Spinning wheels and shaky deals

With the announcement that Toyota will stop its manufacturing in Australia in 2017, Australia has become one of the few wealthy nations on the planet without a car industry. But there’s a good argument that Australia never had a car industry in the first place.

The mass production industry began with General Motors Holden’s FX model in 1948, with GMH being a 100 per cent-owned subsidiary of General Motors in the United States. The same pattern followed with Ford, then Chrysler, and at one time up to five foreign-owned car manufacturers were producing almost exclusively for the Australian domestic car market. This is very different to all other car-producing nations, which normally began with domestic manufacturers expanding output, firstly for a local market and then for exports. Many of these were subsequently bought out by the major US and Japanese producers during the Age of Globalisation, but for at least three decades after WWII, most car producers were nationally-owned affairs.

Except in Australia, where the car industry was shaped more by government policy than by the evolution of local manufacturing.

The government policy motivation for inviting foreign car manufacturers to set up shop here was employment. The early post-WWII economic ideology was a very different one to that which prevails today, best epitomised in my favourite phrase from the 1945 White Paper, Full Employment in Australia. The emphasis was, it said:

“To maintain such pressure on employment as to guarantee a shortage of men rather than a shortage of jobs.”

This could have been done by encouraging locally-owned manufacturing, but it was faster to entice foreign manufacturers to either expand existing plants (as with GMH) or set up shop here (as with many others including Leyland, Volkswagen, Renault) via the carrot of a largely captive local market and the stick of high tariff barriers.

This employment strategy had many Achilles heels, but to me the outstanding one was economies of scale.

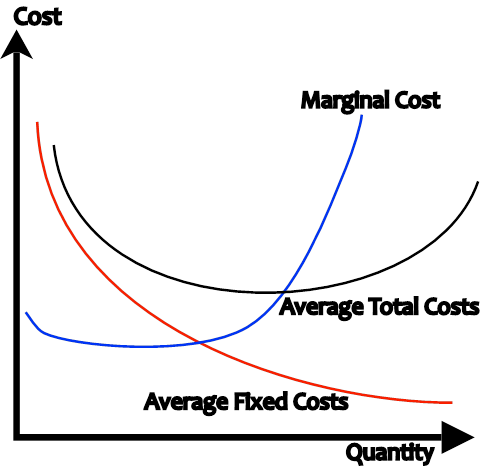

As usual, the fact that Australia’s policy was blindsided to this Achilles heel was the fault of conventional economic thinking, which is dominated by a fantasy that fixed costs are relatively unimportant. Instead, it sees variable costs as the key factor that determines how many units a given factory will produce. The standard drawing of this fantasy is shown in Figure 1 – and any economic textbook.

In this drawing (I don’t think it deserves the title of a model), there are two key costs of production: fixed costs, which are independent of the level of output (factories, buildings, etc), and variable costs which depend on how many units are produced (employment, raw materials used in production, etc). Fixed costs per unit of output fall smoothly as output grows: with one unit of production per year, average fixed costs equal the entire cost of building the factory; with 1000 units per year, average fixed costs per unit is 1000th of the cost of the factory, and so on.

Variable costs per unit of output instead are normally drawn as falling per unit early in production, and then rising steeply after that. The key cost here is the 'marginal cost': the cost of producing one more unit of output.

The rationale here is poorly conveyed to students, who often think it’s because the cost of buying these inputs rises as output rises. Nope: the drawing assumes that the firm pays exactly the same price for the 10,000th ton of steel as it did for the first. The entire rationale for drawing rising marginal cost is that the productivity of each additional variable input is assumed to fall, due to 'diminishing marginal productivity'.

Figure 1: The textbook fantasy of the costs of a typical firm

What’s that? It’s a fantasy is what. Economists imagine that if a construction firm has, for example, four jackhammers and one worker, the firm will get the one worker to dig a hole using all four jackhammers at once – really low productivity. Then if demand for holes rises it will hire a second worker, so each worker handles two jackhammers at once – an improvement but still low productivity. If demand rises again, they might hire four workers – and get the highest level of productivity. But if it rises further, they’ll have five workers operating four jackhammers – and productivity starts to fall, so that 'marginal cost' rises.

That’s bollocks of course, as Piero Sraffa argued way back in the 1920s: firms employ workers and fixed capital in a fixed ratio – one worker per jackhammer. If there isn’t enough demand, then fixed capital is left idle; if demand exceeds capacity then they either rent additional capital or build it (well before capacity is reached).

Almost a century of empirical research confirmed Sraffa’s argument, with one researcher arguing that economic theory was an insult to engineers, who are the people who actually design factories (not economists, thank God). Their design objective is:

"To cause the variable factor to be used most efficiently when the plant is operated close to capacity. Under such conditions an average variable cost curve declines steadily until the point of capacity output is reached."

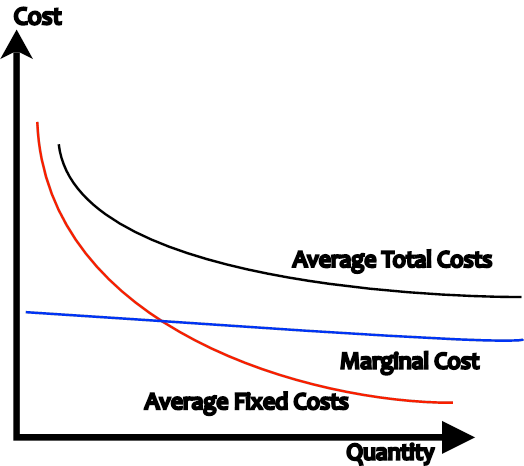

What this means in practice is that costs actually look more like Figure 2. Variable costs remain constant (or even fall) so that production gets cheaper as output rises – not more expensive, as economics textbooks claim.

Figure 2: What costs are actually like

This is especially true for products like cars where the design and tooling costs – the costs of making the machines that make the cars – are enormous. The result is that a factory producing, say, 365,000 cars a year – like BMW’s plant in South Carolina – has an enormous cost advantage over a factory producing 36,500 cars a year.

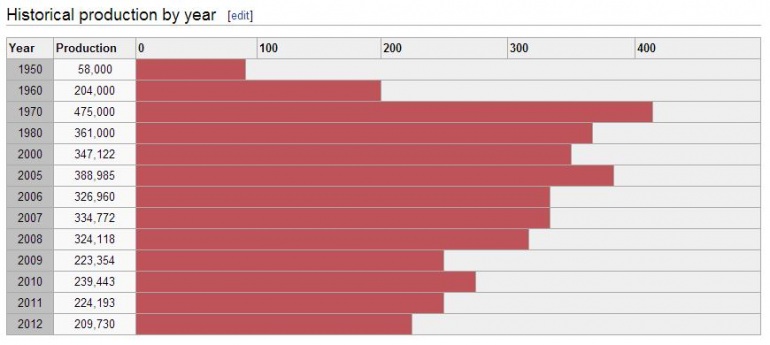

The problem with Australia’s old 'employment at any cost' car policy was that, with as many as five manufacturers (and often more than one plant each), per-unit costs were high because output per factory was so low. Even at the peak of Australian production – back in 1970 no less (see Figure 3) – the biggest factory produced well under 100,000 cars a year.

There was never much chance of 'Australian' car manufacturing holding out against that scale of cost disadvantage, even with high tariffs, which were ultimately systematically reduced as a new ideology emphasising efficiency (as economists define it – wrongly of course) won the day over trying to ensure full employment.

Figure 3: Australia's total output of cars by decade and years

And it’s more complicated than just scale economies too. I had thought that these meant that Australia should only have ever tried to produce one or two car models, but working with car designers back in the days of the Button Plan disavowed me even of that: they claimed that the design industry needed between three and five models to be produced to guarantee that the machine tools industry had sufficient work to make it viable. That may well have changed today (and may change more in the future if large-scale 3D print-manufacturing becomes viable), but it shows that manufacturing is more complicated than simply whacking up tariff walls and encouraging every Tom, Dick and Ford to set up local operations.

Then again, it’s more complicated than relying upon 'market forces' to do the job alone too. Today’s most innovative car manufacturer is undoubtedly Elon Musk’s Tesla, and on the surface that looks like a victory of innovative capitalism uber alles. But even that archetypal capitalist innovator got going via a half-billion-dollar low-interest loan from the US government. Maybe the problem with Australia’s failed attempt to establish a car industry was not that the government tried to do so at all, but that it did so ham-fistedly.

Much like the way it has let the industry fade away, really.

Steve Keen is author of Debunking Economics and the blog Debtwatch and developer of the Minsky software program.