SPONSORED CONTENT: Income matters as much in retirement as it does in business

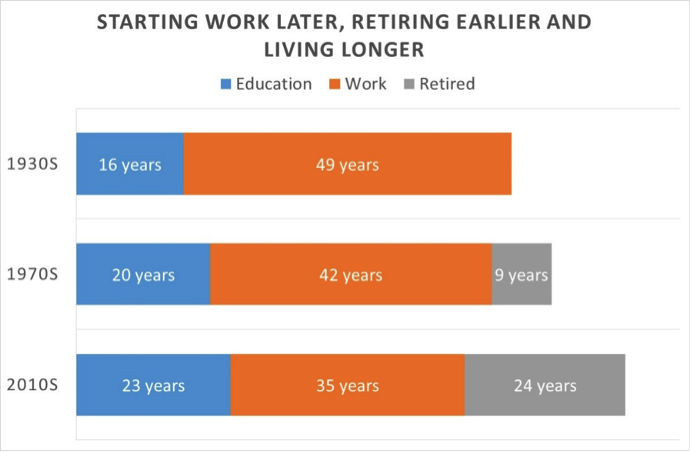

Working less to pay for more life: a 1930s Australian retired at 65 years old, but was expected to live to only 63. Since then the ratio of years worked to years retired has increased dramatically.

In the 1930s, the average Australian worked from 16 to 65, or for 49 years, but life expectancy was only 63 years. That is, the average person could spend 100% of their income as they earned it, not needing to worry about funding their retirement years.

By the 1970s, we started work a bit later at 20 and retired at 62, with a life expectancy of 71. That is, we worked 42 years and had an average of nine years in retirement. Each year of work needed to additionally pay for three months in retirement.

Now we work from 23 on average, and retire at 58, with life expectancy of 82. We work for 35 years and on average are retired for 24 years. Each year of work now needs to additionally pay for eight months in retirement.

Managing your retirement is no different to managing a business – the golden rule is don't run out of money. Assuming you are already retired, you need to earn more income without blowing up the business (your capital), and try to cut costs without killing off the business (your lifestyle!).

The difference is that in business you can sometimes raise more money. Once you retire, you have a finite amount of wealth to fund your retirement years, so the risks of getting it wrong are higher.

“The asset class that most investors consider the ‘safest' – cash – is actually extremely risky” – Warren Buffett, Berkshire Hathaway AGM

Because of the dramatic consequences of getting it wrong, retirees should increase income to a point that helps you fund your lifestyle but no further.

Similarly, like in business, earning too little income will result in “going out of business”, in this case running out of money before you can afford to.

In today's environment where cash deposit rates are at historic lows, and not expected to rise in the foreseeable future, allocating too much to cash is actually one of the riskiest investment strategies.

Warren Buffett made this point: “The asset class that most investors consider the “safest”—cash—is actually extremely risky.” This ‘zero-risk' strategy will steadily erode the value of the nest egg over the retiree's life even with very modest withdrawals.

On the other hand, an equity-only portfolio has high expected returns, but comes with more and more short-term volatility as the world recovers from the GFC.

Given this conflict between the need for safety and the need for growth, it's no wonder retirees around the world use bonds to increase their income. Bonds are the middle ground between cash and shares – they offer greater security than equities, while offering more income than cash.

Boosting your retirement income with fixed income

Fixed income involves less capital risk than shares by its very nature. Because bond interest must be paid by companies before any dividends are paid, they are by definition less risky than the shares of that same company.

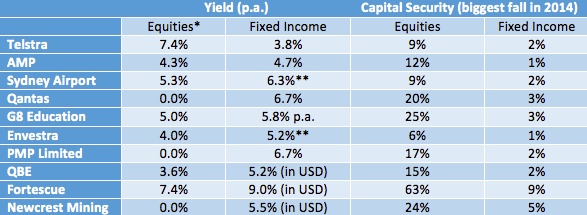

The table below shows 10 examples of well known Australian companies with their shares on the ASX and with bonds available to SMSFs. The table shows that whether its equities or bonds that offer the higher yield varies company by company. Security of capital however is consistently better for bonds than equities, for the reasons above.

The great advantage of the SMSF investor is that they are not constrained by asset class or other artificial boundaries. They can choose to invest in a company in a way that suits their view of that company – where they are bullish on share price growth prospects, they can invest in the shares; and where they just want income, they can invest in the bonds.

Comparison of equities and fixed income securities of selected Australian companies

* Equities yield includes franking credits

** Sydney Airport and Envestra yield paid as cash payment guaranteed capital payment set at the rate of inflation

A great example of where better risk-adjusted value can be found in the bonds is Qantas. Qantas has considerable cash reserves and has already shown it is capable of cutting costs sufficiently to be cashflow positive. This is all that bondholders need to be sure that Qantas will be able to meet its legal obligations to pay interest and return the bond principal at maturity.

As Qantas shareholders haven't received a dividend for five years, they will likely only earn a higher return than the bonds if the share price rises substantially. Assessing Qantas's ability to increase earnings enough to justify a higher share price is very difficult, and certainly comes with a risk of the share price falling again. Qantas's share price is currently about 75% above its 2014 lows, whereas even at its lowest point this year, the bonds were only around 5% lower than the current price.

Compare this to Telstra, where the bond is paying just 3.8% p.a. compared to the franked dividend of 7.4% p.a.. For an SMSF investor to be better off buying the bond, they would have to expect the Telstra share price to fall by more than 3.6% p.a. for the next few years. While Telstra shares have more risk than the bonds, by definition, the payoff on the shares might seem better in this case.

Finally, compare this to an example where the bond and the equity are paying around the same income, for example, AMP and Sydney Airport. If you believe that the prospects for AMP's share price are strong and worth the extra volatility, you'd choose the shares over the bonds as the income is more or less the same.

The final reason for SMSFs choosing to invest in bonds is the reliability of income and transparency of the payments that can be expected years into the future. Dividends don't tend to fall in good times, but even bank dividends have been savagely cut in a crisis. Bond interest payments on the other hand are a legal obligation.

Bonds pay a set income on a set date 2-4 times a year, and pay a set amount back at maturity. All of these amounts and dates are known when you invest, that is you can know up to 20-30 years in advance how much income you will be receiving.

Because of the security of capital and the reliability of the income, fixed income is typically used by global retirees for around 70% of their portfolio. The other 30% is invested in shares where they believe in the growth prospects and are willing to place more capital risk in these companies' shares.

In the current interest rate environment, a well diversified portfolio of government, corporate and infrastructure bonds will pay regular income of around 4-5% p.a.. Higher risk fixed income can pay up to 10% p.a., but like any investment, the higher the return, the higher the risk and so more diversification is required.

This article is sponsored content and does not reflect the views of Business Spectator.