The $6,000 diversified bond portfolio

| Summary: There are a range of options to build a portfolio of bonds from securities listed on the ASX. However, there is a distinct lack of issuer diversity in the ASX-listed market, which is dominated by financial institutions. |

| Key take-out: Almost without exception, the ASX-listed interest rate securities pay floating-rate coupons (which rise and fall in line with the bank bill rate). A bond portfolio can be put together with an investment from as little as $6,000. |

| Key beneficiaries: General investors. Category: Fixed interest. |

How easy is it to put together a portfolio of bonds listed on the ASX that will provide capital stability, an attractive and predictable income, and a diversity of issuers and bond maturity dates?

My initial response to this question was to say that it would be very difficult. After all, the listed bond market, or perhaps we should say interest rate securities market (as the ASX calls it), is only a fraction of the size of the wholesale market, and many bemoan its lack of depth and liquidity.

But, actually, the listed market has some advantages over the wholesale market – the most obvious being that because it is a listed market there is very good liquidity and relative ease of access.

The wholesale market relies a lot more on what a trader may have in their trading inventory on a given day, or what the trader wants to buy.

A key point of difference

Another advantage of the listed market, albeit not exclusive, is that, almost without exception, the interest rate securities pay floating-rate coupons. That is, the coupons are determined by a credit margin that is paid over the bank bill rate.

So, as the bank bill rate moves up or down over time, so will the coupon paid. That is a major advantage at the present time, when the consensus view is that interest rates have reached the bottom of the cycle and the next move from here will be up.

This is an important factor in ensuring the capital stability of an interest rate security portfolio.

A typical fixed-rate bond portfolio will rise in value as interest rates fall, and will decline in value as interest rates rise, because the return on that portfolio is fixed, while interest rates in the market place will change. As the return on a floating-rate portfolio will move largely in line with interest rates in the market, there will be little impact on the capital value of the portfolio.

However, there are two things to bear in mind here if a bond portfolio is not comprised solely of government bonds (the ultimate risk-free asset – at least in economic theory):

- The portfolio will be exposed to credit risk i.e. the risk that the issuer of the bond will default. Needless to say, such an event will adversely impact the capital stability of the portfolio.

- Because of the existence of credit risk, the capital value of the portfolio will tend to be positively correlated to movements in the stockmarket, rather than being negatively correlated. So if the stockmarket is falling, the capital value of the portfolio is likely to fall too, although nowhere near as much should one of the bond issuers default.

What else does a potential investor need to be aware of and prepared to accept?

Lack of diversity

There is a distinct lack of issuer diversity in the ASX-listed market, and it is necessary to work with the range of listed products available. Also, the market is dominated by financial institutions of one sort or another but, then again, so is the wholesale market.

Unlike the wholesale market though, senior ranking bonds are few but subordinated and hybrid notes are plentiful. Subordinated and hybrid notes increase the level of risk that an investor is exposed to, but they also increase the potential return to the investor.

There is also a question of relative value in the case of hybrid notes. In my view, the equity of the hybrid issuer often offers a better risk/return profile than the hybrid but many other investors prefer the hybrid.

It is these differences of opinion that make a market.

An inexpensive ASX bonds portfolio

With these disclaimers out of the way, I can now say that it is possible to put together a listed interest rate security portfolio with the attributes outlined in the opening sentence. And the best news is that the portfolio can be put together with an investment from as little as around $6,000, or it can be scaled up to $1.2 million or more, depending on available liquidity in individual security issues.

Bond investing is not about the upside that comes with equities. Bond investing is about preserving capital, generating income and minimising the downside risks.

This is a hypothetical conservative portfolio – there is no recommendation of any particular bonds here rather an attempt to show that you can have a bond portfolio without having to be a millionaire.

As such, the portfolio is comprised of senior, subordinated and hybrid notes in almost equal measure and is presented in the following table. With this composition, duplication of issuers can be avoided though it is necessary to include one fixed-rate senior bond.

The Heritage Bank Bond pays a fixed coupon of 10% per annum. However, as the bond comprises approximately 8% of the portfolio, changes in capital value will have only a limited impact on the capital value of the portfolio.

The Model Listed Bond Portfolio | ||||||||

Security Name | ASX Code | Security Type | Last Price 21/3/14 | Yield to Call | Early Redemption Date | Final Maturity Date | Minimum Units | Portfolio Value |

ANZ Capital Note | ANZPD | Hybrid | $102.25 | 7.29% | Sep-21 | Perpetual | 5 | $511.25 |

Bank of Queensland CPS | BOQPD | Hybrid | $108.54 | 7.00% | Apr-18 | Perpetual | 5 | $542.70 |

NAB CPS II | NABPB | Hybrid | $101.00 | 6.82% | Dec-20 | Perpetual | 5 | $505.00 |

CBA PERLS VI | CBAPC | Hybrid | $103.98 | 6.44% | Dec-18 | Perpetual | 5 | $519.90 |

AGL Energy Subordinated Notes | AGKHA | Subordinated | $105.55 | 6.00% | Jun-19 | Jun-39 | 5 | $527.75 |

Suncorp Subordinated Notes | SUNPD | Subordinated | $102.40 | 6.01% | Nov-18 | Nov-23 | 5 | $512.00 |

AMP Subordinated Notes 2 | AMPHA | Subordinated | $101.36 | 5.97% | Dec-18 | Dec-23 | 5 | $506.80 |

Westpac Subordinated Notes | WBCHA | Subordinated | $102.92 | 5.25% | Aug-18 | Aug-22 | 5 | $514.60 |

Tatts Group Bond | TTSHA | Senior | $104.60 | 6.08% | Jul-19 | Jul-19 | 5 | $523.00 |

Heritage Bank 10% Bond | HBSHB | Senior | $105.65 | 5.47% | Jun-17 | Jun-17 | 5 | $528.25 |

Australian Unity Notes | AYUHA | Senior | $103.85 | 5.09% | Apr-16 | Apr-16 | 5 | $519.25 |

Primary Bonds Series A | PRYHA | Senior | $104.65 | 5.09% | Sep-15 | Sep-15 | 5 | $523.25 |

Weighted Average Yield to Call | 6.04% | |||||||

Weighted Average Term to Call | 4.5 years | |||||||

Total Portfolio Value | $6,233.75 | |||||||

At the time of composition (March 21, 2014), the portfolio was generating a yield to maturity/first call date of 6.04% per annum (two weeks earlier the yield was 6.1% - timing is everything), with a weighted average term to maturity of 4.5 years.

The yield is well ahead of what could be achieved with a term deposit, but the credit risk of the portfolio is higher.

Nevertheless, the credit quality of the issuers of the notes is sound, but any risk/reward trade-off needs to be balanced by the degree of subordination of the individual notes within the capital structure of the issuer. With the credit spread over the interpolated 4.5 year swap rate being 2.42% (2.61% over the Commonwealth government bond rate), investors are compensated for the estimated credit risk.

Whether the yield adequately compensates for the subordination risks entailed for at least one-third of the portfolio is a relative value call that many investors have been happy to make, to date.

The value of holdings of each note in the portfolio is the minimum, bound by the need for a parcel of at least $500, and with each bond having a market value close to the face value of $100, the minimum number of bonds that can be purchased is five.

The composition of the portfolio follows the ladder principle.

There are 12 listed notes in the portfolio – four are hybrids, four are subordinated and four are senior ranking. Thus, there is a spread of risk categories.

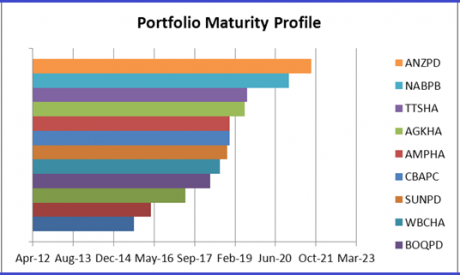

At the same time, the weighted-average term to maturity is determined by having a range of maturities from September 2015 to September 2021, as shown in the chart below.

Finally, with all the notes being listed on the ASX, each note can be acquired at a brokerage cost of$14.95 or less, if done online, and portfolio changes can be effected at the same rate.

Philip Bayley is a former director of Standard & Poor's and now works as an independent consultant to debt capital market participants. He also writes on matters concerning debt capital markets and banking for various publications and is associated with Australia Ratings.