The heavy toll of eurozone inaction

With eurozone inflation falling further in May, the stage is set for the European Central Bank to finally act and stimulate an economy that is showing few signs of genuine recovery. The ECB has been slow to act -- though it is not solely to blame -- and in the process has guaranteed that the European depression will carry on for years to come.

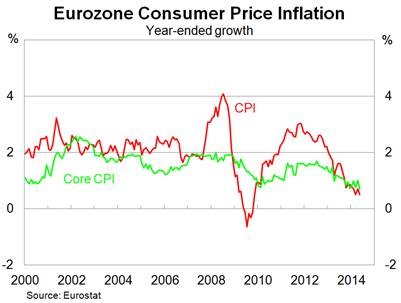

According to advance estimates, annual inflation in the eurozone fell to 0.5 per cent in May. The result was softer than expected and well below the ECB’s target for inflation of about 2 per cent.

The core measure, which removes volatile items such as food, energy, alcohol and tobacco, has climbed by just 0.7 per cent over the year. Deflation is not an immediate concern, but it can no longer be discounted. That spells grave problems for the ECB and the eurozone.

The outlook for inflation remains benign even if the ECB embraces greater quantitative easing. To see why, we only need to consider the two driving forces of ongoing and temporary inflation: wage growth and the exchange rate.

Wage pressures are driven by a greater demand for labour than there is an available supply of workers. When the unemployment rate is low, firms compete for the best available candidates and boost wage expectations.

But with an unemployment rate of 11.7 per cent in April, there remains insufficient demand for labour across the region. Both Spain and Greece have unemployment rates of around 25 per cent.

It is worth remembering that these figures ignore the millions of Europeans who have given up on finding employment after years of unemployment and the millions more who are desperate to work more hours.

The reality is that the eurozone is years away from wage demands boosting inflation. Indeed, the recovery so far is struggling even to generate much employment growth.

A depreciation for the euro, which would be driven lower via quantitative easing, is also unlikely to contribute materially to inflation since such a high share of euro trade occurs within the eurozone. The region’s exposure to other currencies is relatively unimportant compared with many non-euro countries.

But quantitative easing might help the recovery gather some momentum and, for that reason, the ECB should have acted long ago. It wouldn’t be great news for the Australian dollar -- or our economic rebalancing -- but a welcome reprieve for a bunch of countries in desperate need of growth.

Although non-euro trade is not large, the likes of Spain and Italy and Greece desperately need to regain some competitiveness against international competition. Otherwise the only method to improve competitiveness is via internal devaluation -- a slow and painful process.

Internal devaluation -- where a country becomes more competitive via relatively lower inflation -- has become increasingly problematic in a currency zone where the strongest economy (Germany) is stringently anti-inflation. Some gains have certainly been made but it remains a work in progress.

The recent European elections, highlighted by a strong protest vote, should provide a timely reminder to the ECB and other policymakers of the ongoing human toll that this crisis has caused. With every day of inactivity – either by the ECB or the likes of Germany, which could stimulate its economy but chooses not to -- that toll grows.

Regardless of whether the ECB cuts rates or embraces quantitative easing, the eurozone faces considerable challenges for years to come. Quantitative easing might help in the near term but these are challenges that the ECB cannot solve by itself. The stronger economies in the region, such as Germany, need to do their bit to get the recovery moving as well.