Taking the SMSF property path

| Summary: The rules around self-managed superannuation funds investing in property are very specific in terms of what you can buy, and the loan types and structures required. Here’s what you need to know. |

| Key take-out: In many instances the amount that your SMSF will be able to borrow can depend on how you have structured the fund. |

| Key beneficiaries: SMSF trustees and superannuation accountholders. Category: Property investment. |

Self-managed superannuation funds have soared in popularity in recent years, with funds under management recently passing the $500 billion mark.

This popularity was boosted by changes in 2007 and 2010 to 67A(1) of the Superannuation Industry (Supervision) Act 1993 (SIS Act), which effectively allowed limited recourse borrowing within a SMSF for the acquisition of a single acquirable asset. This has enabled trustees of SMSFs to gear into shares, managed funds and property.

Restrictions under section 67A include:

- The borrowings must be for one single acquirable asset. For example, one property or one class of shares.

- The borrowings can be used for purchase costs, maintenance and repairs but can’t be used for improvements. In other words a SMSF can borrow to buy an established property but can’t borrow to build a new house.

Borrowing within a SMSF isn’t for everyone; trustees need to ensure that borrowing is allowed under the trust deed and is within the sole purpose test of providing retirement benefits to fund members. Trustees should also ensure sufficient cash flow to meet both the costs of the borrowings and any ongoing expenses, plus that beneficiaries have sufficient years before retirement to pay down any investment loan.

If you believe borrowing within a SMSF may be for you, here are some facts you need to know.

What type of property can you buy?

If your aim is to borrow to invest in property within your SMSF, you need to be aware that there are certain types of property you can buy and certain types you can’t with SMSF borrowings. What you can buy includes:

- An established residential rental property.

- An established business premises (including your own business premises, provided you pay a commercial rate of rent).

- A rural property.

- An overseas property.

At all times, of course, the properties must reflect the sole purpose test of the SMSF.

Types of property you can’t borrow to buy within a SMSF include:

- A holiday house for personal or related-person use.

- Your own or a family member’s residential property.

- A residential investment property that you already own.

- Land to build on.

- A property to renovate (note that you can use cash within the SMSF fund for renovations, but can’t use borrowing for renovation).

Type of loan

When borrowing through a SMSF the type of loan used is a ‘limited recourse loan’. This means in the event of a default, the lender can only make a claim against the asset purchased with the loan funds. In this way the legislation seeks to quarantine and protect the other superannuation fund assets of the beneficiaries.

Being limited recourse, the loan features available within a SMSF are more restricted than the features of investment loans held by individuals. While trustees have the choice of fixed or variable loans – or potentially a split loan – the SIS Act restricts additional borrowing. Therefore trustees don’t have the ability to take out a line of credit, to use a redraw facility or to use a construction loan.

Being limited recourse also limits the loan-to-valuation (LVR) ratio that financial institutions will consider (see table). Interestingly though, a few lenders are now offering the option of an offset account in order for trustees to offset the interest on the loan. CANSTAR research has found that these are sometimes available on both variable loans and fixed-rate loans and are currently available through AMP, BankSA, Bank of Melbourne and St George Bank.

Parties to the loan

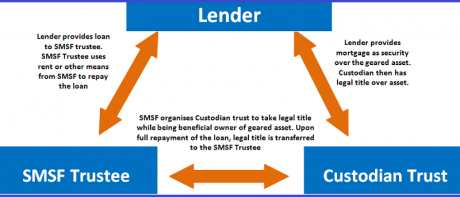

As mentioned, a limited recourse loan means in the event of a default, the lender can only make a claim against the asset purchased with the loan funds. To facilitate this from a legal point of view, the shares or property purchased with the borrowed funds must be held in a separate trust that’s disconnected from the other investments. This trust holds the legal title to the assets until the loan is repaid.

- The trustee of the SMSF. During the life of the non-recourse loan the trustee is the beneficial owner of the asset and is responsible for looking after the repayment of the loan.

- The custodian. The custodian is the individual or company that holds legal ownership of the geared asset. When the loan is eventually paid off, legal title is transferred from the custodian to the SMSF trustee. The custodian may be an individual or company; some lenders may specify that a company structure must be used.

- The lender. The lender, which may be a financial institution or an individual person, who provides a loan to the SMSF trustee.

Sometimes a fourth party may be the SMSF beneficiaries, as some financial institutions may seek to obtain a personal guarantee over the borrowings. While this is allowed and can help to facilitate approval of a loan, you should be aware that providing a personal guarantee may put your personal assets at risk.

Trust structure

It’s absolutely essential to get professional advice when determining how to structure both your SMSF and your custodian arrangements. A financial planner or accountant can provide great assistance in determining the structure as well as developing an appropriate investment plan.

In many instances the amount that your SMSF will be able to borrow can depend on how you have structured the SMSF. CANSTAR research found that lenders are willing, on average, to lend a higher LVR to SMSFs which have a corporate (as opposed to personal) trustee. CANSTAR has calculated the minimum, maximum and average LVRs under different borrowing arrangements as follows:

Max. LVR without guarantee | Max. personal LVR with guarantee | Max. corporate LVR with guarantee | |

Median | 71% | 74% | 80% |

Average | 72% | 74% | 77% |

Min | 50% | 60% | 60% |

Max | 80% | 80% | 80% |

Source: Canstar. Surveyed LVRs as at September 2013.

Other types of lender services

A broad range of professionals can provide advice to SMSFs. As a SMSF trustee some of the services you may require include:

- An auditor. It’s a compulsory requirement for SMSFs to have their accounts audited each year. From July 1 this year it also became a compulsory requirement for SMSF auditors to be registered with the Australian Securities and Investments Commission before being able to sign off on audits. As trustee, ultimate responsibility for compliance rests with you so ensure your auditor is registered.

- A financial planner. As trustee of a SMSF, it’s imperative you ensure the investment activities of the fund meet the sole purpose test of providing benefits to its members on retirement. To ensure you’re meeting this test it can be wise to seek investment strategy advice from a financial planner. Effective July 1, 2012, it also became a statutory requirement for SMSFs to consider, within the investment strategy of the fund, whether contracts of insurance are appropriate for the members of that fund. A financial planner can assist you in making this assessment as well.

- An accountant or tax agent. There’s a great deal of financial paperwork associated with administering a SMSF and you’ll need professional advice. The financial penalties for breaching the SMSF rules can be steep.

- A solicitor or other estate-planning specialist. Estate planning and succession planning are crucial elements of a successfully run SMSF.

It’s key to remember that if you’re considering establishing a SMSF this is generally not a passive investment and appropriate time will need to be applied to ensure compliance and also that investments are performing towards your retirement goals. Choosing the right institution may help reduce some of that load and many of the services needed can be obtained under the one roof.

Mitchell Watson, is research manager with CANSTAR, www.canstar.com.au. This article was first published in Australian Property Investor, and is reproduced with permission.