The jobs market has its work cut out

The unemployment rate rose slightly in October, but the devil is in the details. The low participation rate and falling full-time employment points to a soft labour market that will need to show recovery before the Reserve Bank hikes rates.

According to the Australian Bureau of Statistics, the unemployment rate rose to 5.7 per cent in October, in line with market expectations, to be 0.4 percentage points higher over the year. But the unemployment rate hides the true weakness in the labour market – the participation rate is down 0.5 percentage points since June and is now at its lowest level since October 2006. To put this in perspective, if the participation rate had remained unchanged since June 2013, the unemployment rate would currently be around 6.4 per cent or near its highest level in a decade.

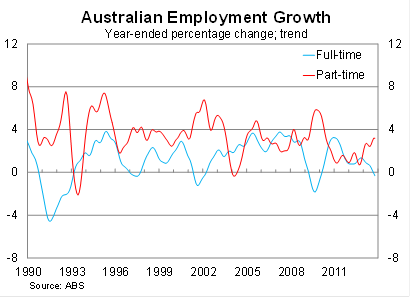

Employment was effectively unchanged in October, but has been on a modest downward trend since June, as we can see in the graph above. Based on the trend data, employment growth is at its weakest since mid-2003. But for employment, the devil is in the detail due to the shift towards part-time employment since 2009.

Full-time employment has declined by 60,000 over the past year or 0.7 per cent. By comparison, part-time employment is up almost 150,000 over the same period. The result is a rising divergence between full and part-time employment, which has boosted work flexibility, but has also weighed on income and consumption growth over the past few years. At the moment, total employment is growing too slowly to absorb population growth, perhaps resulting in a growing disillusion with the jobs market.

Of particular concern must be the historical relationship between part-time and full-time employment. During economic downturns, part-time employment is typically more resilient as businesses seek to create employment flexibility, while employees are willing to take fewer hours if it means greater job security. This process occurred during the global financial crisis and after the dot-com bubble burst in 2000, as well as during out last recession in the early 1990s.

At the state level, the participation rate in NSW and Victoria is down by 0.5 percentage points since June 2013, while South Australia is down by 0.8 percentage points. Queensland is the only state that has had rising participation over the past four months.

The unemployment rate is at 5.9 per cent for New South Wales, Victoria and Queensland, while in South Australia the unemployment rate rose by 0.6 percentage points to 6.6 per cent. Western Australia continues to be the strongest state, with an unemployment rate of just 4.3 per cent. With the exception of Queensland and Western Australia, the unemployment rate in the other states has increased by between 0.6 and 1 percentage point over the past year.

The employment result sits in contrast to elevated consumer sentiment and solid retail spending data from September. But as a key indicator for the Australian economy, the slowdown in employment points to a fairly subdued economy over the remainder of 2013 and into 2014. A subdued labour market will also make it difficult for house prices to maintain their recent gains, as I touched on yesterday (Buyer beware of the house market bandwagon, November 6). Consistent with RBA expectations, it seems likely that the Australian economy will grow at below trend pace for some time. It is also clear that there is some way to go to rebalance the Australian economy away from the resource-rich states.

There is, however, some cause to be optimistic about the employment outlook. Construction is set to pick up in the near-term and if the Australian dollar depreciates in early 2014, employment is likely to be boosted across a range of export industries. There are also a couple of interest rate cuts that have their full effect on the economy. The question is how quickly these factors can come into play and for the Australian dollar if it comes into play.

For the Reserve Bank, there was little in this report that would shift them from their present course. They will remain on hold in December, as they wait to get a clearer view of domestic and international economic conditions. But it is difficult to see them raising rates in the near-term until job creation improves.