Searching for value in Google

Summary: Internet behemoth Google has lagged the broader market this year, falling 5% when the S&P500 has soared. Concerns that desktop search is a maturing business, that the company may face continued margin pressures in the cloud business and that there may be adverse regulatory rulings from Europe have dogged the stock. But Google is quickly adapting to new revenue drivers in the mobile space, with YouTube being the jewel in its crown. |

Key take-out: Strong market positions in the growth segments of the internet and an attractive valuation support our “buy” recommendation at current prices. In spite of its size, the company should be able to double-digit revenue and earnings growth for years to come. |

Key beneficiaries: General investors. Category: International Shares. |

Recommendation: Buy Price at call: $US516.35 Target price: $US647 Risk: Low |

I always get interested when a dominant and disruptive company like Google lags the broader market. This year Google is down 5% or so, significantly underperforming the S&P500.

With a market capitalisation of $US360 billion, Google enjoys roughly 65% of the global market for search. No competitor has more than 10%. In 2014 the company will have generated over $US66.5 billion in revenues. While not growing as fast as its post-IPO heyday when it was a much smaller company, Google is still growing revenues year-on-year at 15-20%.

Interestingly, Google trades at 17 times 2015 earnings per share (EPS), slightly more than the S&P500, but is generating five times the revenue growth. Its main competitor for the online advertising dollar is Facebook, a company we like. Facebook trades at a heady 34 times 2015 EPS. Google also has over $US60 billion of cash on the balance sheet.

Google has not been on investor's radar this year due to concerns that desktop search is a maturing business and the company may face continued margin pressures in the cloud business. Also, there is the issue of adverse regulatory rulings from Europe that has created some uncertainty. Perceived competition from social media is also hampering positive sentiment for the stock.

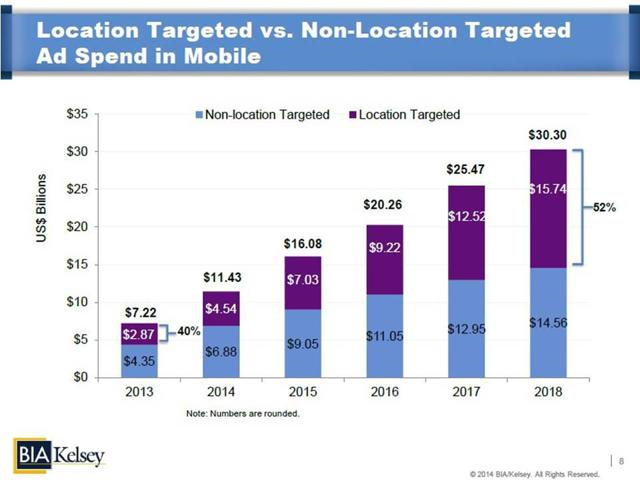

Certainly, desktop search is maturing and is migrating to the mobile world. In the chart below, “non-location targeted” is ad spend for desktop and “location targeted” is ad spend for mobile. It's now over 50% and trending higher.

Facebook realised this when the stock was languishing at $US18 in 2012 and has made the adjustment from the world of HTML to mobile.

Google is making the shift as well, furiously developing tools to improve the user experience on mobiles. For example, just recently they have added an in-app voice search function for Android phones.

Some other pertinent mobile metrics are the following:

- 66% of emails are first opened on a mobile device [source];

- 50% of YouTube's traffic is from mobile [source];

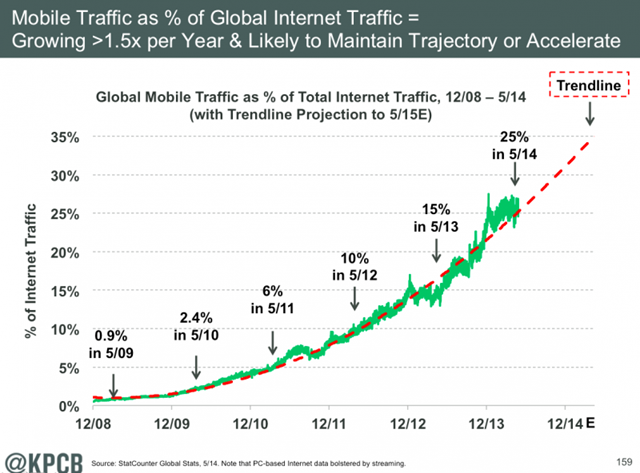

- Mobile traffic accounts for 25% of all global internet traffic and is growing strongly (see below).

Google “Play” – the Android app store – is achieving critical mass and is approaching Apple App store revenues.

Google's “jewel in the crown” in order to get and maintain critical mass in the mobile advertising space is YouTube, particularly for the more lucrative “brand” advertising.

YouTube revenue growth continues to be robust, even if it has decelerated from recent years off a larger base. The service should have $US1.75 billion in net revenues by 2015-16, with a billion users who watch six billion hours of video per month.

Brands like Coca-Cola and General Motors are becoming regular advertisers. They like Google's TrueView feature, which allows users to click away ads after the first five seconds, because it allows them to pay for only those users that watch the ad in its entirety.

Google's cloud business will require ongoing investments in headcount and systems if it is to effectively compete with Amazon, the 800 pound gorilla of the cloud.

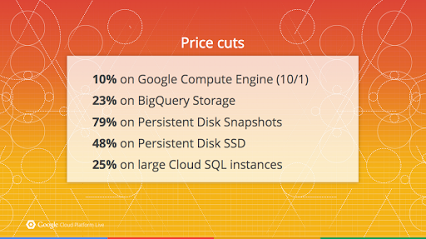

Concerns over margin pressure are real, but as I pointed out in last week's Amazon piece, the main players in this space may begin to compete more on services – not price – which would be positive in a market that's big enough for all. That being said, in its cloud platform conference held on November 4, what did Google announce? Price cuts!

Still, taking a medium term view the cloud is big enough for more than two players and a more rational pricing scheme will eventually evolve. Analysts estimate that over 80% of US corporates and institutions will be using cloud based applications by 2020. This is a huge addressable market with room for multiple players.

Europe has been investigating Google for over four years on antitrust and privacy issues. If found guilty, Google could be susceptible to a large fine of between $US4 billion and $US6 billion.

Google is more popular among the European public than any other region in the world. The company has higher than 90% market share in Europe simply because users there prefer it over alternatives, while it has less than 68% market share in the US. The timing and outcomes of this case are anybody's guess. It may drag on for years like the Microsoft case and only result in “headline” risk.

That this case is pending doesn't diminish the attractions for the stock. Google faced problems in China over censorship and decided to leave the market. It could do the same in Europe and given the lack of a government firewall could serve its European clients from outside the region.

If nothing else this case adds credence to the theory that there isn't a business or industry that Europe doesn't want to regulate and that probably explains why there are so few home grown technology players in the region.

For investors that appreciate the profound economic impacts that McKinsey' s “12 Disruptive Technologies” will have in the future, Google is a relatively conservative way to play at least four of them – mobile internet, the Internet of Things (Google Glass), cloud computing and self-autonomous vehicles.

Recommendation

Google is a buy at current prices given its strong market positions in the growth segments of the internet and its attractive valuation. In spite of its size the company should be able to achieve double-digit revenue and earnings growth for years to come. Underperformance in 2014 has created a buying opportunity for what should be a core holding for a global investor.

Google should trade at a premium to the S&P500 given its growth potential. My target price is $US647, calculated by 18.5 times 2016 core EPS of US$35.

Should investors own Google and Facebook? In a 30-40 stock portfolio you could justify it but, for those of you holding five to 10 overseas holdings, you just need one or the other. Both are excellent plays on internet growth and advertising spend. Google would be more suitable for conservative investors given its size and valuation.

Risks

- Deterioration in the ad market, particularly as vast majority of revenue driven by advertising;

- Elevated investment in research & development and dilution from additional restricted stock grants;

- Resolution of Europe's anti-trust probe, potentially lowering Google's share of search advertising spend in the region;

- Global tax reform, given Google's 15-20% effective tax rate;

- Foreign currency headwinds.

To see Google's forecasts and financial summary, click here.