SG Fleet enters market in wrong gear

SG Fleet’s (SGF) market debut will give fresh ammunition to sceptics who shun initial public offers because of their poor track record.

The novated leasing and vehicle fleet management solutions provider crashed to $1.72 on first trade at noon, which is 7.03% below its offer price of $1.85 a share.

Many had suspected that the new stock would lag as it wasn’t trading at a deep enough discount to incumbent McMillan Shakespeare, which coincidentally is trading around 0.7% firmer at $10.27 after spending the morning wallowing in the red.

While the magnitude of the price fall looks dramatic, it only really puts SG Fleet on par with its larger rival McMillan Shakespeare (MMS) on a price/earnings basis. McMillan is on a forecast 2014-15 P/E of around 11 times.

Further, SG’s other valuation metrics are also not particularly compelling. Its expected yield, for instance, would come in around 6%, which is similar to what McMillan is expected to offer.

The fact is SG should be priced at a decent discount as it’s the new kid on the block. New floats are typically priced more attractively to their peers to attract investor support and to account for their lack of a trading history as a public enterprise.

It doesn’t help that the outlook for novated leasing is cloudy at best after the previous federal Labor government threatened to change the tax treatment of salary packaged vehicles. The current government may have trashed the proposed changes, but the incident has highlighted the dangers of investing in companies whose fortunes are so closely tied with government regulation, particularly at a time when governments are scrambling to rein in costs and entitlements.

Both companies have a growing exposure to the United Kingdom, which should help them diversify risks. But the novated leasing industry in the UK equally relies on government support, and that support should never be taken for granted no matter which jurisdiction one operates in.

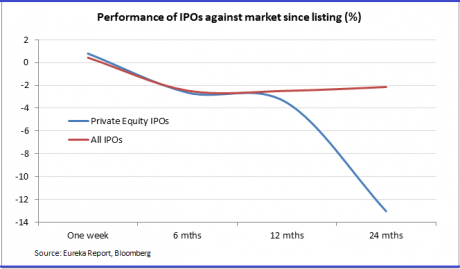

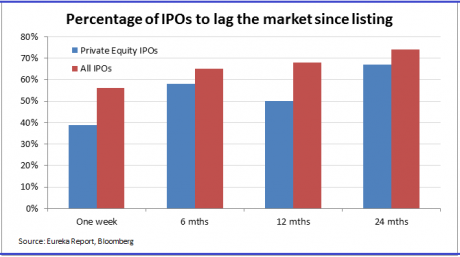

The other sad truth is that most initial public offers (IPOs) do not perform well over the medium term. This is particularly true for IPOs that are sold by private equity firms. It’s a wonder why new listings are called “floats” when so many sink as shown in the charts below.

As Eureka Report highlighted in September last year, most professional investors shun private equity-backed IPOs, especially when the private equity firm sells out completely as is in the case of SG with CHAMP going from 40% plus ownership before float to zero.

SG Fleet had to cut its offer price to ensure the float got away today. It was initially hoping to sell shares at between $2.06 and $2.46 a pop.