The BKI share purchase plan

Summary: The BKI Investments Share Purchase Plan closes at 7pm on Thursday April 28. The minimum investment is $2,500 and maximum is $15,000, with the issue price no higher than $1.60. BKI are long term investors in the truest sense and this capital raising will help grow the LIC, important for lowering the management expense ratio (MER). |

Key take out: We are happy with our exposure to BKI in the LIC model portfolio (currently we have a 23.72 per cent weighting), so will not be taking up the offer – but individual investors should ask whether they have sufficient exposure to BKI already, and whether there is investment capital available – these questions should be asked before diving in. |

Key beneficiaries: General investors. Category: Listed Investment Companies. |

The Share Purchase Plan (SPP) for BKI Investments Limited (BKI) shareholders closes at 7pm tomorrow (Thursday, April 28). Shareholders are eligible to apply for a maximum of $15,000 worth of shares and a minimum of $2,500.

What this means is if you currently hold BKI shares you can buy up to $15,000 more if you want to without incurring the cost of brokerage. If you are a shareholder and want to take part in this you need to act fast. The offer closes tomorrow and to take part you will need to use the BPAY option to do this.

The issue price will not be any higher than $1.60. The last NTA update had pre tax NTA sitting at $1.55 and post tax at $1.46. If the issue price was to remain above NTA, the SPP will be accretive to the current NTA. As a BKI shareholder you should hope other shareholders are supportive and want to take up their full allocation.

The Eureka Report LIC Portfolio will not be participating as it is already full to the brim with BKI and is very happy with it - the current portfolio weighting is 23.72 per cent. Saying that, the SPP is a fair way to involve all BKI shareholders the ability to participate in growing the LIC and Eureka Report members who hold BKI shareholders should decide to participate based on their current asset allocation. Do you have enough and have spare capital? These are the questions you should ask yourself.

Typically when a manager of capital asks for more funds, because they can deploy that capital, it comes at a time when the average investor does not want to open their wallet. Conversely=, when the average investor feels good about opening their wallet this typically occurs when the manager can least successfully deploy the capital.

The last time BKI had a SPP it raised $47.8 million. This was in July 2014 and the market had been moving along nicely. The ASX 200 for the month sat between 5370 and 5644. The SPP prior to that was shortly after Greece began making front-page news. In October 2012, when the market fluctuated between 4375 and 4581, BKI raised $19.1m from this SPP.

Feel uncomfortable about buying shares in these uncertain markets? Good, because BKI Managing Director Tom Millner does not: “We decided to conduct another SPP because we see a number of attractive opportunities in the market. Despite the worry and volatility in the market we are seeing some good opportunities for the long-term investor, with many stocks presenting attractive yields and valuations compared to historical averages.”

Investors should take note that this SPP is not to raise capital like an ordinary company would to make an acquisition or help strengthen a balance sheet. The purpose of the SPP is to grow the LIC. I recall my first conversation with Millner and he said one simple line about growing an LIC, “when it comes to LICs, bigger is better.” The logic behind this is the bigger the LIC the more liquid it becomes and the lower the management expense ratio (MER) becomes.

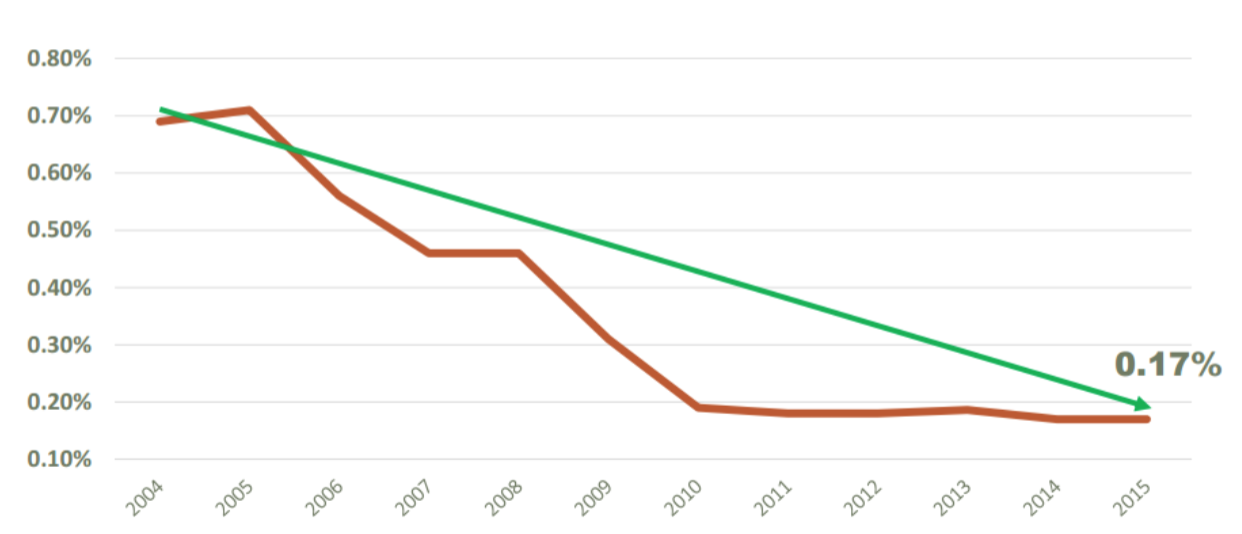

BKI has a history of actively lowering the MER. The board do this because they are shareholders too and the less they charge in fees the more they have to pay in dividends. At BKI they have a saying, “the thicker the carpet the thinner the dividend”. The chart below from BKI's April investor presentation shows the lowering of the MER over the years.

The team at BKI are in the truest sense long-term investors. The potential for them to have additional capital to deploy in a volatile is nothing but positive in our opinion.