Shopping for yield in Woolies' property float

PORTFOLIO POINT: With an issue price range at a discount to net tangible assets, and a forecast yield around 7%-8%, the Woolworths’ property float could be a bargain.

The creation of the SCA Property Group is an interesting addition to the universe of income securities that include high-yielding equities, listed property trusts and income securities. Immediately my interest is drawn to this security by the quality of the issuing entity (Woolworths) plus the structure, which includes an entitlement issue and shareholder offer.

The transaction and the offer

- SCA Property Group is to be created as an independent and internally managed real estate investment trust (REIT). The transaction creates a property trust by releasing approximately $1.4 billion of property from Woolworths’ balance sheet.

- Woolworths will transfer its interest in the portfolio to SCA Property Group and, subject to shareholder approval, distribute (in specie) approximately 247 million stapled units to Woolworths’ shareholders;

- In addition, a total of 337 million stapled units ($425 million to $506 million) are available to be offered, and this will comprise:

- Woolworths’ retail shareholders offer;

- Brokers’ firm offer;

- Institutional offer; and

- General offer.

- The offer price range is from $1.26 to $1.50, and this equates to a discount to declared net tangible assets ($1.58) per unit between 20% and 5%. The final price will be determined (or priced) at the conclusion of the institutional offer.

- A forecast FY14 distribution yield of 8.3% ($1.26) to 6.9% ($1.50), based on the final price range.

- The trust gearing commences at 27% (debt to assets) and this will increase to about 34% when all properties in the development pipeline are completed.

The key aspects of the SCA Portfolio

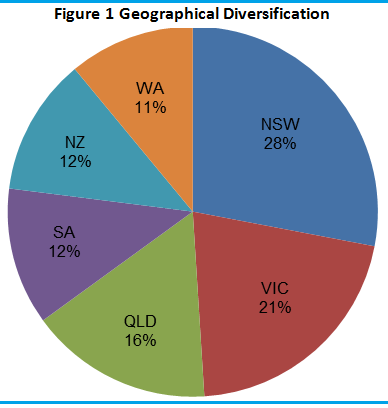

The portfolio is well diversified geographically, with the major states of NSW and Victoria being appropriately weighted, as are the growth states of Western Australia and Queensland.

The spread across different retail asset classes appears reasonable.

The tenants are reasonably spread and the 41% exposure directly to Woolworths stores is of comfort.

Apart from the above features, below are the key observations:

- There are 69 shopping centres, which have been independently valued at $1.4 billion. These comprise 56 completed assets valued at $1.1 billion and 13 developing assets valued at $300 million. This is a structure that offers growth.

- The portfolio is based on convenience and weighted towards consumer stapled anchored food retailers such as Woolworths with long-term leases. This will provide a secure income stream that will support regular income distributions.

- The average property age is 2.1 years. The recent and modern development profile suggests lower maintenance and upgrade costs.

- Weighted average lease expiry is 15.8 years. Long-term leases limit renewal risk.

- The portfolio average capitalisation rate is 8.1%. This valuation basis seems reasonable.

- Occupancy level is 95%. Relatively high and underwritten for two years by Woolworths.

My View

I believe SCA Property Group is best compared with the listed Charter Hall Retail Trust (CQR) and BWP Trust (BWP). CQR is regarded as the closest comparison due to its similar consumer stapled retailing focus, whereas BWP has a focus on DIY retailing with Bunnings Warehouse being the major tenant.

A comparison to other securities is normally not appropriate for valuing a share. However, the trading of listed property trusts that own property assets can be more readily done on this basis. Property trust valuations are driven mainly by underlying asset values (NTA), yield (market yields) and the quality of tenant (subjective analysis). So, as we scan down the comparative table we can draw a conclusion on where SCA should trade in the market.

Key features for properties compared to SCA, BWP and CQR:

Considering the above I can draw the following conclusions when comparing SCA to both BWP and CQR because:

- The offer of SCA Property Group at the highest price ($1.50) is still below the NTA. I note that BWP and CQR are now trading at a premium to NTA.

- The estimated forecast FY14 yield is well within the yield that BWP and CQR.

- Whilst the gearing is higher than BWP, it is lower than CQR. In my view the 34% gearing is relatively low given that the income stream is sourced from solid retail rental income.

- The weighted average lease expiry of 15.8 years is very attractive compared to BWP and more specifically with CQR. In passing I note that the weighted average lease expiry for CQR at 6.5 years is an issue that needs to be watched by investors.

- At about four times (FY14 forecast), the interest cover is also well above the broader REITs sector, which I note is usually between two to three times. In this regard both SCA and BWP rate well.

Based on the above features (which are commonly considered when investing it REITs) I believe SCA Property Group ranks well compared to BWP Trust and CQR. Therefore I believe the units will trade above the upper limit of $1.50. Indeed it seems likely that the units will be well supported by institutions at prices up to $1.50, and so Woolworths’ shareholders should consider adding to their entitlement, especially if the final price is below this level.

John Abernethy is the chief investment officer at Clime Investment Management. If you’re a sophisticated investor, wholesale investor or have $500,000 or more to invest, Clime is offering you the opportunity to discuss your portfolio and investment options with John Abernethy. Click here to register your details.

Clime Income Model Portfolio

Return since June 30, 2012: 10.90%

Returns since Inception (April 24, 2012): 10.71%

Average Yield: 8.06%

Start Value: $118,757.19

Current Value: $131,706.92

Clime Income Portfolio - Prices as at close on 22nd November 2012 | |||||

| Hybrids/Pseudo Debt Securities | |||||

| Company | Market Price | Margin over BBSW | Running Yield | Franking | TR (%) |

| ANZHA | $103.85 | 2.75% | 5.79% | 0.00% | 4.73% |

| MXUPA | $80.00 | 3.90% | 8.95% | 0.00% | 11.59% |

| AAZPB | $95.05 | 4.80% | 8.48% | 0.00% | 8.86% |

| MBLHB | $68.41 | 1.70% | 7.25% | 0.00% | 16.97% |

| NABHA | $71.53 | 1.25% | 6.31% | 0.00% | 7.27% |

| SVWPA | $84.60 | 4.75% | 9.46% | 100.00% | 7.45% |

| WOWHC | $105.20 | 3.25% | 6.19% | 0.00% | 3.14% |

| RHCPA | $103.80 | 4.85% | 7.80% | 100.00% | 7.05% |

| High Yielding Equities | |||||

| Company | Market Price | FY13 Dividend | GUDY | Franking | TR (%) |

| TLS | $4.27 | $0.28 | 9.37% | 100.00% | 22.22% |

| AAD | $1.37 | $0.12 | 8.76% | 0.00% | 7.66% |

| CBA | $58.67 | $3.48 | 8.47% | 100.00% | 16.23% |

| WBC | $24.83 | $1.73 | 9.95% | 100.00% | 16.32% |