Revisiting Bitcoin Basics

Bitcoin celebrated its 13th birthday earlier this year despite ever-present and ongoing attacks by critics, regulators, nation states, competing technologies and the temperamental nature of buyers and sellers on digital asset exchanges.

As of writing, the Bitcoin price is languishing around $A30,000, roughly 55 per cent below its calendar 2022 high back in early January. It has traded within a horizontal channel of $A26,000-35,000 since mid-June.

So why would anyone want to invest in Bitcoin given the recent volatility? It might be worth looking at the fundamentals of this emerging technology and give investors a chance to reappraise its value as both a technology and a tradeable asset.

Despite the negative price action, the Bitcoin blockchain ledger continues to grow day after day as transactions are added to blocks through “mining”. Miners must demonstrate a “proof-of-work” when creating a block that can be verified by other nodes on the network. The first miner to do so earns the “block reward” which is paid in Bitcoin. This cycle incentivises miners to secure the network (through the perpetual creation of blocks and insertion onto the ledger) and decentralises the ability for any party to corrupt the ledger.

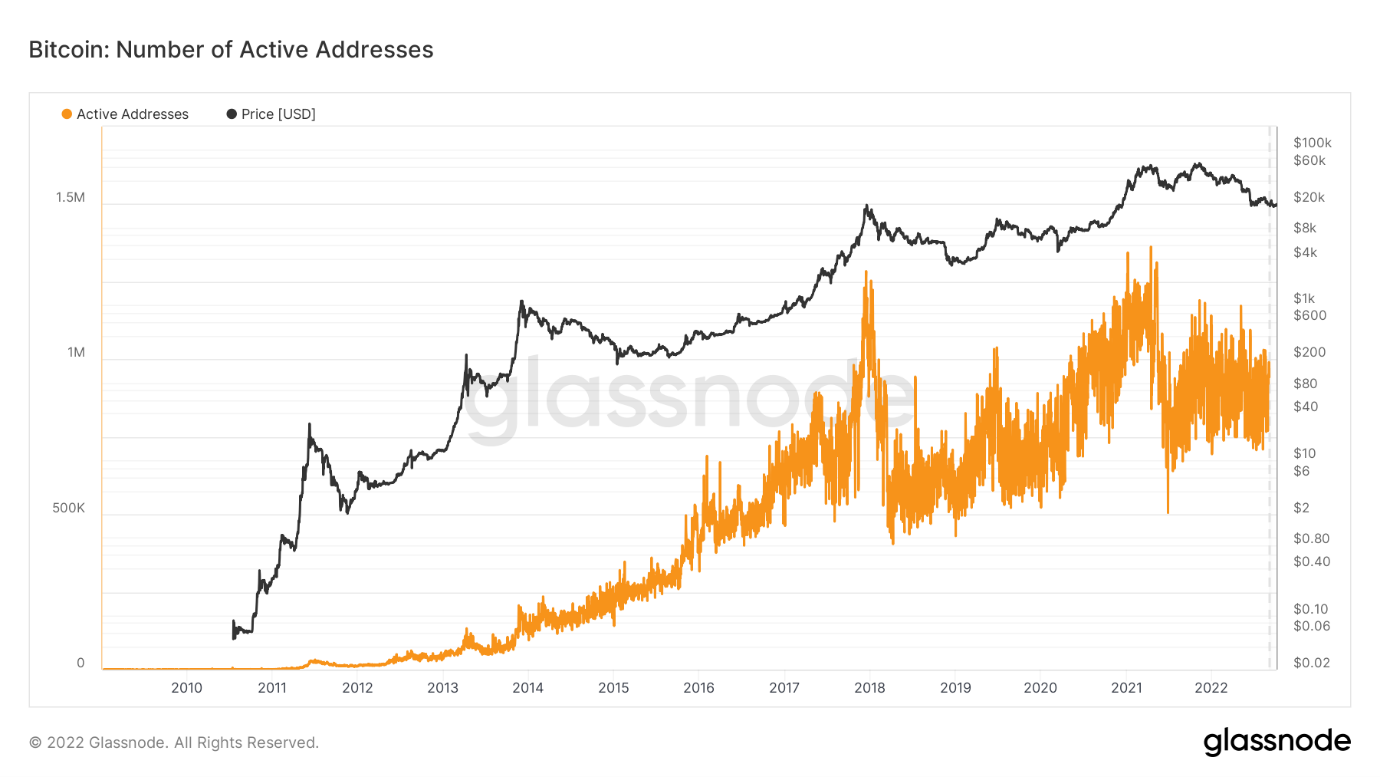

This cycle has occurred uninterrupted since Satoshi Nakamoto mined the very first block (called the Genesis block) on 3rd January 2009 and is strong evidence that Bitcoin as a technology continues to resonate with a growing pool of users, notwithstanding volatility in both price and number of active addresses.

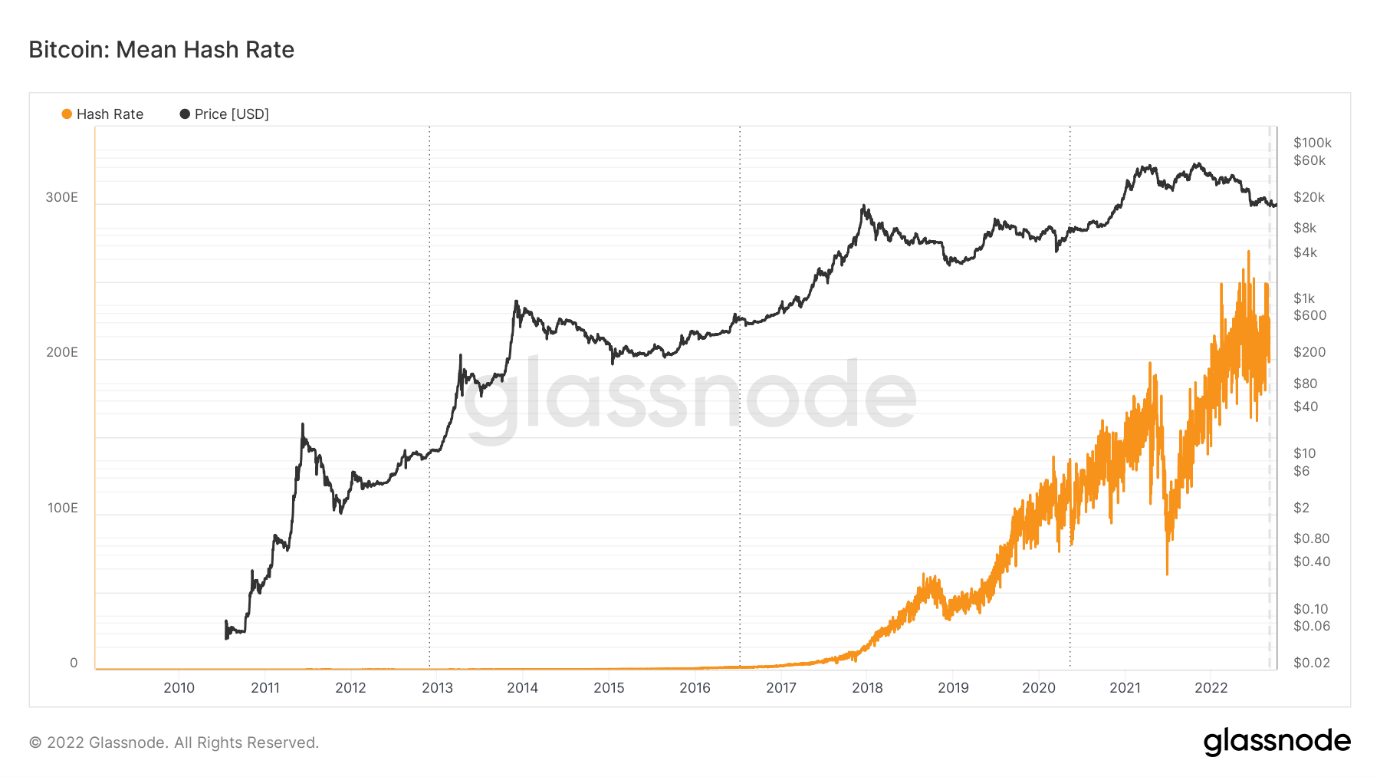

Similarly, Bitcoin’s “hash rate” continues to grow, reflecting the growth of computer and processing power contributed by miners to secure the network.

Hash rate responds to price because miners incur electricity and other operating costs to mine Bitcoin and often sell Bitcoin into fiat currency to pay these costs. Hash rate is a useful indicator because any sustained fall might signal a systemic challenge to Bitcoin’s long-term viability. Investors can take advantage of both price action and on-chain data to analyse trends and patterns, and form conclusions about the past, present, and future.

Data tells us what has happened and is happening right now. But investors must balance the arguments for and against to develop an investment thesis.

Let’s start with the arguments for.

Decentralised

Bitcoin is arguably the most decentralised crypto of them all. There is no Bitcoin company, CEO, or foundation, and therefore nobody to sanction. The Bitcoin software source code is open source, and anyone can download the Bitcoin core and operate their own node or mining rig.

Bitcoin runs over the same Internet that globally interconnects all of us. Because anyone can spin up a Bitcoin node and connect it to the Internet without permission, it’s practically impossible to prevent somebody, somewhere from doing so if they wish. If a node can be reached and a mining rig can verify the next block, then Bitcoin will continue to work like a perpetual machine.

Decentralisation makes Bitcoin resilient to any prohibitive legal enforcement in any jurisdiction (when China banned mining, hash power from outside China quickly filled the gap).

Secure

Since each block is connected to every previous block (all the way back to the Genesis block) by a cryptographic algorithm, as the blockchain ledger grows, its censorship resistance increases. Altering the ledger via a hack or an attempt to control most of the hash power (known as a “51% attack”) is programmatically difficult due to the secure cryptographic algorithms involved and enormous power required. Any such attempt would likely to cause the price to fall which acts as a disincentive to the attacker.

The Bitcoin blockchain has never been corrupted and is arguably the world’s most secure digital network.

Scarce

Bitcoin’s supply is capped at 21 million coins with a current supply as of writing of 19.14 million coins issued. The supply schedule is fixed in the software and cannot be changed unless most of the network agrees.

Since May 2020, 6.25 BTC is issued by the network protocol as the block reward to whichever miner secures the block, which happens every ten minutes or so. The block reward halves every 210,000 blocks or approximately four years.

Because Bitcoin’s supply is fixed, and its schedule is transparent and set in stone for all practical purposes, it is scarce and cannot be debased. The protocol guarantees that its value must increase if demand increases.

Permissionless

Anyone can participate as a Bitcoin node operator, miner, holder, buyer, seller, or user. Bitcoin is permissionless. Regulators can ban it, but as an open-source technology running on the global Internet, total enforcement is impossible.

Pseudonymous

Bitcoin is pseudonymous in the sense that the network and protocol does not enforce any kind of “know your customer” (KYC) identify verification. Regulated “on-and-off” ramps such as exchanges do, but access to a Bitcoin node is all that is needed to transact pseudonymously. While this attribute might not matter much in open societies, it may have value in authoritarian ones.

At the same time, the Bitcoin blockchain ledger itself is entirely transparent to all, including enforcement agencies, so while the protocol itself is pseudonymous, using Bitcoin in a practical sense does not put bad actors beyond the reach of law enforcement.

The market has responded to Bitcoin’s features positively to date. So, what can go wrong?

Network failure

Bitcoin’s value largely rests upon its infallible record as an immutable ledger. If the blockchain were to be corrupted, hacked or compromised, then confidence in its resilience would be shaken. If a bad actor mounted a successful 51% attack (despite the enormous electricity cost that this would entail), the consequences could be disastrous.

Competition

Bitcoin could be supplanted by a superior alternative that ultimately reduces demand to the point where miners’ cost to secure the blockchain ledger rises above Bitcoin’s market price. This could result in a death spiral from which there is no recovery if the challenger supplants Bitcoin as the crypto king.

Regulation

Regulation could significantly reduce demand, either via limitations on use or outright prohibition. If this were to happen across jurisdictions on an ad-hoc or coordinated basis, the fall in demand could have the same outcome as a superior alternative.

Confidence

The market may simply lose confidence in the value proposition and form the view that Bitcoin is a ponzi-like scheme in which the last person holding the bag is the loser. If investors head for the exit and insufficient “hodlers” remain standing, then Bitcoin could whither into irrelevance.

Bitcoin is an emerging technology, but its performance to date as both a nascent technology and a tradeable asset has been remarkable, despite the price volatility. Smart investors must weigh up the balance of probabilities while also considering their risk appetite, asset allocation and timeframe.

Frequently Asked Questions about this Article…

Investing in Bitcoin can be appealing due to its fundamentals as an emerging technology. Despite price fluctuations, Bitcoin's blockchain continues to grow, showcasing its resilience and potential as a tradeable asset. Its decentralised nature, security, scarcity, and permissionless features make it a unique investment opportunity.

Bitcoin's decentralisation means there is no central authority or CEO, making it resilient to legal enforcement and censorship. This open-source technology allows anyone to operate a node or mining rig, ensuring that Bitcoin remains operational globally, which can be reassuring for investors concerned about regulatory risks.

Bitcoin is considered secure due to its blockchain technology, where each block is cryptographically linked to the previous one. This makes altering the ledger extremely difficult and costly, deterring potential attacks. Its track record as an uncorrupted digital network adds to its security appeal for investors.

Bitcoin's scarcity is due to its capped supply of 21 million coins, with a transparent and fixed issuance schedule. This limited supply, combined with increasing demand, can drive up its value over time, making it an attractive option for investors looking for scarce assets.

Investing in Bitcoin carries risks such as network failure, competition from superior alternatives, regulatory challenges, and loss of market confidence. These factors could impact Bitcoin's demand and value, so it's important for investors to consider their risk tolerance and investment strategy.