The Great Sharemarket Return: Fantastic value

| Summary: The retail sector has encountered extremely tough conditions in recent times, but furniture and bedding retailer, and property manager, Fantastic Holdings is continuing to expand. |

| Key take-out: Recording stronger results in the first-half, Fantastic Holdings has low gearing, a solid cash flow, and is paying a grossed-up dividend yield of 5.9%. |

| Key beneficiaries: General investors. Category: Growth. |

Value can often be found in the most unlikely of places.

For quite some time, the analysts at Clime Asset Management have found it at Fantastic Holdings, the purveyor of affordable furniture.

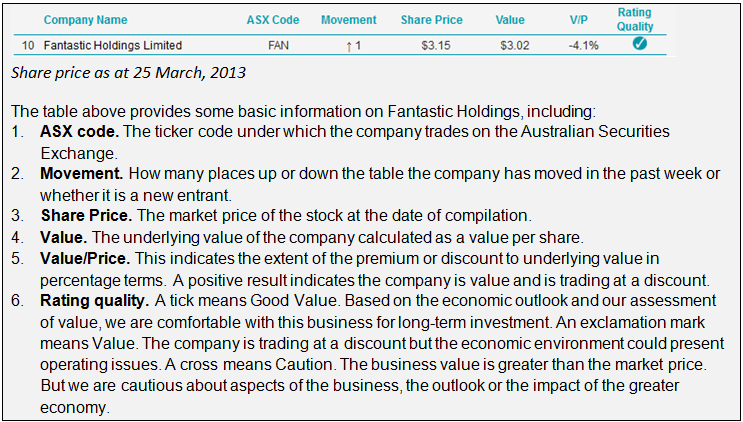

The company this week slipped in at Number 10 on Clime’s top-rated table of relatively safe companies that require low rates of return to justify their spot as value stocks.

Fantastic actually is two businesses. There is the retail furniture and retail mattress and manufacturing operation that trades under Fantastic Furniture, Original Mattress, Le Cornu and Dare Gallery. In addition, the company has a property division that develops sites for the company and other leaseholders.

Vertically integrated from manufacture, import and retail through to store development, its three key operational subsidiaries are Fantastic Lounge Factory, Royal Comfort Bedding and FHL distribution.

From humble beginnings selling plastic furniture at Parklea Markets in 1989, the company now boasts 130 stores nationally and is growing through a mixture of organic expansion and acquisition.

Retail generally has had a tough time of it since the financial crisis, and furniture has been particularly difficult.

Fantastic, however, consistently has lifted sales and net profit in recent times and in the latest half year, notched up a 2.2% lift in net profit to $13.5 million on a 2.5% rise in revenue to $233.4 million, a record result despite the subdued trading environment.

While Fantastic’s share price currently of $3.15 is higher than Clime’s intrinsic value of $3.06, the company has long been a favourite.

An enduring theme of Clime’s top ranking value tips are companies with strong balance sheets and solid positions within their market.

“Gearing remains low, with the net debt-to-equity ratio at 5.4%,” the analysts note. Operating cash flow was a healthy $17.17 million, with minimal intangibles.

Another constant theme is management holding a sizeable stake in the business.

As an added attraction, the fully franked 4.1% dividend grosses up to a solid 5.9%.

The latest results included a note of caution from chief executive Julian Tertini that January sales and early February were slightly below the previous year, while “clear signs of improved customer sentiment remained patchy”.

That prompted a rethink on the stock from major investment banking analysts.

JP Morgan and Macquarie both downgraded the company from a buy to neutral, while Credit Suisse maintained its underperform recommendation.

Credit Suisse found the valuation a little stretched, while the first-half results, although in line with expectations, raised concerns at JP Morgan about revenue growth and Macquarie pointed to possible future cost pressures.

Fantastic Holdings Forecasts | ||

2013 | 2014 | |

Earnings/share | 23.7c | 25.1c |

Dividend/share | 14.8c | 15.3c |

Earnings/share growth | 15.9% | 5.9% |

Dividend/share growth | 14.9% | 3.3% |

Price/Earnings ratio | 13.0 | 12.3 |

Dividend yield | 4.8% | 5.0% |

Source: Broker consensus |

Clime has consistently but incrementally upgraded its valuation on the stock since February 2009. In the immediate euphoria following the financial crisis, Fantastic’s share price went into orbit, rising above $4.20 as Clime valued it closer to $1.60.

Since August 2010, however, the market value has been more in step with Clime’s valuation, rising gradually from August 2011 when it was trading around $2.

The company still has a sizeable rollout program in place, aiming to have 200 stores within the next few years.

While weak consumer sentiment has hit margins, it is likely to receive a boost from any consumer recovery resulting from the recent heavy cuts to domestic interest rates.

With construction and development at historically weak points in the cycle, Clime reasons that any uptick in this area should benefit furniture manufacturers and suppliers such as Fantastic.

Clime & Eureka have joined forces to offer a first-rate stock valuation & research solution. Gain a sneak peak with MyClime and identify companies with attractive dividends and yield. Click here for a free trial to MyClime.