Super-charged Federal Budget

Summary: Australia's superannuation pool is being examined as the government considers the issue of budget expenditure. Bureaucrats see concessional taxes on super as their money, and proposals of changes to super taxes have support from most commentators and economists. Although the government cannot afford another broken promise and the Coalition rank and file may not support raising taxes, we need to be alert to a government attack on super concessions. |

Key take-out: The risk of an assault on super is real and very high. Despite being a lazy approach, it has a lot of support. |

Key beneficiaries: SMSF trustees and superannuation accountholders. Category: Superannuation. |

Given Australia's budget problem has been defined as one of excess expenditure, you would be right in thinking that there is no way super could ultimately escape the budget firing line.

Think of the debate. The government came to power talking about the budget crisis and the debt emergency. Rightly, the PM noted that the issue was one of excess expenditure: Put simply, the surge in spending that followed the GFC was never reined in. Revenues meanwhile have been growing at a fairly robust pace: Admittedly lower than forecast, but this is largely due to the fact that the minerals resource rent tax brought in no revenue.

Yet economic policy making has become a bit of a laughing stock in Australia. There is no consistency, decisions appear to be arbitrary and no one on either side seems to know what to do. It's a sad state of affairs but also a potentially dangerous one for public policy, given the tendency in such circumstances “towards more and more eccentric proposals” – as the highly regarded Bank for International Settlements put it.

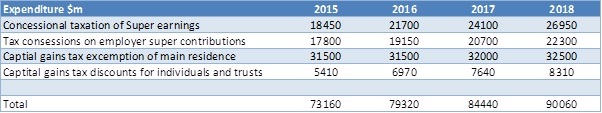

So it is that Australia's vast pool of superannuation is being examined. A major reason for that comes down to how bureaucrats see your income and wealth. They view the concessional taxes on super earnings and on employer contributions as their money. So they classify it as an expenditure and in this perverse world, the government is spending money, by not taxing you at a higher rate. On that double think – targeting this expenditure item will help the government with its budget problem. And it's a sizeable “expenditure” one. Take a look at the table below.

Table 1: Treasury's estimate of “Tax Expenditures”

As you can see, the government is set to “spend” $36.2 billion in 2015, on super concessions alone – broken up between an $18.5bn spend on the concessional taxation of super earnings and a further $17.8bn on employer contributions. That's expected to rise to nearly $50bn in a few years' time – 2018. So ending those concessions would in effect, eliminate the budget deficit.

As ridiculous as it may sound, and the estimated costs of $36 billion are far fetched and poorly conceived as Robert Gottliebsen explains today (see Save our super), there are reasons for serious concern on this front.

Still we should be concerned because the proposal has met with broad-based support from most commentators and economists on this flawed logic: That the super tax concession is seen as a rort, which unjustly rewards the rich.

Alternatively others again might not think it's a bad policy, but they suggest the country can't afford it right now (eg shock-jock Alan Jones).

So the risk of an assault on super is real and very high.

For investors the question is what might they do?

There are various proposals floating around, all of which involve taxing super more. Not earnings though – just future contributions. The only question remains to what degree. The Tax review conducted by ex-Treasury Secretary Ken Henry, and recently endorsed by the Murray Inquiry, suggested that super contributions be taxed at the marginal tax rate, less an offset. The offset would be capped at $25,000 per year which would ensure that most people still pay a 15% tax on their contributions. Henry argued that the offset should be doubled for people over the age of 50. A Greens proposal would tax super contributions progressively – from 0-4% for low income earners, up to 32% for high income earners.

If something was to be adopted it would most likely be a variation around those options and weighted toward higher income earners. Maybe they'll simply lift the tax rate from 15% to 20%.

What might halt the government from making super changes?

First of all, the government has promised not to tinker with super in its first term. In an ideal world that should be sufficient. But the world is far from ideal.

More practically though, this government simply cannot afford another broken promise. They have little political capital left, Abbott and Hockey have only a weak grip on their positions. They could of course try to step around that by deception – ie simply announce changes at the next budget to take effect at some point in the future after their first term – thus “keeping their promise”.

Next – the fact is that a tax, is a tax, is a tax. Any changes to super concessions would be a revenue measure and no amount of PR can convince an already sceptical electorate that changes to super would somehow reflect a prudent act of fiscal restraint.

The government has stated very clearly that the budget's problems are due to excessive expenditure. Lifting taxes to deal with excessive spending isn't what the Coalition is about and the party rank and file may simply not support it. It would certainly be politically damaging if they did, and the government would be ridiculed going into the next election as a high taxing government.

Something else that might stop an assault, or at least limit it, is the reason concessions were allowed in the first place. Tax concessions were brought in to ensure, or rather to encourage citizens to save for their own retirement. The Government's upcoming intergenerational report (due for release on Thursday March 5) will highlight the problem the country is going to have funding retirees and the need to encourage a self-sustaining super system.

On that basis, arguments will be mounted that the government should not forget long-term aging population problems and associated pension costs.

Overall then, I think we need to be alert to a government attack on super concessions. While it is a lazy, revenue-based approach to what is ultimately an expenditure problem, it has a lot of support among bureaucrats and the broader economic community.