The big Australian stocks in disruptors' sights

Summary: There is a frightening amount of change on the horizon, but much of it should be lovingly embraced. |

Key take-out: In Australia and overseas, big businesses are in many respects trying to hold back the 21st-century tide. |

Key beneficiaries: General investors. Category: Strategy. |

Sometimes we feel really scared that the world as we know it is going to be changed too much. So, today, let me take you on a journey where the companies that you know are going to be disrupted, but in which total community prosperity will be enhanced.

Energy

Let's start in China. The Chinese sensed that its American export bonanza was faltering, which would be a major disruption.

But Chinese manufacturing is now on the rise again, albeit that this time the big consumers are the Chinese themselves rather than the Americans. As it happened, the Chinese did not expect the garden to be as rosy and cut back their iron ore and coal production too far. Australia is a winner from the resulting higher coal and iron ore prices.

We must expect scientific disruptions given the speed and intensity of research being conducted. To illustrate, scientists are working very hard to change the energy world, as we know it.

I have been reading that there is a substance in the pipeline which may completely disrupt the solar energy business – and also the total energy sector. While I am always suspicious of very new concepts, let me take you on the journey even though development may take longer than the researchers expect.

Currently our solar energy is generated via silicon, which is obtained from special sorts of sand. It requires a high energy and expensive process to produce solar panels.

Our solar energy panels only absorb a small portion of the energy that is in sunlight. There is now a material being developed that will absorb far more of the sun's energy and which is produced at a much lower cost than silicon. We will need to watch the progress of such materials, but they are an example of how by using computers to speed the research process technology can transform industries in a much more rapid way than was the case in the past.

And the researchers of this new substance say they will produce solar energy at nearly zero cost, which means that “Mr Tesla” Elon Musk and his batteries will boom. If the scientists win then many other parts of the energy business, led by the current solar technology, will face a different world – but overall it will be a much healthier economy.

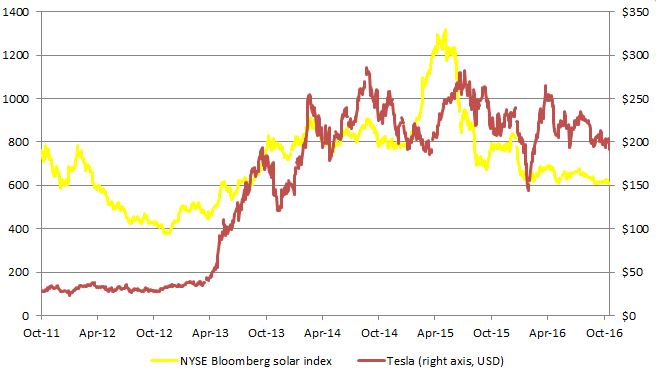

Chart 1: Solar and Tesla (past 5 years)

Source: Bloomberg, Eureka Report

Telstra

But there are many more conventional disrupting developments outside scientific research. As I mentioned on September 21 in Why investors should monitor their customer journeys, our Anglesea home was being connected to the NBN. After the initial difficulties with Telstra it turned out to be a very smooth exercise – although on some channels internet TV is slow. Others in the community are reporting NBN problems, so this is going to be a slow, expensive process. But I can see from what has been delivered to me that, over time, accessing the NBN is going to be a commodity and a major disruption to Telstra.

The advantage that Telstra had in owning the network is no longer there, so margins will be reduced. At the moment Telstra is being compensated by payments from the Government as part of the deal with the NBN. Accordingly, it is doing well but, going forward – say, four or five years – those payments will be slashed and Telstra will be in a much harsher world.

Its rivals, Vodafone and Optus, are beginning to wake up that they are going to need to invest in the mobile world. This long-term disruptive threat contributes to Telstra being on such a high yield. In effect it is paying out most of its profits and the market is suspicious that such dividends can be maintained. Markets have every right to be nervous because, like banks, telecommunications is a capital-intensive business that requires constant investment.

The NBN deal insulated Telstra from this but that won't last forever, so in time a more conventional approach to profits distribution will be required.

The supermarkets

In the retail disruption arena we are now seeing full confirmation of the fact that the volume of supermarket sales in not rising rapidly and Woolworths and Coles – and particularly Woolworths – are trapped in a fight over a relatively stagnant market.

The first disruptor is Aldi, which is winning in the low priced goods space because it has a much lower cost model than either Coles or Woolworths (who use their big supermarket model to cover a much wider range of markets).

The company that is most exposed to Aldi is Woolworths, because it needs to invest large sums to overcome the years when the Masters hardware gamble sucked the life out of the supermarket business.

For its rival, Wesfarmers, luck is a fortune. The coal price has jumped once again and that means that Wesfarmers will have cash running through its veins from coal operations to help it in its retail operations. You will remember that Woolworths went into the hardware business in 2011 to starve Wesfarmers of Bunnings' cash for the then recently purchased Coles supermarket business. Coal boomed, so there was cash aplenty for Wesfarmers and, in any event, Bunnings was completely unaffected by Woolworths' Masters.

In the last coal boom Wesfarmers so loved the annual coal cash generation it foolishly did not sell the asset. Hopefully management will do it this time.

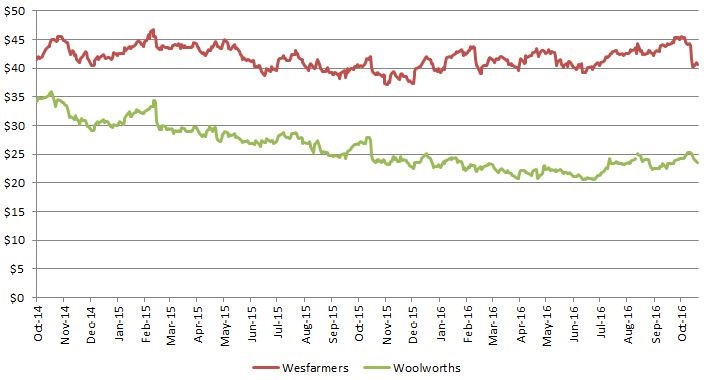

Chart 2: Supermarket share prices (past 2 years)

Source: Bloomberg, Eureka Report

But we shouldn't forget that there are three other disruptors to the conventional retail food businesses. The first is low interest rates, which curbs spending of older people trying to live on their own savings. Retiree spending will be further curbed by the vicious attack on self-funded retirees who currently supplement their private income with the government pension (see below).

The second supermarket disruptor is the low cost restaurant/take-away business. As working families with mortgages gain more revenue because their repayments have been lowered they are spending more of this money paying someone else to do the cooking, and that hurts supermarkets.

So in a very strange way lower interest rates have become a disruptor for supermarket growth.

And, of course, we have online retailing.

Supermarkets like Coles are being disruptors themselves by moving into insurance and credit cards. Banks and insurance groups will need to watch out.

Banks

And on the bank front, I am watching an increasing number of business loans being organised outside banks. The interest rates are higher but they are tailored much more skillfully to the needs of the customer. At this stage banks don't seem to be suffering but I believe that as smaller enterprises become more important in driving our economy so they are going to use non-bank finance in greater amounts. These non-bank organisations are simply easier to deal with.

In this context, it is fascinating to see the non-bank movement trying to mobilise capital to help developers who are in trouble with apartments. There are some very innovative deals on the planning stage. They may fail but the combination of bank regulation and the lack of knowledge to assess businesses are holding our banks back. That means they are not growing their revenue line substantially, so profit growth will have to come via lower costs, which in turn will require more investment.

And another thing

And finally, as the retirement community starts to understand the magnitude of the changes the Abbott government introduced in 2015, which apply from January 1 next year, there is great anger. I don't think there is any chance of the legislation being changed so, as I discussed last week, those in the line of Government fire will need to look closely at how they handle this.

In the meantime, be very careful about downsizing your residential house if you are currently relying on the combination of the Government pension and private income to live.