Some much-needed budget HELP for the Coalition

The budget debate has heated up in recent weeks, with much debate over how the Coalition can fix it. The Grattan Institute contributed to the discussion over the weekend with a timely report into the rising cost of student loans.

The Higher Education Loan Program will be familiar to many Australians. The program involves providing income-contingent loans to students that are repaid at a later date.

These loans are designed to help create a skilled workforce, promote equality of opportunity, support social mobility and promote the pursuit of knowledge.

I -- like many Australians -- could never have undertaken a university degree without the support of HELP. But while the program is successful and popular, it does have some faults, particularly when it comes to collecting its debts.

The Grattan report into HELP isn’t a game-changer for the federal budget, but it highlights another area where the government can make significant gains in the near and long term.

According to Grattan, about 17 per cent of new student loans are classified as doubtful, indicating that the government does not expect them to be fully repaid. The value of doubtful loans is estimated to be around $1.1 billion this financial year.

With rising student numbers and more money going into the program than being paid down, the cost of doubtful loans will continue to rise.

The Grattan Institute recommends a range of reforms that could help improve the long-term sustainability of the HELP program.

First is to collect HELP loans from Australians who are earning money abroad. Once an Australian moves overseas they are no longer required to pay the HELP loan until they return to Australia and beginning earning money domestically. By comparison, similar programs in England and New Zealand require debtors who move abroad to pay.

Grattan recommends that Australia follows New Zealand and introduces a flat annual repayment from debtors living overseas.

Second, Grattan recommends tying the threshold on loan repayments to inflation rather than average weekly earnings. Average weekly earnings rise faster than inflation, which means that over time, fewer debtors are obliged to repay.

Third, Grattan suggests removing the provision that allows the HELP debt to be written off by deceased estates. This would make the treatment of HELP debts similar to other types of debts. This factor is the major driver of doubtful debts.

Grattan estimates that these reforms, if implemented now, would save the federal government $860m per year by 2016/17. It isn’t a game changer, but at the same time would make a considerable difference to the budget over the long term.

I’d support all three suggestions but I would add in two others that I think could prove beneficial.

First, I’d allow HELP repayments to also be tied to household income rather than simply individual income. This has the benefit of helping to collect doubtful debts now rather than waiting decades for the debt-holder to pass away.

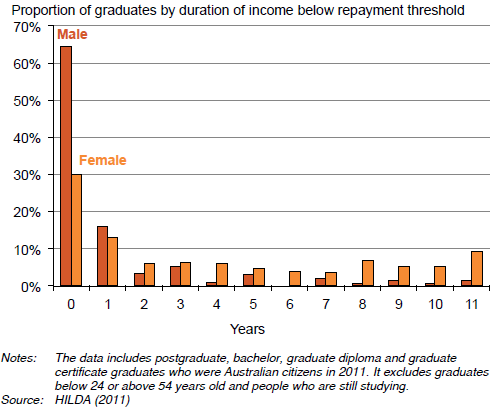

Most people who fail to pay off their HELP debt do so because they are not the household’s main income earner. Most are also women, who are perhaps working on a casual or part-time basis.

Years spent below the HELP repayment threshold, 2001 – 2011

Naturally the household income threshold would be well above the individual income threshold and there would need to be specific provisions for the number of kids in the household.

But it seems likely that this suggestion could help to account for the difference in labour force participation between men and women and the issues this creates for income-contingent loans.

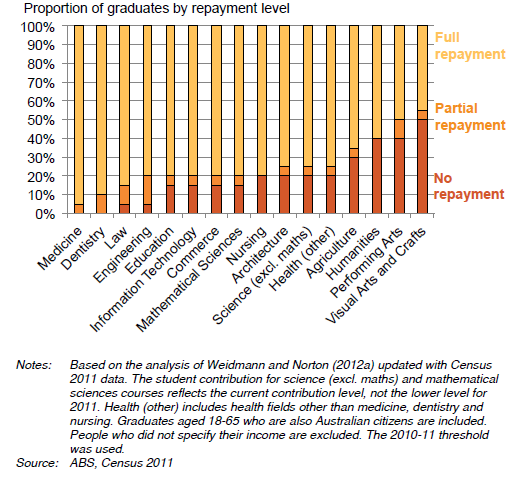

Second, the graduates of some disciples are more likely than others to repay their debt. As a result, the level of doubtful debts reflects course selection.

Proportion of bachelor degree graduates by their expected repayment level, 2011

After finishing high school, it is often incredibly difficult to know how you should spend the rest of your life. If course selection can be improved, then presumably the level of doubtful debts would decline.

We shouldn’t aim for social engineering but there are a lot of degrees out there that make for far better hobbies than they do careers. Not to mention that unfinished degrees are simply a waste of resources for both the government and the student. Schools and universities simply have to get better at helping students find the right path.

The HELP program has become much larger than was ever envisioned when it was introduced in 1989. By 2017, the Commonwealth is expected to have around $13bn of loans that it does not expect to collect. The Grattan Institute has provided a handful of sensible suggestions that would not only help the budget, but allow a popular program to be more sustainable in the long term.