Retailers need a little sparkle

A softer than expected GDP number is assisting Glenn Stevens’ quest to lower the Australian dollar – the local currency slipped well below 91 cents moments after the numbers were released. As Stevens has said time and time again, Australia needs a lower dollar to help other sectors of the economy contribute growth to the economy as the mining boom as we have known it, ends.

Specifically, the idea is a weaker dollar will be beneficial to the manufacturing, retailing and tourism sectors, all of which are currency-sensitive.

Despite a lower currency being touted as the solution to Australia’s faltering growth, consumptions declining contribution to GDP suggests retailers might need something else. Retailers and to be fair, probably other interest-rate sensitive areas other than housing, need consumer confidence to equate to increased spending.

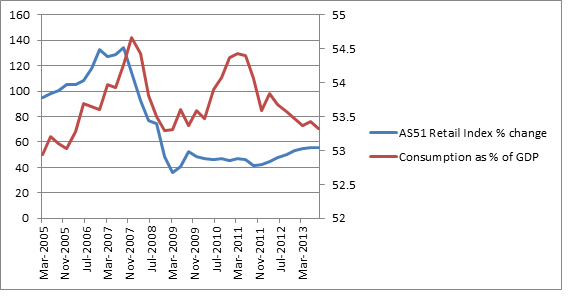

The red line of the below graph details consumptions contribution to GDP since the start of 2005 against the blue line, which is the ASX 200 Retail Index.

Source: ABS

Retailing is accounted for under consumption’s contribution to GDP. It has been suggested increasing consumption is going to be the way forward – we have seen the beginnings of this with services stealing the discretionary spending of consumers.

The current trajectory of consumption as a percentage of GDP indicates we are in fact consuming less across the board. Not surprisingly, this meant consumption only contributed a third of GDP growth in the September quarter even though consumption has consistently contributed to half of GDP.

We have seen retailers slash costs and implement systems to improve efficiency across the board over the last few years in a bid to maintain profit margins as sales growth has been negligible. This has propped up retailers and the corresponding index for now, but it is evident consumers need to alter saving and spending habits to turn around the fortunes of sectors leveraged to consumption.