The Greek tragedy's effect on yield

Summary: The last time Greece was in crisis five years ago, Europe was in a desperate situation. The problem was contained because the troika bought out the Greeks' loans held by European and international banks. Now, Europe would have to lend even more money to Greece to avoid a Greek collapse, which would be back to square one – the US would hike rates and the RBA would cut. |

Key take-out: If the US does not increase rates in response to the Greek crisis, this would depress the US dollar and escalate our own currency, meaning our interest rates would be lowered faster than is currently on the agenda. |

Key beneficiaries: General investors Category: Economics and Investment strategy. |

Whenever you are in a dispute with a person and they are threatening you with an action… once that action is taken, and you survive, you are in a much stronger position.

For weeks the Europeans have been threatening Greece with actions that would cause the Greek banks to virtually shut. Now they are shut and Greece, in a strange way, is actually in a stronger position.

I start with this anecdote because to understand what is happening in Greece you do need to step back a little. In summary, no matter which way the Greece saga goes, I don't think the basic forces are going to be a disaster for Australia but there is a possibility that they will accelerate our interest rate reductions.

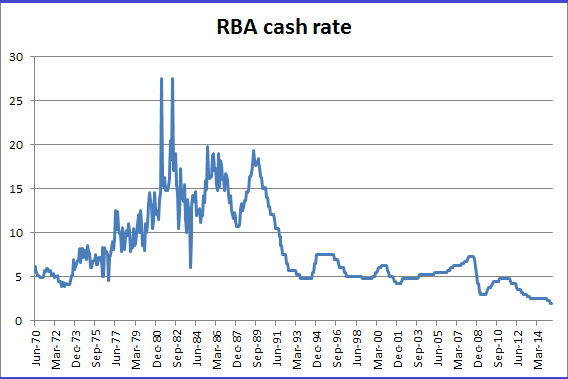

Source: RBA

Separately, Australia will need to watch carefully what is happening in China, which is more dangerous. In terms of Greece, as we all know, the Greeks were advised by some of the top American investment banks to rig their books and borrow far more than they were allowed under European rules. Athens was a wonderful city as it basked in the borrowed money.

The lenders were none other than a series of European and other international banks. Some five years ago when the crisis hit the table, as it inevitably would, Europe and the world were in a truly desperate situation. If Greece had defaulted it would have sent a series of European banks to the wall. This, in turn, would have had serious ramifications for the international banking community particularly as Italy, Spain and Portugal were also in danger of falling over in the wake of a full blown Greek crisis.

The problem was contained because the Europeans led by their central bank bought out the Greeks' loans held by most of the European and international banks. So instead of Greece owing big sums to the banking community they owed it to a combination of the European Central Bank, the IMF and the European Union.

Of course the Europeans also had to lend additional money to keep Greece afloat. All these loans were relatively short term and a big swag of them mature this year. And Greece needs additional money to keep its banking system going. When the loans were made there was not the slightest chance that Greece would be able to repay them on time in 2015 or any other year over the next five years. In the intervening period Greece has ended up in a severe recession and while it has not done all the things Europe wanted it to do Greece has gone a fair way along the line. The IMF and European Central Bank are demanding further reforms or they won't roll over the money and/or lend new money: Unless an agreement is reached Greece becomes a failed state within the EU and probably leaves the euro.

The Europeans will therefore lose all their money. In rough terms Greece has about €325 billion in debt of which around 75 per cent is owned to the various statutory authorities. I have always believed that because the money now being offered to Greece is mostly required to repay earlier loans to the same statutory authorities, that an agreement would be reached. And so I gave an agreement where Greece stays in the euro 60 percent chance (see Four market messages you can't ignore, June 22).

Greece leaving the euro and/or becoming a failed state was accorded a 40 per cent probability. At the time the markets were giving Greece leaving the Euro only a 20 per cent chance. Now it's about 50/50. Greece will suffer a big escalation in short-term economic difficulties if it embraces its own currency – the drachma – even though that is the best long-term solution. Because Europe has over played its hand in current negotiations, to avoid a Greek collapse it will now have to lend even more money to Greece because the latest closure of Greek banks will further damage the economy and increase its need for European funds.

But I don't think the Europeans are quite ready to accept the reality that they have lost all of the €325 billion or whatever loan figure ends up being agreed to if Greece leaves the euro.

So rather than predict the outcome let's look at what the implications are for a continuation of European funding of Greece and what happens if the whole exercise comes crashing down and Greece leaves the euro.

- In the case of the continuation of European funding it's pretty much back to square one. The US will raise interest rates later this year and almost certainly Australia will drop its interest rates by a quarter of a percent. We are back to where we started.

- But if Greece becomes a failed state it will clearly cause jitters in world capital markets. But because the direct involvement of the world banking community is relatively small, in my view on a global scale this is a relatively small disaster.

The only qualification I have to that is if Greek banks have been gambling on derivative trading then the world has a much greater degree of risk. There has been no suggestion that this has been the case but you can never be sure.

If Greece becomes a failed state it is unlikely that the Americans would lift interest rates as they planned to do because there will be a rush of money to the US dollar as a safe haven.

If America does not increase its rates it will depress the US dollar and escalate our own currency. In those circumstances our interest rates will have to be lowered much further and much faster than is currently on the agenda.

We will see a swing back to yield stocks.

Meanwhile over in China we are seeing a typical fall that takes place when a market has been highly leveraged with margin trading. As shares fall people with heavy borrowings have to sell and as they depress prices more are forced to sell. Chinese individuals rather than institutions have fanned most of the margin buying and they have suffered big losses.

When on Tuesday the Shanghai index was down 6 per cent, taking losses to around 20 per cent, the Chinese authorities encouraged big institutions to step in. The market ended with a 5 per cent gain – a swing around of about 10 per cent. The Chinese authorities welcomed the boom because it helped Chinese banks raise much needed capital.

But the Chinese share market had risen too quickly and needed a correction. However by Tuesday morning that correction had gone too far.

It is now clear that China's economy is slowing faster than the government would like and so it has now intervened by lowering interest rates and stabilising the share market.

But that does not help iron ore prices, which had enjoyed a short respite from their inevitable downward spiral as higher production meets sluggish China demand. That means lower tax income for Australia and of course lower share prices for our miners.