The hidden curse of bank stocks

Summary: When banks and other listed companies increase the number of shares on issue, they effectively dilute the dividend that each share receives. This can have a significant impact on the performance of investments, because even when bigger profits are posted, if more shares have been issued then the profits will be spread across more shareholders in the form of dividends. This can reduce the power of your holdings to generate income. |

Key take out: Investors should look at the financial statements for the stocks they own to track the number of shares on issue and understand the performance of their ownership stake. |

Key beneficiaries: General investors. Category: Shares. |

Most Eureka shareholders will have seen the value of their bank shares drop – often quite markedly – in recent months. We regularly hear the explanation for these price falls: Tighter regulations, slower economic growth etc. But the perhaps the most significant drag on the value of your bank shares is the least reported…it's the enervating effect of lower and lower earnings per share.

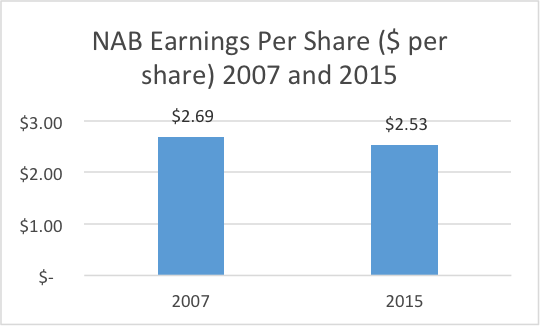

Consider the following: How can a bank – let's take NAB as an example - significantly increase profit from 2007 ($4.58 billion) to 2015 ($6.34bn) while earnings per share actually fall from $2.69 to $2.53 over the same period?

Sometimes we get away from the most basic fundamental of shareholding – that as share owners, we become a part owner of a business. We rarely own a big part of a business, but we own a slice of a business nevertheless. Every year, as a shareholder in the business, we are entitled to benefit from our share of the company earnings. These might be paid to us in the form of a dividend, or reinvested in the company to (hopefully) grow company profits in the future.

One element of owning a company (being a shareholder) that is not often talked about is the impact that a company issuing extra shares has on each individual shareholder. There are many reasons that a company might issue extra shares, including to pay dividends (through a dividend reinvestment program), incentives for employees and executives, to pay for an acquisition (for example another company that they are taking over) or to raise more funds – as happened often during the global financial crisis, when borrowing money was challenging.

As an example to illustrate the way that extra shares can dilute the earnings that each shareholder receives, let's consider a hypothetical company with 1,000,000 shares on issue. If a shareholder owns 1000 shares, they own 1/1000 of the company. If the profit of the company is $1,000,000, and 100% of this is paid as a dividend, then they will receive $1 per share as a dividend – or $1,000 for their holding of 1,000 shares.

The following year the company increases their profit to $1,200,000, which they again pay completely as a dividend. This would seem to be a great result for the shareholders – a 20 per cent increase in company profit, well worth a headline in the business section of the newspaper. However, let's assume that over the course of the year the company issued 50,000 shares as bonuses for managers, 50,000 shares to staff as part of a staff incentive program and 150,000 shares to pay for the acquisition of a new business. Now there are 1,250,000 shares outstanding, and the $1,200,000 profit actually leads to a decreased dividend of 96 cents per share, even though headline profit increased 20 per cent to $1,200,000. The decrease is entirely due to the extra shares that have been issued in the company.

While this is a hypothetical example, it is something that real life investors need to be aware of – and it is interesting to consider this in “real life” by looking at the big banks in the period of the financial crisis through to now.

The Big 4 Banks – Profits from 2007 to Now

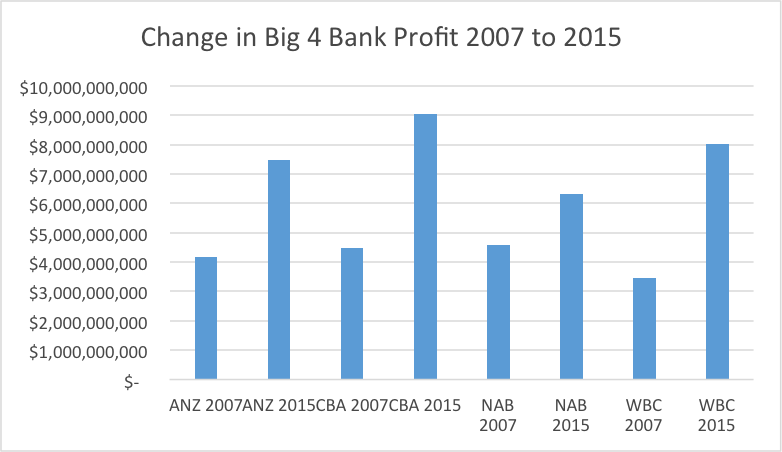

We now move on to look at what has actually happened for the “Big 4” banks in Australia. We start our analysis with the 2007 reporting year, which was directly before the global financial crisis, and compare it with what has happened from then to now. We particularly look at the change in profit of these banks, and the change in the number of shares on issues. We find that while profits have gone up quite impressively, the gain to shareholders has been diluted as banks have issued significant numbers of new shares over this period of time.

The following graph sets out the increase in profits of each of the banks.

The Change in Shares Outstanding from 2007 to Now

While there have been significant increases in profits, for example ANZ increased their profit from $4.18bn to $7.49bn over this period, there has also been increases in the number of shares on issue which has decreased the earnings per share impact that investors have seen. In the case of ANZ, the number of shares on issue has increased from 1.864m to 2.903m. This means that someone who has owned, say, 1000 shares in 2007 right through to 2015 saw their share (percentage) of total company earnings decrease. The following graph sets out the change in the number of ordinary shares outstanding from 2007 to 2015:

The Unusual Times of the Global Financial Crisis

It should be noted that the analysis that we have done has taken place over a somewhat extraordinary period of time – when banks were under financial pressure and raising money by issuing extra shares was an important strategy. It should also be noted that shareholders may have taken advantage of opportunities to buy extra shares in the banks at discounts through capital raisings or, when there was a renounceable rights issue, benefited financially through the sale of their rights.

Conclusion

Headline profit is often the number reported when companies announce their results – and it is a key figure. However, it doesn't take into account the individual shareholder, and what this means for their share of the company ownership. Earnings per share and dividends per share will provide the shareholder important information about the performance of their ownership stake in the company. As we watch the companies that we own, it might be worth diving into the financial statements and keeping an eye on the change in the number of shares on issue. After all, we don't want good headline profit results to be diluted by a company issuing more and more shares.