Research Roundup: Returns, recession and risk

This week's research roundup features plenty on returns of differing types, a perspective on whether a recession is probable, and a look at copper, banks and risk strategies. The first item is a review of asset class performance over the last decade, and you'll never guess what was the winner. The worst performer is also a bit of a surprise, but not totally.

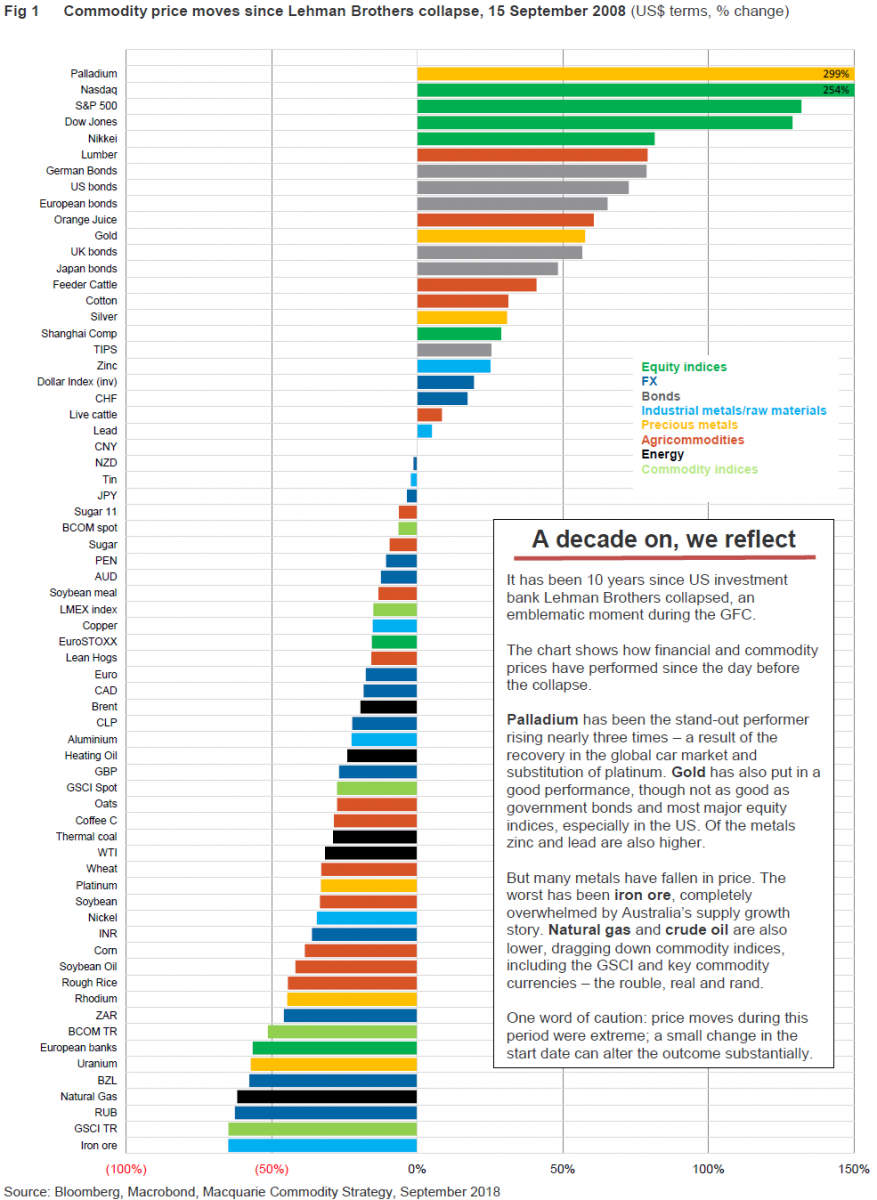

Macquarie: The GFC, 10 years later

Can you believe it? Already a decade has passed since investment bank Lehman Brothers collapsed, and Macquarie has decided to mark the occasion by tracking the performance of a range of asset classes over that 10-year period. Few would have realised that the best-performing asset is a rare commodity. Palladium leads the way, with the precious metal having increased in price by 299 per cent in that time. Prominent stock exchanges were also strong performers, with the Nasdaq, S&P 500, Dow Jones (now at record levels) and the Nikkei rounding out the top five. There there are commodities such as lumber, which has outperformed bonds, and orange juice rounding out the top 10.

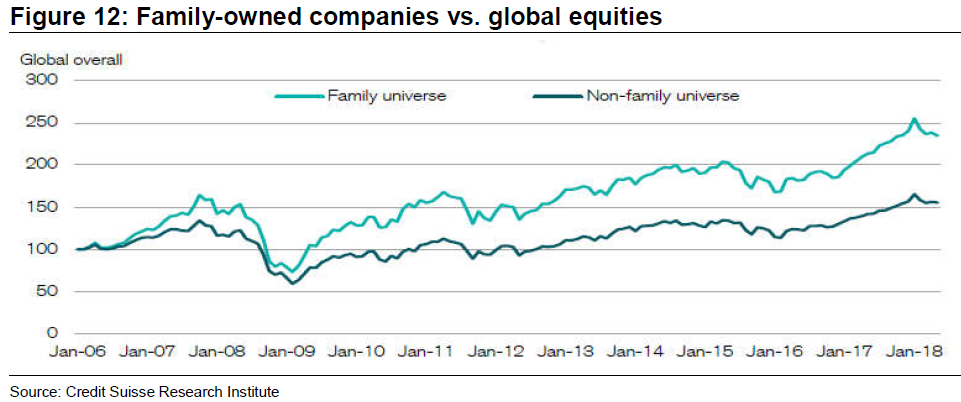

Credit Suisse: A family which runs a company together, outperforms together

Credit Suisse has taken a close look at the performance of family-owned companies relative to world stocks. According to the investment bank, they have performed better by a margin of 3.4 per cent per year over the last 12 years. The investment bank believes this to be the case because family-owned businesses tend to emphasise long-term growth as opposed to short-term fixes, exemplified by their greater propensity to invest in research and development (R&D), as well as capital expenditure. In addition, Credit Suisse notes that family businesses are more likely to invest surplus cash back into the business, whereas listed companies tend to prioritise dividends.

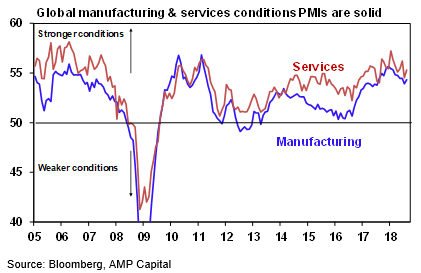

AMP Capital: Don't mention the “R” word

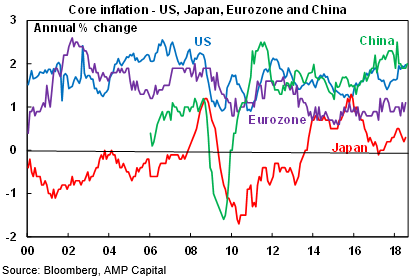

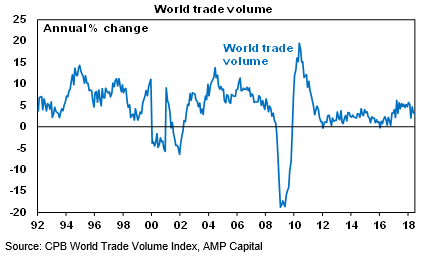

It is now over 17 years since Australia was in a recession, but that hasn't stopped bearish commentators from speculating that – a decade after the Global Financial Crisis – we must be overdue for an economic downturn. But should we really be worried? AMP Chief Economist Shane Oliver says that global conditions remain solid, despite concerns around the rising US dollar and the US-China trade war. Indicators such as the global purchasing managers indexes, global inflation and global trade are all part of the growth picture. What happens to global trade over time is worth monitoring.

Demand remains strong

Core inflation still benign

Trade a potential red flag

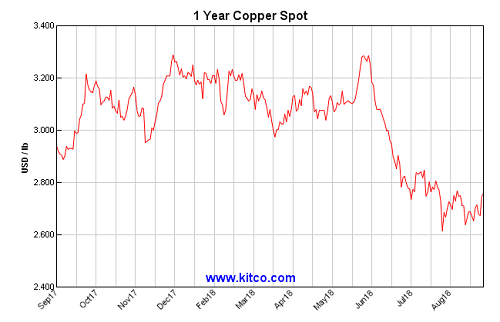

InvestSMART: Dr Copper isn't getting better

Copper is a lead indicator of global manufacturing demand, and the steady ramp-up in the US-China trade war has spurred a price fall in the industrial metal. We analysed this in detail at the end of August on an article, Why Dr Copper is feeling unwell. The short-term volatility in the copper price has been well covered, but the one-year price chart below is more indicative of the pain copper producers are feeling right now. And it's not likely to subside until geopolitical tensions stabilise.

BlackRock: Insurers ramp up risk exposure

A global study of insurers by investment manager BlackRock and the Economist Intelligence Unit has found that nearly half of the companies surveyed, representing assets under management of around $US7.8 trillion, plan to increase their portfolio risk exposure over the next one to two years. Alternatives and emerging market opportunities remain attractive, while ESG investing is of growing relevance to portfolio managers.

Kimberly Kim, Head of BlackRock's Financial Institutions Group in Asia Pacific, commented: “Similar to 2017, insurers worldwide still see increased investment returns as a primary means to boost profitability. What is different this year, however, is the marked change in insurers' willingness to take risk."

This is an important shift, reflecting a significant easing of concerns around macroeconomic and market risks, despite continued geopolitical tensions and a less positive outlook.

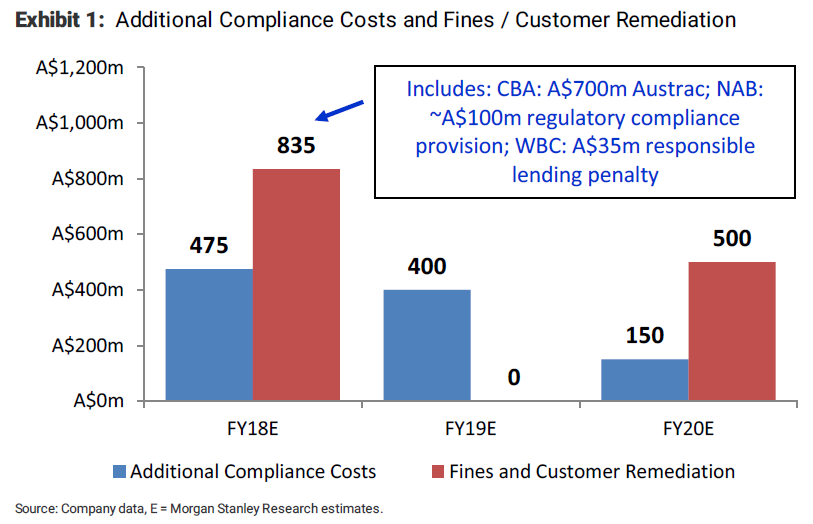

Morgan Stanley: Banks face the music

The Royal Commission is having an impact on banks. That much is obvious, but what is the impact? Morgan Stanley has estimated the amount the major banks will collectively need to spend on compliance, as well as fines and customer remediation, over the next three financial years. The $835 million figure for this financial year includes fines already incurred, but the investment bank expects the monetary fallout from the Royal Commission to continue well into the future, with fines worth $500 million already projected for the 2020 financial year. Morgan Stanley notes that banks may be faced with further legal action from customers and even more fines than expected, which it thinks could have a negative impact on earnings.