The Cryptocurrency Crackdown in China

China’s regulators have recently revealed yet another ban on crypto-related activities following previous efforts over the last decade or so of Bitcoin’s emergence.

Agencies, including China’s central bank the People’s Bank of China (PBOC), the Central Cyberspace Administration of China and the Ministry of Public Security announced last Friday a range of measures, which include:

- Confirming that “virtual currencies issued by non-monetary authorities” aren’t legal tender.

- Banning financial institutions from “developing and participating in virtual currency-related businesses”.

- Explicitly banning exchanges, businesses acting as “counterparty” or “matching” for virtual currency transactions, token issuance financing and derivative services related to crypto, including the provision of such services by foreign providers to Chinese residents.

The announcement specifically defined virtual currencies as “using encryption technology, distributed accounts or similar technologies, and exist in digital form, such as Bitcoin, Ethereum, etc., including so-called stable currencies such as Tether”.

The specific callout of Bitcoin, Ethereum and Tether leaves no doubt as to the Chinese regulator’s intent.

It also explained that relevant authorities and legitimate financial institutions and non-bank payment institutions would work together to implement monitoring and surveillance activities to enforce the ban.

Measures included are “to cut off payment channels, dispose of relevant websites and mobile applications, strengthen the registration and advertising management of relevant market entities, and crack down on relevant illegal financial activities in accordance with the law”.

Although China has previously moved to curtail crypto-related activities, this is certainly the most comprehensive and coordinated effort amongst multiple departments and ministries to date. It leaves the crypto sector in no doubt about its intent and is likely paving the way for China’s own Central Bank Digital Currency (CBDC), the digital Yuan.

What does this mean for crypto, and should investors be concerned?

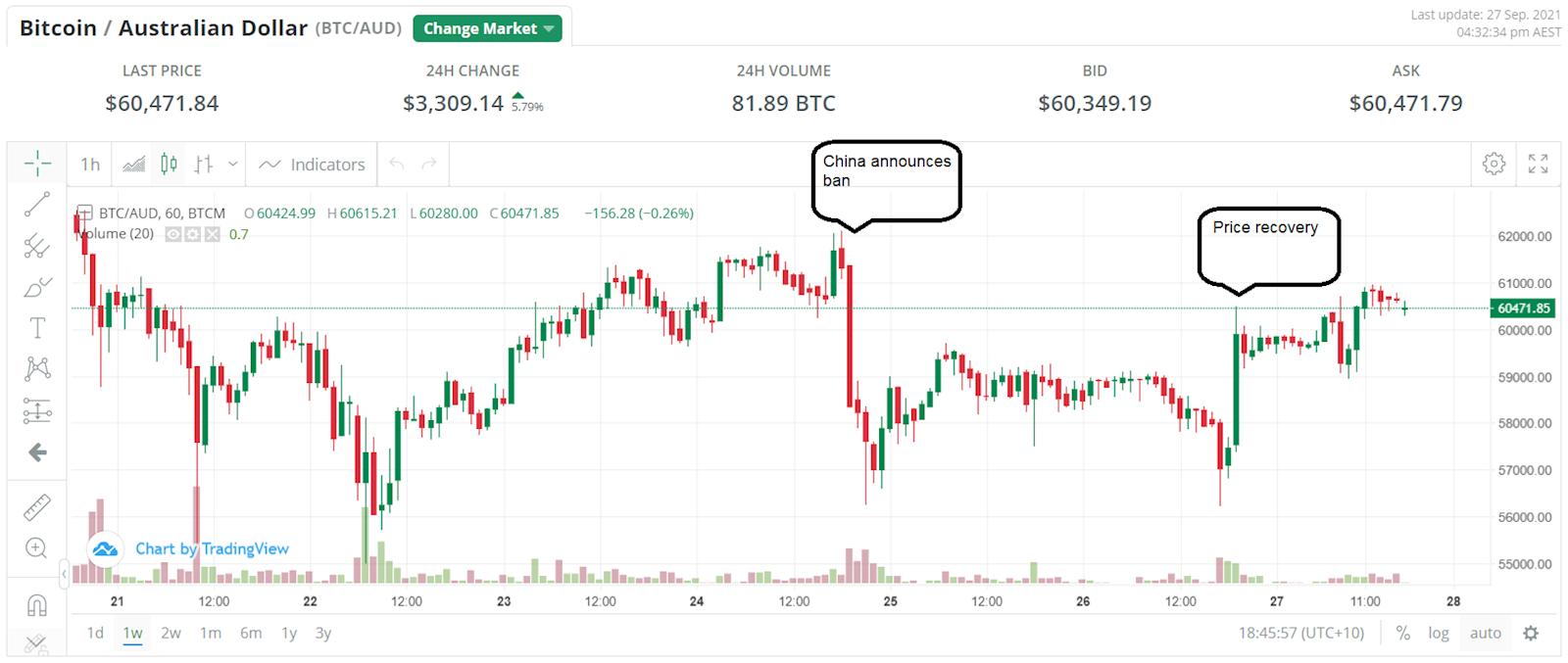

Bitcoin’s price initially fell from around $A62,000 to a low of around $56,000 but has since recovered to be over $60,000 as of writing. Other crypto assets also fell with similar recoveries following. So price action may suggest that the market is not overly concerned by China’s move.

Source: https://app.btcmarkets.net/

One reason for this is that Bitcoin miners were already banned back in May and June. So Bitcoin processing capacity (aka “hash rate”) has been moving out of China to friendlier climes for some months and provided by existing miners located outside China. And many Chinese exchanges left China in 2017 during the last major “purge” by Chinese authorities.

Another reason is simply that the ongoing growth in crypto related services, activities, and trade volume outside of China are absorbing the negative impacts from inside China.

China’s ban means that some $A8 billion in Bitcoin mining annual revenue will be lost to Chinese miners, not to mention revenues arising from crypto trading and other related products and services. Chinese residents will also run the risk of punishment if they are to continue to trade or mine crypto illegally, including when outside of China. Both the state and Chinese residents lose, at least from the perspective of the global crypto market.

But China’s move is all part of its broader geo-political strategy to oppose non-state controlled crypto networks and to enforce its own digital Yuan CBDC. This will allow it to gain the efficiencies of digitising cash and coins, but also to enforce monetary policy and regulation through the digital Yuan technology layer. The authorities would likely have near real-time visibility of all digital Yuan transactions and so would establish a kind of global monetary surveillance over the Yuan (and its users).

China is also hoping that a digital Yuan will encourage other payment services to emerge to offset the dominance that AliPay and WeChat Pay hold over Chinese consumers, and to limit the damage to the Chinese economy should either of those players experience turbulence.

It’s also consistent with the state’s efforts to reign in Jack Ma and his Alibaba and Ant Group businesses. Alibaba was China’s leading tech business, and Ant Group was about to become the world’s largest ever initial public offering until the authorities stepped in. Jack Ma was also a global celebrity mixing it up with American tech titans and Hollywood stars alike. That all changed when the state exerted its authority.

But in terms of crypto, China’s latest move appears unlikely to upset the apple cart that much. Although some shorter-term skittishness in crypto markets may remain because of the ban, it seems likely that other factors will have as much (or as little impact) over the longer term.

As ever, crypto investors should keep a close watch on events as they unfold to manage risk, and/or ignore the noise for longer-term trends to play out.

Frequently Asked Questions about this Article…

China's recent cryptocurrency crackdown involves a comprehensive ban on crypto-related activities. This includes prohibiting financial institutions from engaging in virtual currency businesses, banning exchanges and token issuance, and cutting off payment channels for crypto transactions. The move is part of China's broader strategy to enforce its own digital Yuan and oppose non-state-controlled crypto networks.

Initially, Bitcoin's price fell following China's announcement, but it quickly recovered. The market seems to have absorbed the impact, partly because Bitcoin miners had already moved operations out of China earlier this year. The ongoing growth of crypto services outside China is also mitigating the negative effects of the ban.

China is enforcing a ban on cryptocurrencies to pave the way for its own Central Bank Digital Currency (CBDC), the digital Yuan. This move is part of a broader geopolitical strategy to maintain control over monetary policy and regulation, and to encourage the emergence of new payment services to balance the dominance of AliPay and WeChat Pay.

Chinese residents who continue to trade or mine cryptocurrencies illegally face the risk of punishment, even if they are outside China. The ban is comprehensive, and authorities are implementing measures to monitor and enforce compliance, which could lead to legal consequences for those who defy the regulations.

While there may be some short-term volatility in crypto markets due to China's ban, the long-term impact is expected to be limited. The global crypto market is resilient, with growth in crypto services outside China helping to absorb the negative effects. Investors should stay informed and manage risks, but the overall market sentiment remains cautiously optimistic.