Research Watch

PORTFOLIO POINT: This is a sampling of this week’s best research notes. In a world of too much information, we hope our selection helps you spot the market’s key signals.

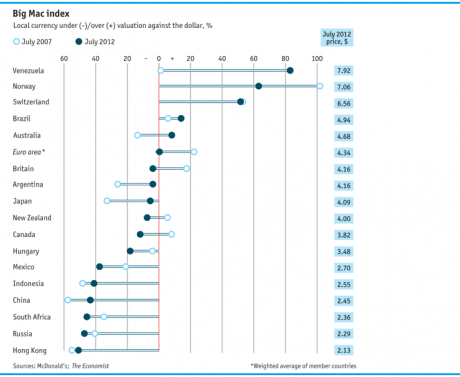

Last time we heard from investment guru Jeremy Grantham he was listing his top tips for surviving jittery markets – now the GMO co-founder seems worried those jitters will become more violent. Grantham’s latest quarterly note, released this week, warns that one of the market’s two critical pillars is looking shaky: expect declines. Doug Kass, the Wall Street legend who famously predicted stocks would bottom, makes another high-profile call: bonds will be the short trade of the next decade. Although researchers from Hoisington have studied similar post-panic periods and reckon bonds might rally for more than 10 years. McKinsey has charted the rise of investment in private equity and hedge funds, concluding that alternative investing is going mainstream and will continue to grow strongly. And, at Bronte Capital, John Hempton illustrates the spectacular decline of Vodafone’s Australian operations – the company performs worse here than it does in crisis-hit Greece. Paul Krugman latches onto a werid and under-reported passage from Mario Draghi’s market moving speech – “the euro is like a bumblebee...”. While The Economist’s latest Big Mac Index suggests the euro is the most undervalued major currency (at the other end, the Australian dollar looks stretched). Elsewhere, Goldman charts the new world of macro investing, Apple ripens for the Dow, and private jets are selling cheap. This week’s video is actually a radio segment, following two broadcasters as they set up their own shell company in an offshore tax haven. It’s simpler – and cheaper – than it sounds.

Groundhog Day... “The economic environment seems to be stuck in a rather unpleasant perpetual loop. Greece is always about to default; the latest bailout is always about to save the day and yet never seems to; China is always about to collapse but instead teases us by inching down; and I swear the Financial Times is beginning to recycle its reports! In the US, the fiscal cliff looms along with debt limits and the usual election uncertainties. The dysfunctional US Congress continues for the time being in its intractable ways. The stock market rises and falls and rises and falls again. It is getting difficult to find anything new to say at client meetings. I, for one, wish that the world would get on with whatever is coming next. One slight change, though, is that fantastic (almost unbelievable) profit margin and earnings gains have finally weakened a little. They, together with Bernanke’s super low rates, have been the twin pillars of the market and not bad ones at all: [in the US] we are up 8% for the year in a thoroughly unsettling financial and economic world. With margins weakening, one of the twin pillars is looking shaky and price declines look more likely than before.” (Jeremy Grantham, chief investment strategist at GMO, August 2012)

The best short for the next decade... “My favourite short of the next decade is the US bond market, for those that possess deep enough pockets, have the fortitude and the patience. I am long ProShares UltraShort 20 Year Treasury, which is the inverse, double-short bond ETF. Over the past 2½ years, bonds have achieved a near 60% total return. A remarkable feature is the consistency of positive returns and the absence of many drawdown years of consequence. Nevertheless, they should be viewed as a return-free asset class that is very risky. The 10-year yields are under 1.5%, less than half the yield during the recessions in 2001 and 2008. That means I am paying over 65 times earnings for a 10-year-bond, a rich price even by Amazon’s or LinkedIn’s standards.” (Doug Kass via Barrons, July 28)

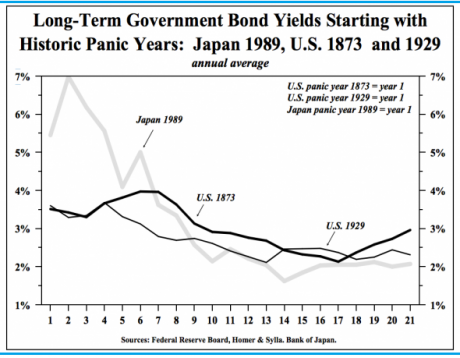

Or not...

“In the aftermath of all these debt-induced panics, long-term Treasury bond yields declined, respectively, from 3.5%, 3.6% and 5.5 % to the extremely low levels of 2% or less in all three cases. The average low in interest rates in these cases occurred almost fourteen years after their respective panic years with an average of 2%. The dispersion around the average was small, with the time after the panic year ranging between twelve years and sixteen years. The low in bond yields was between 1.6% and 2.1%, on an average yearly basis. Amazingly, twenty years after each of these panic years, long-term yields were still very depressed, with the average yield of just 2.5%. ... The relevant point to take from this analysis is that US economic conditions beginning in 2008 were caused by the same conditions that existed in these above mentioned panic years. Therefore, history suggests that over-indebtedness and its resultant slowing of economic activity supports the proposition that a prolonged move to very depressed levels of long-term government yields is probable.” (Hosington Investment Management, July 2012)

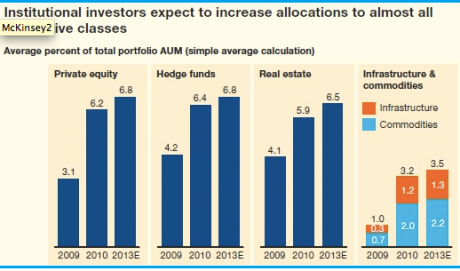

The rise of alternative investing...

(McKinsey, July 31)

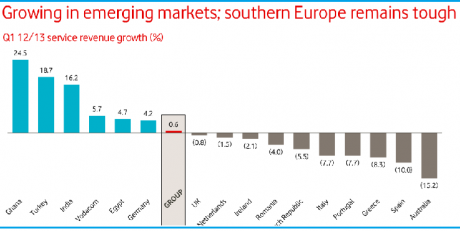

Portugal, Greece, Spain, Australia... “Here is an extraordinary slide of revenue by jurisdiction from the last Vodafone conference call...

“Revenue performance in Australia is worse than any Southern European country. This was entirely predictable. … In what has been a disastrous 18 months for the company, following its infamous network outages in 2011, Vodafone’s customer base slid to 6.8 million, from a high of 7.5 million in 2010. Note the scale of this stuff-up. The population of Australia is 22.6 million and there are roughly the same number of mobile phones. They lost 700,000 customers or 3% of the population. (This is in a business where a 1% movement is a big change in share.) My guess, in terms of lost customers and future profits the stuff up will wind up being worth something like $1 billion.” (John Hempton of Bronte Capital, July 25)

Well, that’s one way to join the Dow... “According to a research report from Sanford C. Bernstein, Apple is finally considering splitting its $US600-plus stock in a way that could right-size it for entry into the venerable (ancient) blue chip index. … Apple’s decision in March to pay its first dividend in 17 years makes it more likely the stock could be added to the index after a split, according to Tuesday’s Bernstein report. ‘We see the timing as ripe’, wrote analyst Toni Sacconaghi, who noted that Apple is the only dividend-paying company with a more than $215 billion market cap that has yet to be inducted into Club Dow. … A more timely inclusion of Apple into the Dow might well have brought the index to all-time highs by now. How great would it have been to hear the evening news lead with that much-needed milestone? The world’s most admired and highly valued company managed to pull off the bulk of its success precisely as the market and economy went to hell: The iPhone launched in June 2007, as word first emerged that Bear Stearns was in trouble. Apple, whose stock has since gained 400%, was perhaps the best, proudest thing corporate America had going for it.” (Businessweek, July 31)

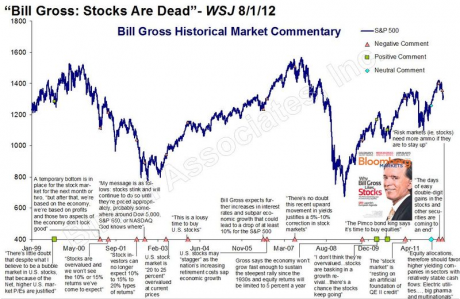

Gross market commentary...

(Lazlo Birinyi of Birinyi Associates, August 1)

Is the euro undervalued?...

(The Economist, July 26)Or is the euro a bumblebee?... “Given the tsunami of reporting about Mario Draghi’s remarks last week, not to mention the huge market reaction, it’s kind of strange how few links I’ve seen to what he actually said, which is considerably stranger than you’d gather from the coverage... Here’s the passage that caught my eye: The euro is like a bumblebee. This is a mystery of nature because it shouldn’t fly but instead it does. So the euro was a bumblebee that flew very well for several years. And now – and I think people ask ‘how come?’ – probably there was something in the atmosphere, in the air, that made the bumblebee fly. Now something must have changed in the air, and we know what after the financial crisis. The bumblebee would have to graduate to a real bee. And that’s what it’s doing. Only considerably later did he make the declaration that the ECB would do 'whatever it takes' – a declaration everyone seized on, but which may mean little. The thing is, we know pretty well why the bumblebee was able to fly: massive capital flows from the core to the periphery, which led to an inflationary boom in said periphery, and which therefore also allowed the German economy – which was in the doldrums in the late 1990s – to experience a big gain in competitiveness and hence a surge in its trade surplus without needing to go through painful deflation. ... To keep the thing flying, you’d need something like a reverse play along the same lines: an inflationary boom in Germany, so that the periphery can regain competitiveness without devastating deflation. … Nothing like that is happening.” (Paul Krugman, July 29)

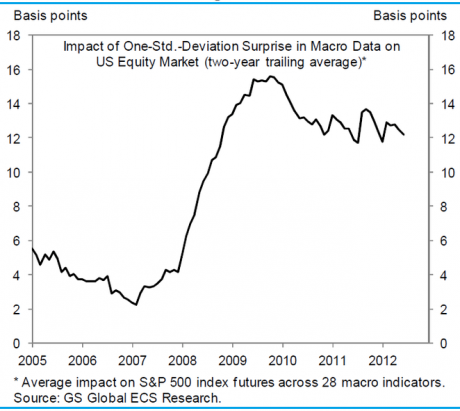

Investing in a macro world...

“According to Goldman Sachs US economics analyst, equity markets have become increasingly responsive to macroeconomic news releases ever since the financial crisis took place in 2008.” (Bondsquawk, August 1)

It’s time to buy a private jet... “Moguls and wealthy celebrities are seeing the value of their private jets tumble as the regular pool of used jet buyers has dried up ... In fact, the value of the trade-in jets has fallen by as much as 50%, the sources said. The super rich regularly shed their posh luxury jets for upgrades every few years, but they are finding out that the old bucket of bolts isn’t worth what they thought it would be. ‘Private jets had always held their values better than almost any asset class in the past decade, losing only about 2% a year,’ said Dan Jennings, CEO of The Private Jet Co., a leading broker in private aviation. ‘The bottom has fallen out for pre-owned jets and the bargain rush is on.’' … A sleek Gulfstream 5 – a symbol of success known among owners simply as a G5 – can now be had for as little as $20 million.” (New York Post, July 30)

Audio of the Week: Fancy a Belizean bank account?... Two broadcasters set up their own shell company and bank account in an offshore tax haven, and discover where the easiest place to register a business anonymously is. You can even hire your own board of directors for $600. It’s as entertaining as it is shocking.

(NPR, July 27)