The hard task of fixing soft jobs growth

The Australian labour market continues to be weak and, with the non-mining sector showing distinct signs of moderation in the June quarter, this is unlikely to change any time soon. It is time to ask tough questions of our state and federal governments: do they have a plan in place to boost employment? And if not, why not?

On a seasonally-adjusted basis, the unemployment rate remained at 5.8 per cent in May, beating market expectations, and is 0.4 percentage points higher over the year. The trend measure was at 5.9 per cent, though the difference is due to rounding.

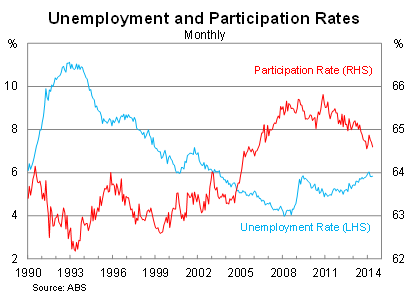

As always, a correct assessment of Australia’s labour market requires consideration of both the unemployment and participation rates. Considering either one in isolation is often misleading. The participation rate indicates that the labour market softened further in May, despite the unemployment rate remaining unchanged.

The participation rate declined to 64.6 per cent in May, down slightly from April, and remains at around its lowest point in eight years. The bad news is that the participation rate will continue to decline, as more ‘baby boomers’ continue to retire, with the economy relying on an increasingly smaller share of the population to support our older population.

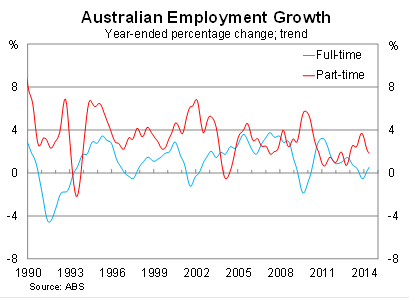

Employment declined by 4,800 people in May, which was driven by a 27,000-person decline in part-time employment. Male employment fell by 13,100 in May, which more than offset a rise in female employment.

On a trend basis, employment rose by 13,100 in May but the pace of growth has slowed significantly since a fairly dubious February result. The trend is less widely reported but it provides a greater indication of labour market conditions than the seasonally-adjusted estimates.

The graph below, which shows year-ended trend growth, highlights how weak the labour market has been. Full-time employment continues to grow at a modest pace, with part-time employment growth easing further.

At the state level, employment growth was driven by Victoria and Western Australia. By comparison, employment in New South Wales declined by 22,200 people. Over the past year, employment growth continues to be driven by the resource-rich states, reflecting how slow the economy is rebalancing away from the mining sector.

Today’s result represents a continuation of the poor employment growth that has characterised our economy following the global financial crisis. Although economic growth has been solid, the non-mining sector suffered and that’s where the jobs are (or at least where they should be).

Although the Reserve Bank of Australia is working hard to stimulate the non-mining economy there is little reason to believe that this situation will improve significantly in the near-term. With the exception of housing construction (a fairly small share of GDP) most of the non-mining sector is showing signs of moderating in the June quarter.

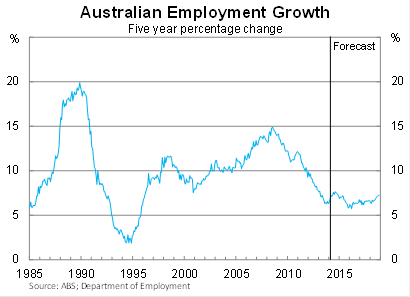

Soft employment growth will not come as a surprise to the RBA or the federal government, which is openly forecasting five years of subpar employment growth (There’s no substance to the Coalition’s attack on welfare, May 23).

What I’d like to know is: does the Coalition have a plan to boost employment? And if not, what are they waiting for?

The mainstream media prematurely celebrated strong employment growth in February, but the past few months will have provided a sobering reminder of the challenge that confronts us.

A soft labour market and negative real wages will continue to weigh on household spending, while business investment is set to fall sharply on the back of lower mining investment. Couple that with a tough budget and a Chinese economy that is beginning to look shaky, and you have a recipe for an exceptionally weak economy.

This result will not change anything for the RBA -- at least not by itself -- but anyone discounting the possibility that the next rate movement might be down is ignoring the headwinds that are facing the Australian economy.