holding just shy of 8½-year lows.

Also on Monday, the Bureau of Statistics (ABS) will release tourist arrivals and lending finance figures – includes housing, personal, business and lease loans. In September lending showed a modest 1.9 per cent rise to $68.5 billion with the strength largely in commercial borrowings.

On Tuesday the National Australia Bank business survey is released alongside the Australian Bureau of Statistics (ABS) quarterly data on house prices. The business survey covers key business indicators, a reading on business confidence as well as gauges on prices, wages and finance. The indicators of confidence and conditions have showed encouraging improvement over the past few months, with a particular focus on a lift in profitability. In terms of the home price index, the data is a bit dated (September quarter) but is another check on price pressures in the housing market.

Also on Tuesday ANZ and Roy Morgan release the weekly consumer sentiment survey. While on Wednesday the monthly Westpac consumer confidence index is released.

The Westpac-Melbourne Institute survey will include the quarterly questions about where consumers believe are the wisest places to put new savings.

On Thursday the ABS releases the monthly employment figures. Figures have been somewhat patchy in recent months with the job market seemingly pausing for breath after outsized increases in late 2015. However there has been some encouraging signs in the past couple of months. Not only are job vacancies holding at four-year highs but hours worked is lifting at the fastest pace in five months. No doubt the focus will be on the shift between part-time and full-time employment. Overall we expect that the number of jobs rose by around 15,000 in November. The participation rate may have held steady at 64.4 per cent, while the unemployment rate held close to recent 3½-year lows of 5.6 per cent.

Also on Thursday the ABS will release population data for the June quarter as well as the Finance & Wealth publication for the September quarter. Population growth has been hovering around a 1.4 per cent annual rate for the past year with Victoria recording the strongest growth. And household wealth is at record highs.

Spotlight on US and Chinese data

So-called ‘top shelf' economic indicators are released in China in the coming week. And in the US the focus will on the Federal Reserve meeting while data on retail sales and consumer prices will also be of interest.

In the US, the monthly budget statement is released on Monday. While on Tuesday the National Federation of Independent Business releases its Business Optimism index alongside data on import and export prices.

On Tuesday, China releases its ‘top shelf' indicators on Tuesday – namely retail sales, production and investment. Annual growth rates are slowing, but that is ‘normal' for a maturing economy. Also, foreign investment, lending and money supply data is due early in the week.

On Wednesday, the Federal Reserve Open Market Committee (FOMC) meeting takes place to decide on interest rates. And given the recent lift in commodity prices, stronger US economy and resulting lift in inflation, it is widely expected that the Fed funds rate will lift from the target band of 0.25-0.5 per cent to 0.5-0.75 per cent.

Also on Wednesday, a bevy of new data is slated for release. US retail sales is issued alongside figures for producer prices, industrial production, business inventories and the usual weekly data on home purchase and refinancing. The producer price index (business inflation) is expected to remain tame, while economists tip a solid 0.5 per cent increase in November retail sales after the 0.8 per cent lift in October. No doubt fluctuating petrol prices are having a significant influence on the results. Encouragingly core sales (sales less autos and gasoline) are expected to have lifted by 0.5 per cent in November.

On Thursday, the weekly figures on claims for unemployment insurance are released together with the November data on consumer prices and current account data. Excluding food and energy, prices are expected to rise by only 0.2 per cent. At present inflation remains well contained, however the Federal Reserve is likely to focus on the possibility of a lift in inflation over 2017.

Also on Thursday, the NAHB housing market index is issued, alongside the 'flash' Markit purchasing managers index, Empire State manufacturing index and the Philadelphia Federal Reserve business survey. Home builder sentiment remains upbeat, the manufacturing sector should continue to show healthy expansion, while healthy readings are expected for the regional surveys.

And on Friday, data on US housing starts and building permits is released. Housing starts may have fallen by around 7.5 per cent in November, after the outsized 25.5 per cent lift in October.

Savanth Sebastian is an economist at CommSec.