Research Roundup: Mid-term reaction

This edition of the research roundup focuses largely on the immediate and longer-term impacts of the US mid-term elections, while also featuring an update on global market indices and the bull market in which we find ourselves.

CommSec: Markets respond well to mid-terms

The US mid-term election was the major event of the week. While the Democrats wrested a majority in the House of Representatives and the Republican Party maintained its hold on the Senate, the investment world waited keenly to see how markets would be affected. As CommSec notes, they reacted as well as they have in decades, with the Dow Jones and S&P 500 both rising by 2.1 per cent in the first trading day after the vote. According to CommSec, this was the best result for both indices in the immediate aftermath of a US mid-term election since 1982. Adding to the positivity, the Nasdaq index welcomed the new Congress with a 2.6 per cent increase on Wednesday (US time).

Citi: Longer-term impact of mid-terms

We’ve had a look at the immediate impact of the US mid-term election on markets, and investment bank Citi has examined how the split Congress may affect the US economy and markets into the future. For the most part, the bank expects the status quo to remain, with no immediate forecast of chaos in the markets, and expectations that they will have risen in one year’s time. In terms of the broader economy, Citi is predicting that tax reform will continue to have a positive effect on US economic growth over the next two years. However, the bank warns that this could potentially be partially undone by budgetary and debt pressures.

Citi doesn’t expect the results of the mid-term election to change trade tensions between China and the US, estimating this could negatively affect growth. The bank is also quick to warn that even though the mid-term election is over, political uncertainty is still present in share markets.

Macquarie: Thank goodness it’s Oct-over

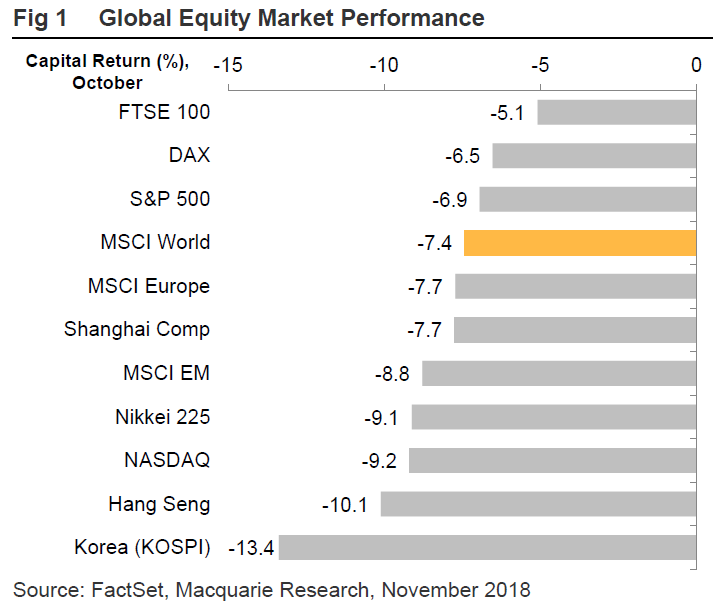

Two weeks ago, we examined the performance of the ASX 200 by sector throughout the month of October. The results weren’t particularly encouraging, and as Macquarie has found, global markets didn’t fare much better in October. As the chart below illustrates, the overall world index gave back 7.4 per cent for the month, while Europe (-7.7 per cent) and emerging markets (-8.8 per cent) also fell away significantly. Macquarie notes that it was a particularly rough month in Asia, with each of the Shanghai Composite, Nikkei 225, Hang Seng and KOSPI indices enduring losses of at least 7.7 per cent. Checking in with a loss of just over 5 per cent, the UK’s FTSE 100 index was October’s ‘best’ performer. Macquarie outlines that the ASX 200 – not shown in the chart – fell 6.1 per cent in October, its lowest monthly return in over three years; while the S&P 500 also made unwanted history, recording its worst month in more than seven years (-6.9 per cent). Let’s hope the markets have a November to remember.

Morgans: Believe in the bull

There has been no shortage of debate in recent weeks centred around whether the October downturn is emblematic of an upcoming crash, or merely a blip on the radar for the bull market. Broking and advisory firm Morgans is adamant that the answer remains the latter, largely due to two key indicators from the US economy: growth levels and share market liquidity. Put simply, Morgans is of the opinion that these two factors are currently far too favourable to constitute a bear market, with the recent declines representing nothing more than an overzealous market returning to normalcy. As a result of the panic which engulfed the market during this ‘bull market correction’, Morgans believes that the S&P 500 was significantly undervalued at the end of last month. It also believes the Australian share market was undervalued at the same date, and expects markets to perform well in the coming months.

KPMG: Major banks struggle in a major way

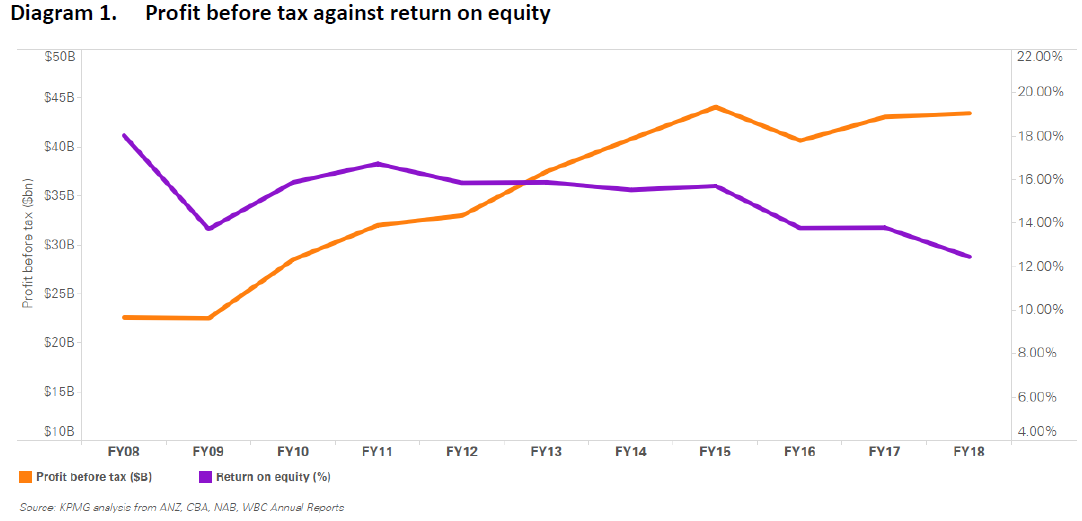

Accounting and advisory firm KPMG has released its annual report investigating the performance of the ‘Big Four’ banks. Unsurprisingly, as indicated in the chart below, this year has not been kind to the major banks. Profit before tax among the banks has only increased marginally, and return on equity has continued its recent freefall. As KPMG notes, the after-tax cash profits from continuing operations of the four banks combined fell by 5.5 per cent for the year.

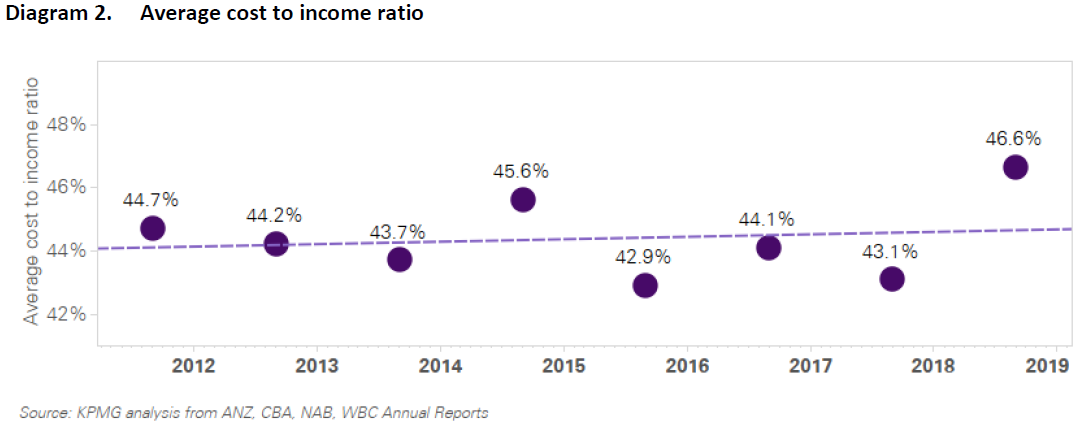

According to KPMG, the declining profits are largely due to decreased non-interest income, greater competition, and higher costs (partly caused by increased regulatory costs). Thanks at least in part to this greater regulatory pressure, costs are making up a far greater percentage of income, as shown in the chart below.

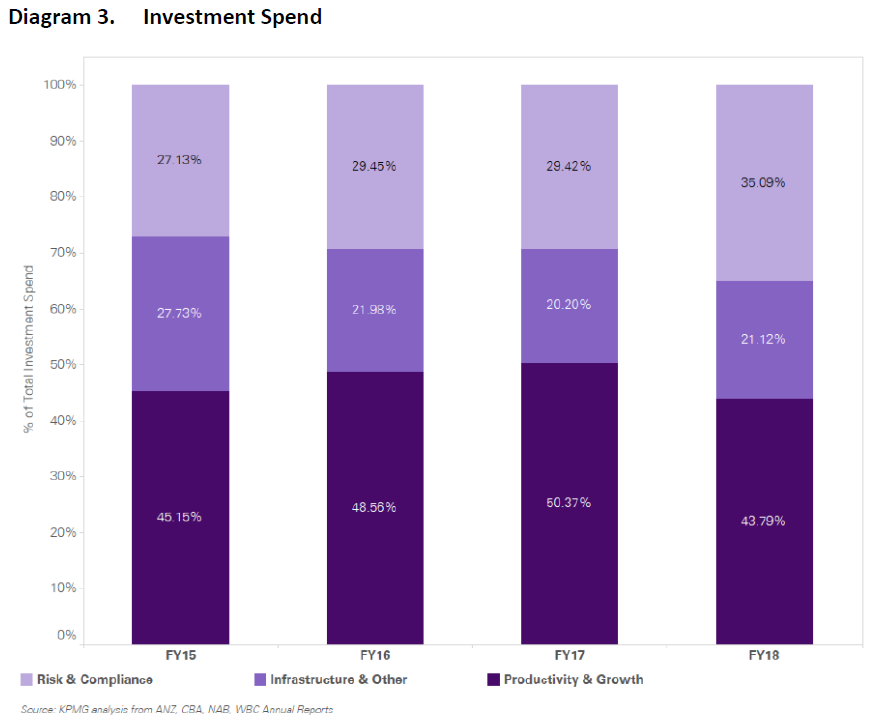

KPMG points out that there is perhaps no greater indication of the pressure faced by the major banks than the fact that a larger proportion of their investment budgets is going towards compliance, at the expense of growth, as the below chart illustrates.

The report predicts a difficult year ahead for the major banks, as competition heightens and costs continue to grow.