Some hard truths for our biggest miners

The past chief executives of Australia’s largest miners, BHP, Rio Tinto and Xstrata have some explaining to do. And the current chief executives, BHP’s Andrew Mackenzie, Rio’s Sam Walsh and Glencore Xstrata’s Ivan Glasenberg need to issue their shareholders with an apology and explain what they are doing to rectify past management’s neglect of productivity.

In fairness I think all three major miner CEOs know they have a productivity problem -- and I know Sam Walsh is right on to trying to fix it. Andrew Mackenzie will not be far behind. However, I certainly did not appreciate the magnitude of the problem until I read with horror the latest mining productivity research by PricewaterhouseCoopers called "Mining for Efficiency". I suspect Messrs Walsh, Mackenzie and Glasenberg will also be shocked at the report.

The good news for shareholders of the three giants is that we now know they can slash their costs dramatically and that improvement should go straight to the bottom line. Sam Walsh has taken out some low-hanging productivity fruit but there is a lot more to come. Many Queensland coal mines that are unprofitable can be made profitable with proper management.

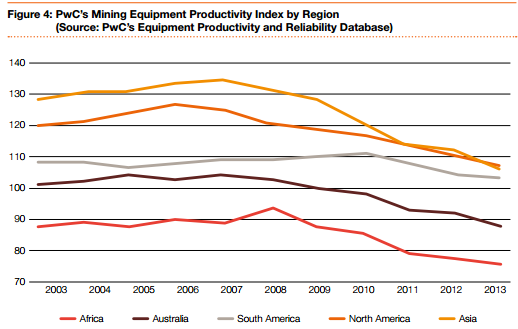

According to PwC, Australia’s mining equipment runs at a significantly lower level compared with other mining regions, with the exception of Africa, and our management of equipment cannot be considered best-in-class in any category. The difference between best in class and median performance across all mines is, in some instances, more than double.

Worse still, Australian productivity for open cut mining equipment fell 18 per cent -- yes 18 per cent -- from 2006 to 2013 despite the industry’s push for greater volumes to capture record-high commodity prices. In simple terms while investment in new earthmoving equipment by Australian miners grew 17 per cent annually, aggregate output increased by only 5 per cent.

This is no mickey mouse study. The PwC database constitutes performance data sourced directly from equipment monitoring systems over a period of 20 years. The data covers five continents and 136 mines. It includes 308 different makes and models featuring more than 4670 individual machines and more than 12,000 years of operating data. Those machines have more than 47 million operating hours and more than 700 million cycles.

In Australia over those decades mining has been dominated by three enterprises -- BHP, Rio Tinto and Xstrata. While there will be other miners in the survey by definition our big three must dominate it in Australia.

Why have our miners failed so miserably to match their counterparts in other parts if the world? Our miners will scream that it’s all the fault of the unions. That’s part of the story but by no means the major part.

PwC say while industrial relations issues are perceived as the primary constraint to productivity, the data shows significant divergences in performance from mines operating in close proximity, chasing the same commodity, and under very similar industrial relations conditions.

In my view most of the industrial relations problems come from silly union agreements that bad managers signed. In short, while in some mines bad union agreements are part of the problem, the bad Australian mining equipment productivity has much deeper causes.

One reason that partly explains the recent trends shown in the PwC findings is that during the boom years some mines were forced to acquire equipment that was available rather than what they really needed and at the same time due to talent shortages recruited relatively less skilled labour to operate it. Add to that the fact that some if the expansion is not yet fully operational.

But the graph shows that in reality we have a long-term problem that we have not recognised. It seems as though in the boom no one cared about productivity. And too many companies compared their productivity performances against what they achieved in the previous year rather than looking hard at world’s best practice. In addition poor managers keep saying that their mine is 'different' and that explains the poor use of equipment. PwC examined all those claims and adjusted its data where it was legitimate. Usually they were just an excuse for poor management.

The boards of Australian miners must now make their CEOs compare plant use with the best in North American and Asian mines -- not Australia. And they should not allow CEOs to blame unions for the failures of their own managers. Meanwhile, shareholders should demand that CEOs account for equipment productivity comparisons with other countries.