Small cap expansion on the cards

| Summary: Listed small cap emerchants specialises in reloadable debit card issuance and processing, as well as corporate expense management programs. The company’s share price has increased six-fold, and it has a target to have $1 billion in pre-loaded dollars on its debit cards – but it could take some time to get there. |

| Key take-out: The company’s recent capital raising was oversubscribed by nearly three times, and a number of fund managers have popped up on emerchants’ share register. |

| Key beneficiaries: General investors. Category: Shares. |

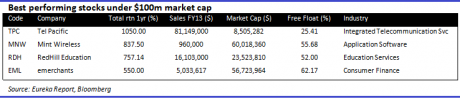

Don’t beat yourself up if you missed the best-performing small cap stocks over the past year.

Most retail investors would not have heard of these overachievers that managed to overcome the negative sentiment weighing down small speculative stocks on our exchange.

There are only four stocks with a market capitalisation of under $100 million that delivered returns in excess of 500% over the last 12-months, with pre-paid telephony products and services provider Tel.Pacific leading the charge as the only “10-bagger” on the list.

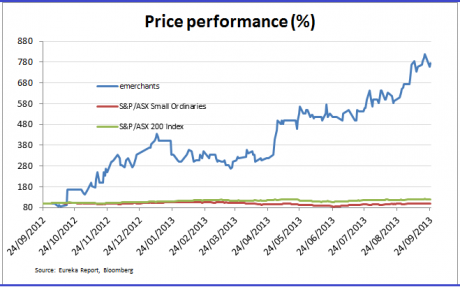

Nothing fires up a small cap investor like a 10-bagger, which is a stock that returns you 10 times your capital. But it’s another card supplier that has caught my eye, as it has managed to win the support of a number of small cap fund managers.

The company is emerchants (EML), which enables businesses and government departments to issue, control and manage debit cards to minimise abuse of funds and fraud.

Management has signed a deal with Queensland’s Department of Communities, Child Safety & Disability Services to use emerchants’ debit cards for single use emergency assistance grants in the aftermath of disasters.

The state’s Department of Treasury & Trade has to give final approval, and that is expected to come before the end of November.

Issuing a pre-loaded debit card to victims of disasters is better than cash due to the instances of fraud; and emerchants’ ability to track and reconcile spending, and limit where the cardholder can spend the funds, makes its cards an attractive alternative.

It is this level of customisable control that gives emerchants an edge over large financial institutions that also supply debit cards.

The technology is also useful to companies to control petty cash, and mining contractor Monadelphous Group is trialling the service for this purpose.

The company’s recent capital raising at 33 cents a new share was oversubscribed by nearly three times, and a number of fund managers have popped up on emerchants’ share register. Besides substantial shareholders LHC Capital Partners and Milfort Asset Management, others that are sitting below the 5% mark (the level where an investor is obliged to inform the market) include UBS, Wilson Asset Management, and WilsonHTM Investment Group.

But after the stock’s six-fold increase in value over the past year to 46.5 cents, how much of its earnings potential is in the share price? This is where it gets interesting.

You have to believe that emerchants can achieve $1 billion in pre-loaded dollars on its cards before it looks like a compelling buy at current levels.

If you believe emerchants’ chief executive, Tom Cregan, the $1 billion mark should be a fairly easy target to reach.

“The government market is circa $6 billion in terms of annual disbursements and petty cash [from corporates] is another $6 billion a year,” says Cregan.

“We’ve gone into other segments as well, such as the not-for-profit space. So if the true market potential is $12 to $15 billion, if we get $1 billion that would only be [6.7%] of the market.”

If emerchants can get $1 billion loaded onto its debit cards, it would potentially generate revenue of around $24 million. Looking at its costs in its 2012-13 earnings report, that could equate to an earnings before interest, tax, depreciation and amortisation (EBITDA) of about $13 million to $14 million.

Based on that earnings assumption, the stock is cheap as it would put it on a price-earnings multiple in the vicinity of five times.

But there is a lot of water that needs to go under the bridge before emerchants can get there. Cregan admits it could take five years to reach that point, and there is a lot can go wrong. As it is, he had to push back his target to get the company to a cash flow positive position by six months, to the first half of 2014-15. This was due to an increase in expenses as emerchants ramps up its sales and marketing efforts.

The stock is not part of the Uncapped 100, and I won’t give a recommendation on emerchants except to say there is no rush to buy at these levels. It is one that is worth keeping a close eye on though, as any hint that it is taking a step closer to the $1 billion target will see the stock surge towards $1.

Brendon Lau does not own shares in emerchants.